Cardano’s recent market cap recovery to $10 billion is a positive signal, yet faces strong competition to break into the top 10 cryptocurrencies. Sustained capital inflows from larger cryptocurrencies into Cardano and other mid-cap layer-1 platforms are crucial for ADA’s continued growth.

What to Know:

- Cardano’s recent market cap recovery to $10 billion is a positive signal, yet faces strong competition to break into the top 10 cryptocurrencies.

- Sustained capital inflows from larger cryptocurrencies into Cardano and other mid-cap layer-1 platforms are crucial for ADA’s continued growth.

- Tangible ecosystem developments that increase on-chain activity and transaction fees are essential for Cardano to maintain its position and attract further institutional interest.

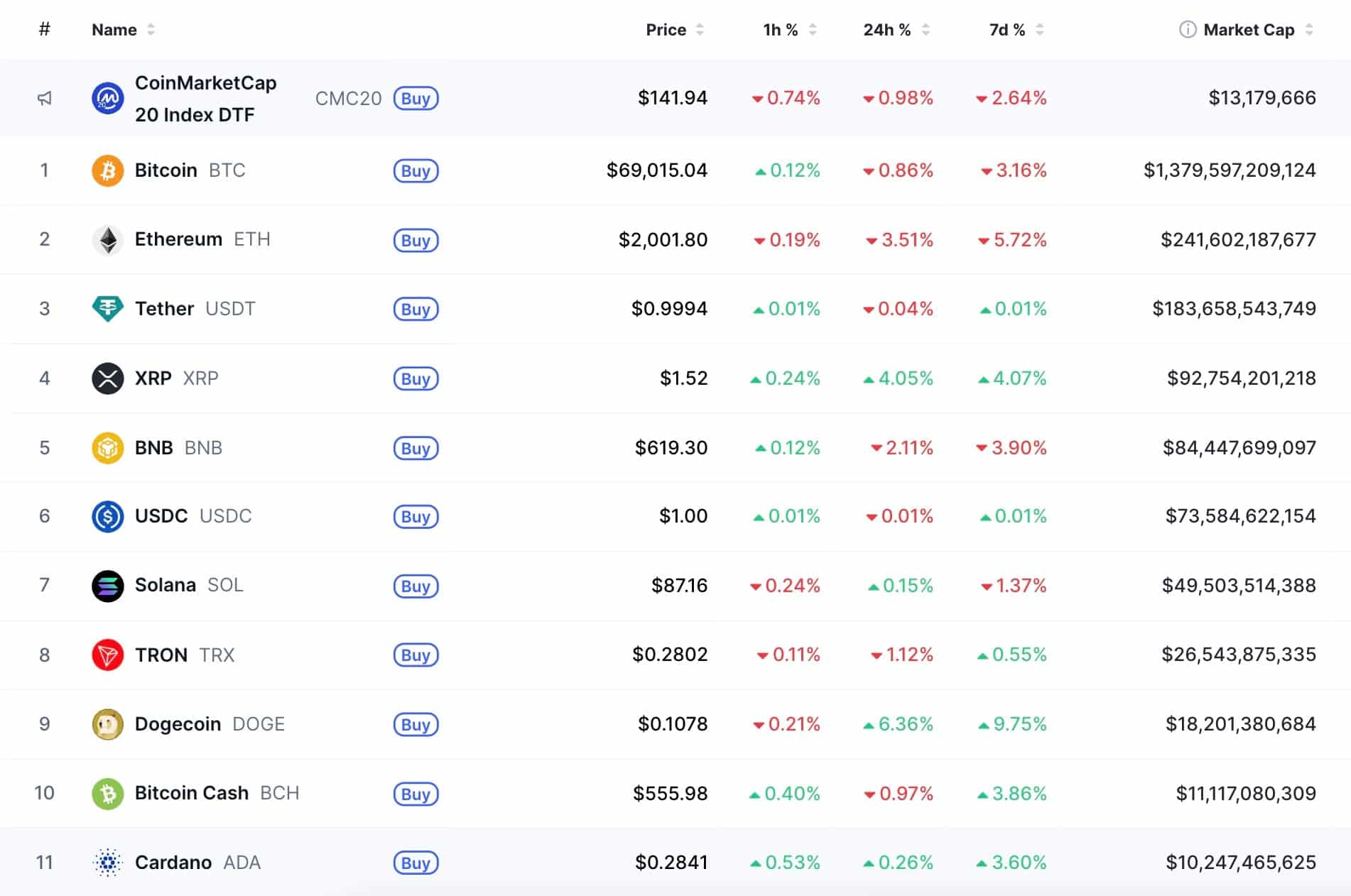

Cardano (ADA) has recently reclaimed a $10 billion market capitalization, a level that once signified its place among the top tier of cryptocurrencies. However, the rise of other digital assets like Bitcoin Cash (BCH) and Dogecoin (DOGE) has raised the bar for entry into the top 10. For institutional investors, this raises the question of whether ADA can sustain its growth and compete effectively in an increasingly crowded market.

Market Cap as a Psychological Threshold

Cardano’s return to a $10 billion market cap is undoubtedly a symbolic victory, but its practical significance is limited. While it places ADA on the cusp of the top 10, it still lags behind competitors like Bitcoin Cash and Dogecoin, which boast significantly higher valuations. This illustrates that in the current market environment, simply achieving a certain market cap is no longer sufficient for sustained success. The market now demands more than just a static valuation; it requires demonstrable growth and competitive strength.

Relative Strength Matters

ADA’s recent gains, while positive, have not been substantial enough to significantly narrow the market cap gap with its competitors. In today’s market, relative strength is paramount. Isolated rebounds are insufficient; ADA needs to demonstrate consistent outperformance against its peers to attract and retain institutional investment. This requires a more compelling narrative and stronger fundamental drivers than just a recovery from previous losses.

Capital Rotation and Layer-1 Competition

For Cardano to solidify its position in the top 10, a sustained rotation of capital from larger-cap assets into mid-cap layer-1 platforms is essential. This would indicate a broader shift in investor sentiment towards alternative blockchain networks. Such a shift could be driven by factors like increased demand for decentralized applications (dApps) or growing concerns about the scalability and cost of established blockchains like Ethereum. However, this capital rotation is not guaranteed and depends on Cardano’s ability to differentiate itself and attract developers and users.

