XRP spot and futures volumes have surged, indicating increased trading activity despite a recent price dip. This increase occurs within a broader context of market uncertainty, typical of digital assets.

What to Know:

- XRP spot and futures volumes have surged, indicating increased trading activity despite a recent price dip.

- This increase occurs within a broader context of market uncertainty, typical of digital assets.

- The volume spike suggests potential opportunities for institutional investors, while the mixed signals reflect ongoing market dynamics around XRP and Ripple.

XRP has recently experienced a notable surge in trading volumes, even as its price has declined. This divergence between price and volume raises intriguing questions about market sentiment and potential future price movements. For institutional and high net worth investors, such dynamics can present tactical opportunities, provided they are well understood and carefully navigated. The current market structure reveals a complex interplay of factors influencing XRP’s valuation.

XRP Volume Uptick

Recent data indicates a significant increase in both futures and spot XRP volumes over the past week. Futures volume jumped by $6.88 billion to $57.98 billion, while spot volume increased by $1.43 billion, reaching $12.06 billion. This surge in activity is particularly noteworthy given that XRP corrected by 3.53% during the same period, trading at $1.38 at the time of writing. Typically, increased volume suggests heightened participation and the potential for a directional price shift, which could signal an imminent reaction in XRP’s price if momentum continues.

Mixed Signals in Trading Activity

Analyzing the direction of trading volume in both spot and futures markets provides a nuanced view. XRP futures volume increased by 10% to $4.92 billion in the past 24 hours, with taker buys accounting for 50.63% of the volume. This slight skew towards longs suggests a prevailing sentiment that favors a potential rebound. In the spot market, however, volume spiked by 24.6% to $1.21 billion, with taker sells slightly higher at 51.26%. This indicates that spot holders are distributing more XRP than buyers are accumulating, creating a mixed signal regarding immediate price direction.

Regional Volume Concentrations

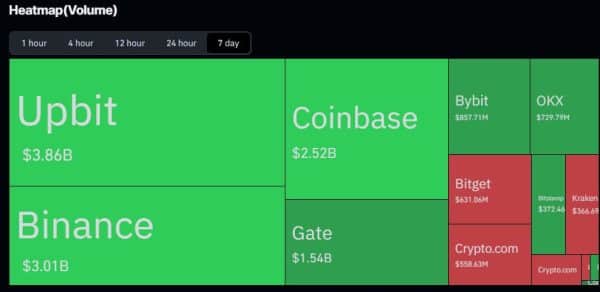

A heatmap of XRP trading volume across different exchanges reveals significant regional concentrations. Upbit, a South Korean platform, leads with $3.86 billion in volume traded over the past seven days. Upbit’s substantial XRP trading activity often surpasses even Bitcoin and Ethereum volumes, underscoring the asset’s popularity in the region. Binance follows with $3.01 billion in XRP volume, while Coinbase and Gate.io contribute $2.52 billion and $1.54 billion, respectively. These concentrations can influence liquidity and price discovery, presenting both opportunities and challenges for institutional traders.

Institutional Implications

The observed dynamics in XRP trading volume have implications for institutional investors. The divergence between spot and futures activity suggests potential arbitrage opportunities, while the concentration of volume in specific exchanges highlights the importance of understanding regional market dynamics. Furthermore, the regulatory posture surrounding XRP and Ripple continues to be a key consideration. Any developments in their legal battles could significantly impact market sentiment and price action. Prudent risk management and diligent monitoring of market structure are essential for navigating these complexities.

Navigating Uncertainty

Given the mixed signals and inherent volatility in the digital asset market, a cautious approach is warranted. While the increase in trading volume indicates heightened interest and potential for price movement, the contrasting trends in spot and futures markets suggest a lack of clear consensus. Institutional investors should focus on rigorous due diligence, employing sophisticated trading strategies, and maintaining a balanced perspective that acknowledges both the opportunities and risks associated with XRP.

In conclusion, the recent surge in XRP trading volume, coupled with its price correction, presents a nuanced picture for investors. The mixed signals in spot and futures markets, along with regional volume concentrations, highlight the need for a strategic and informed approach. As the digital asset landscape continues to evolve, understanding these dynamics is crucial for making sound investment decisions.

Related: XRP News: CEO Reveals Crypto Committee

Source: Original article

Quick Summary

XRP spot and futures volumes have surged, indicating increased trading activity despite a recent price dip. This increase occurs within a broader context of market uncertainty, typical of digital assets. The volume spike suggests potential opportunities for institutional investors, while the mixed signals reflect ongoing market dynamics around XRP and Ripple.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.