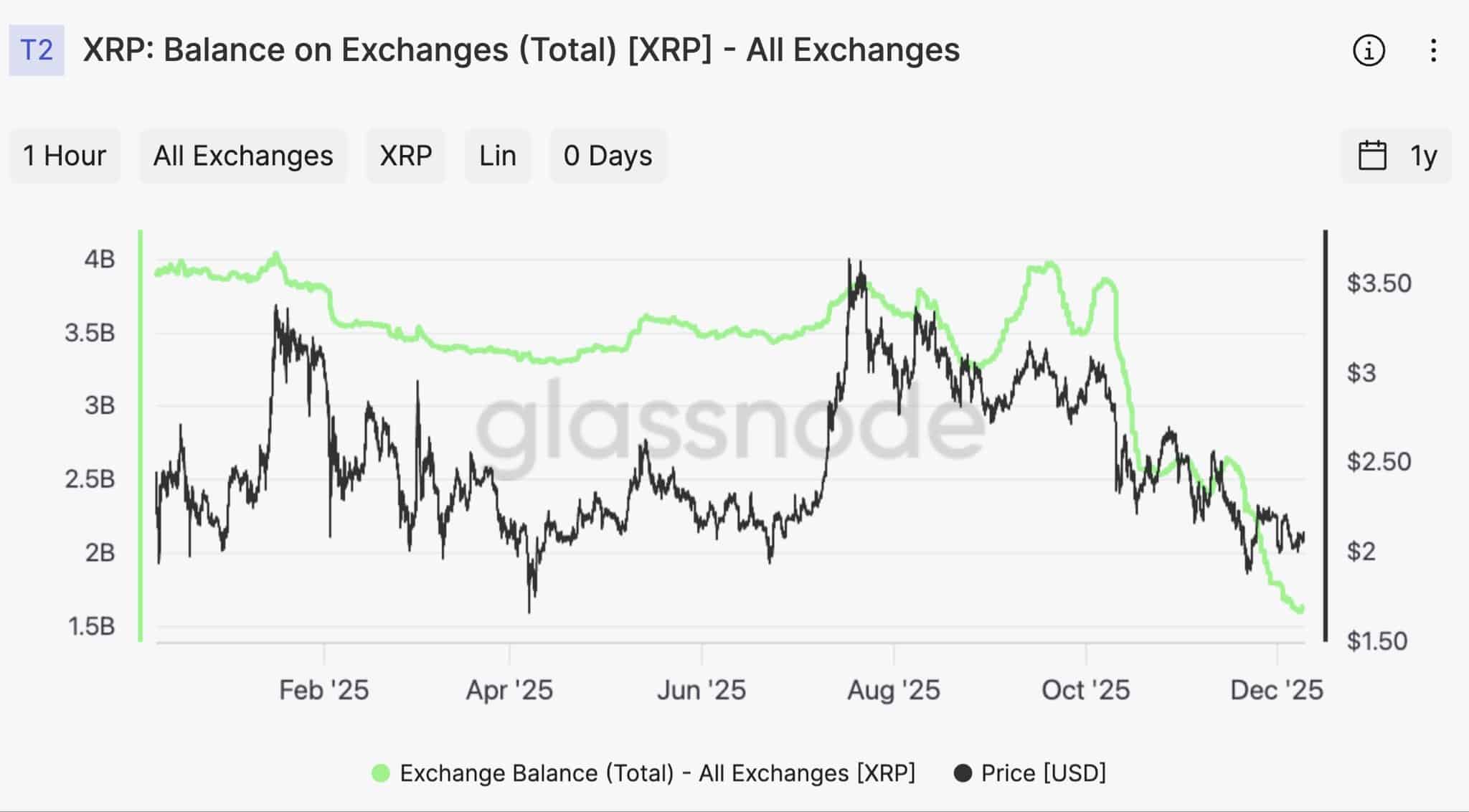

Recent claims suggested XRP exchange supply had dropped to 1.6 billion, sparking supply shock theories. These claims, based on Glassnode data, were interpreted as the total XRP available for sale, hinting at tightening supply.

What to Know:

- Recent claims suggested XRP exchange supply had dropped to 1.6 billion, sparking supply shock theories.

- These claims, based on Glassnode data, were interpreted as the total XRP available for sale, hinting at tightening supply.