Ecosystem Development and On-Chain Activity

Beyond market dynamics, Cardano’s long-term success hinges on its ecosystem’s ability to generate tangible on-chain activity and transaction fees. This means attracting developers to build compelling dApps, fostering a vibrant community, and driving real-world use cases. Unlike speculative rallies driven by hype, sustainable growth requires a robust and active ecosystem. Institutional investors will be closely watching metrics like transaction volume, active addresses, and developer activity to gauge Cardano’s true potential.

The Need for Acceleration

The $10 billion market cap milestone serves as a reminder of Cardano’s potential, but it also underscores the need for acceleration. In a rapidly evolving market, simply recovering lost ground is not enough. Cardano must demonstrate that it can not only keep pace with its competitors but also surpass them in terms of innovation, adoption, and ecosystem growth. This requires a clear strategic vision, effective execution, and a willingness to adapt to changing market conditions.

Historical Parallels and Future Outlook

The current situation is reminiscent of previous cycles where alternative layer-1 platforms emerged to challenge Ethereum’s dominance. While some of these platforms gained significant traction, few have managed to sustain their position in the long term. Cardano’s ability to learn from these past experiences and avoid the pitfalls that have plagued other networks will be crucial for its future success. The focus must be on building a lasting ecosystem rather than relying on short-term market trends.

In conclusion, while Cardano’s recovery to a $10 billion market cap is a welcome sign, it is only the first step in a longer journey. To truly compete with the top cryptocurrencies, ADA needs to demonstrate sustained growth, attract capital inflows, and foster a vibrant ecosystem. The focus should be on building long-term value rather than chasing short-term gains, and institutional investors will be watching closely to see if Cardano can deliver on its promises.

Related: XRP Signals Negative Funding: Derivatives Data

Source: Original article

Quick Summary

Cardano’s recent market cap recovery to $10 billion is a positive signal, yet faces strong competition to break into the top 10 cryptocurrencies. Sustained capital inflows from larger cryptocurrencies into Cardano and other mid-cap layer-1 platforms are crucial for ADA’s continued growth.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.