Ethereum ETF investors face significant paper losses amid market volatility. ETF flows indicate that holders have largely stayed put despite the recent price declines. The $3,500 level represents a potential break-even point that could influence future market behavior.

What to Know:

- Ethereum ETF investors face significant paper losses amid market volatility.

- ETF flows indicate that holders have largely stayed put despite the recent price declines.

- The $3,500 level represents a potential break-even point that could influence future market behavior.

Ethereum’s price decline has resulted in substantial paper losses for its exchange-traded fund (ETF) investors, mirroring a broader downturn affecting Bitcoin and the overall crypto market. The growing presence of Ethereum in traditional investment portfolios has amplified the impact of these price swings. Understanding these dynamics is crucial for investors navigating the evolving crypto landscape.

The recent market downturn has pushed the global crypto market value down significantly, impacting both Bitcoin and Ethereum. Ethereum’s situation is unique due to its increasing presence in traditional portfolios, where performance is closely monitored, and selling can occur rapidly. This shift highlights the growing integration of crypto into mainstream finance and its implications for market stability.

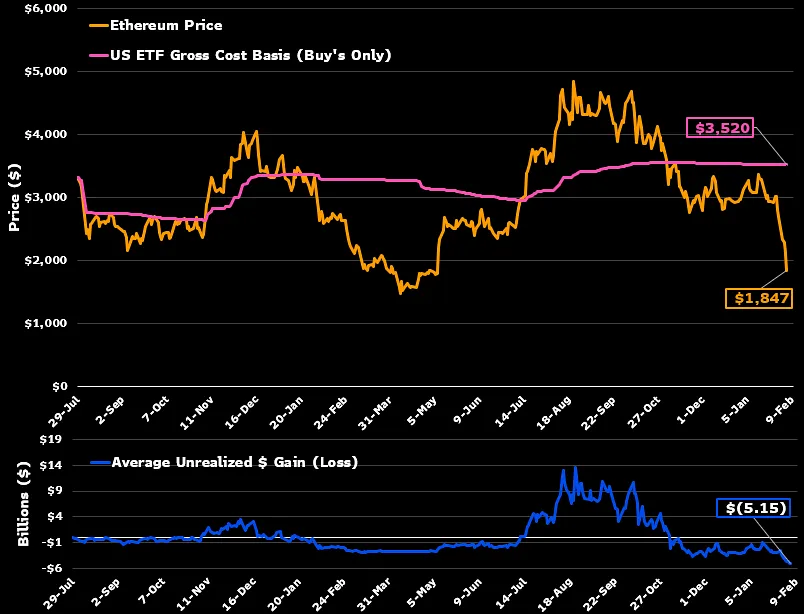

Bloomberg Intelligence ETF analyst James Seyffart estimates that the average Ethereum ETF holder has a cost basis around $3,500. With Ethereum trading below $2,000, the average ETF holder faces a drawdown of approximately 44%, translating to paper losses of about $5.3 billion. This concentration of exposure within ETFs amplifies the impact of price fluctuations.