- A Glassnode researcher clarified the metric tracks only identified exchange wallets and includes custodial holdings, impacting institutional interpretation of XRP liquidity.

Recent discussions around XRP have centered on the circulating supply held on exchanges, with some analysts suggesting a potential supply shock. These claims, fueled by data from Glassnode, indicated that exchange balances had fallen to 1.6 billion XRP. However, a deeper look reveals a more nuanced picture of XRP’s market dynamics. Understanding the subtleties of on-chain data is crucial for institutional investors navigating the crypto markets.

Glassnode Researcher Clarifies Exchange Balance Metric

A Glassnode researcher addressed the circulating claims, emphasizing that the “balance on exchanges” metric reflects only XRP held in wallets internally identified and verified as belonging to exchanges. This figure includes all XRP stored within these wallets, incorporating custodial holdings, and doesn’t distinguish between tokens actively available for trading and those held on behalf of users. The researcher’s clarification, shared by XRP commentator Crypto Arsenal, highlights a misunderstanding of what the exchange balance metric truly measures.

The key takeaway is that the 1.6 billion XRP figure does not represent the total XRP available for sale on exchanges. It’s merely a subset of the total holdings within tracked exchange wallets. This distinction is critical for institutional investors who rely on accurate data to assess market liquidity and potential price movements.

Limitations of On-Chain Data

The researcher further noted that on-chain data alone cannot accurately determine the amount of XRP available for sale. Wallet balances don’t reveal whether tokens belong to long-term holders, custodial accounts, or active traders. Drawing conclusions about “available supply” based solely on identified exchange wallets can therefore be misleading. This limitation underscores the need for a comprehensive approach to market analysis, combining on-chain data with other sources of information, such as order book depth and trading volume.

Glassnode plans to expand its tracking by incorporating exchange addresses identified through XRPL block explorers like XRPScan. This enhancement will provide a more complete view of XRP holdings on exchanges. As more exchange wallets are added to the system, the reported exchange supply is expected to increase, reflecting improved data collection rather than new XRP flowing onto exchanges.

Going forward, GN will look to incorporate identified addresses by XRPL block explorers to improve the range of data GN present.

This process is starting imminently, so if you see the exchange supply going up, dont panic⦠it’s just the curated information being updated. pic.twitter.com/h5uGmI4VVs

— CryptoArsenal (@_CryptoArsenal) February 10, 2026

Broader Context of XRP Exchange Holdings

Previous analyses by The Crypto Basic have also challenged the notion of a collapsing XRP exchange balance. Data from XRPScan indicated that exchanges held significantly more XRP than the 1.6 billion figure suggested by Glassnode’s initial data. In December, XRPScan data revealed exchanges held as much as 16 billion XRP, representing 26% of the circulating supply. This discrepancy highlights the importance of cross-referencing data from multiple sources to gain a more accurate understanding of market conditions.

Data from December also revealed that major exchanges like Upbit, Binance, Binance.US, and Uphold held up to 10 billion XRP tokens. These figures further contradict the idea of a severe supply shortage on exchanges. For institutional investors, this information is crucial for making informed decisions about entry and exit points, as well as managing risk.

Implications for Institutional Investors

The recent discussions surrounding XRP’s exchange supply underscore the complexities of interpreting on-chain data. While metrics like exchange balances can provide valuable insights, it’s essential to understand their limitations. Institutional investors must adopt a holistic approach to market analysis, combining on-chain data with other relevant information, such as regulatory developments, adoption rates, and macroeconomic trends. This approach will enable them to make more informed decisions and navigate the dynamic crypto landscape with greater confidence.

In conclusion, while the initial reports of a potential XRP supply shock may have caused concern, a closer examination reveals a more nuanced picture. The Glassnode researcher’s clarification and the availability of data from other sources like XRPScan suggest that exchange balances are higher than initially reported. As data collection methods improve, a clearer picture of XRP’s market dynamics will emerge, benefiting institutional investors seeking to capitalize on opportunities in this evolving asset class.

Related: Ripple Execs Added to CFTC Advisory

Source: Original article

Quick Summary

Recent claims suggested XRP exchange supply had dropped to 1.6 billion, sparking supply shock theories. These claims, based on Glassnode data, were interpreted as the total XRP available for sale, hinting at tightening supply.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.