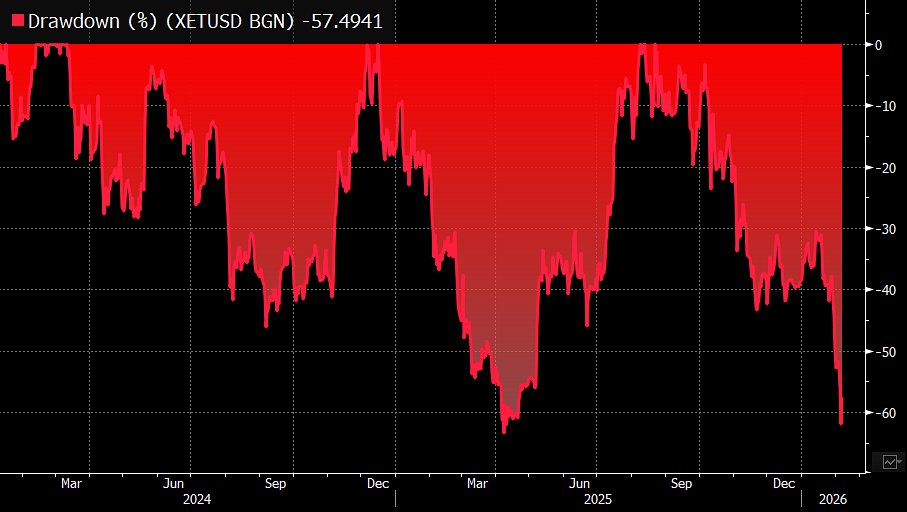

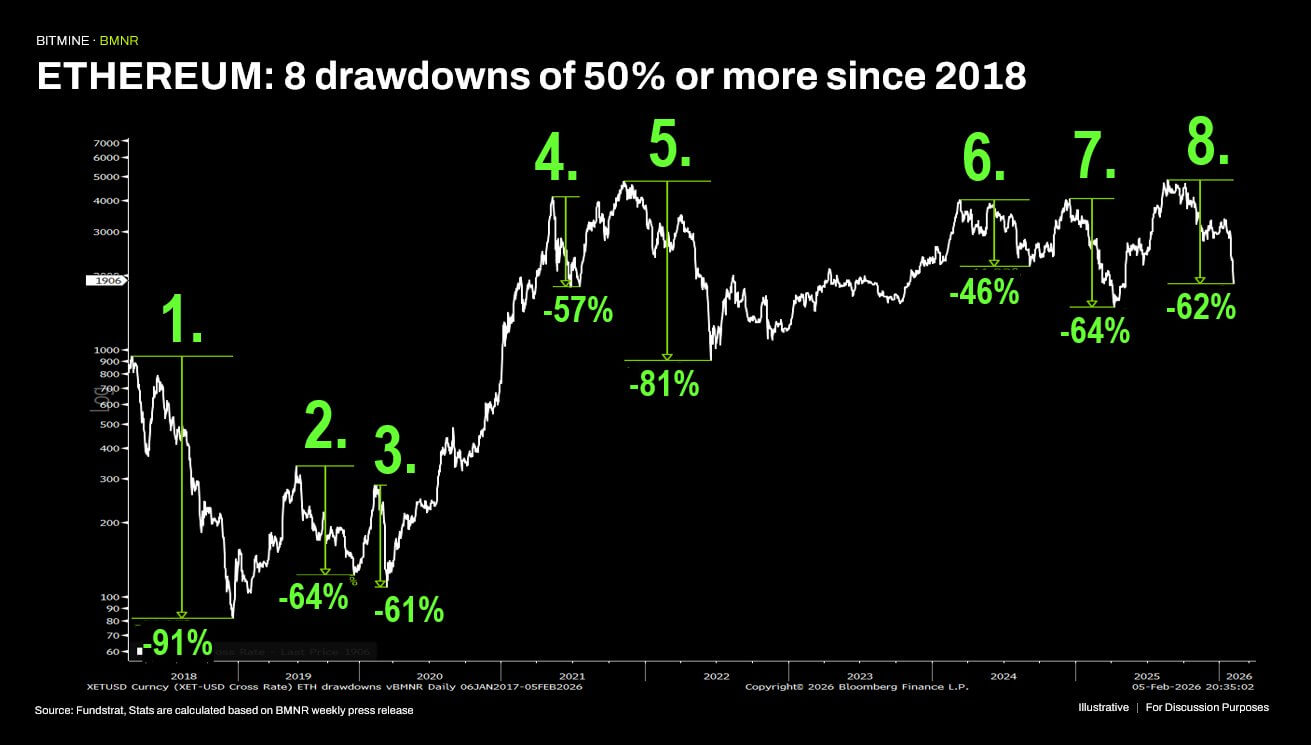

Despite the price drop, ETF flows suggest that many holders have remained invested, indicating a degree of resilience among this investor group. Tom Lee, BitMine’s chair, pointed out that Ethereum has historically experienced significant drawdowns, often followed by periods of recovery. Understanding these historical patterns can provide context for current market conditions.

Seyffart’s analysis suggests that $3,500 could serve as a critical break-even level for Ethereum ETF holders. A return to this level could influence whether investors increase, maintain, or reduce their allocations. However, it could also trigger selling pressure from those seeking to recoup their initial investment, potentially shaping the next market cycle.

The behavior of ETF holders as Ethereum approaches its break-even zone will be crucial in determining the market’s next phase. Factors such as macroeconomic stability and renewed inflows into ETFs could amplify upside potential. Conversely, a retest of lower price levels accompanied by negative flows could challenge the resolve of remaining investors.

The integration of Ethereum into ETFs has introduced new dynamics to the crypto market, compressing decision-making and potentially accelerating both buying and selling activity. While the current situation presents challenges, the long-term outlook for Ethereum remains positive. Monitoring ETF flows and investor behavior will be essential for gauging future market trends and potential recovery.

Related: Bitcoin Price Targets $50K, Ethereum $1.4K

Source: Original article

Quick Summary

Ethereum ETF investors face significant paper losses amid market volatility. ETF flows indicate that holders have largely stayed put despite the recent price declines. The $3,500 level represents a potential break-even point that could influence future market behavior.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.