Tokenized US Treasuries are approaching $11 billion, shifting the focus to distribution and utility. XRP Ledger (XRPL) is making strides in the tokenized asset arena, signaling its intent to become a key venue. The true test lies in whether XRPL can become a genuine RWA venue, or merely an issuance endpoint.

What to Know:

- Tokenized US Treasuries are approaching $11 billion, shifting the focus to distribution and utility.

- XRP Ledger (XRPL) is making strides in the tokenized asset arena, signaling its intent to become a key venue.

- The true test lies in whether XRPL can become a genuine RWA venue, or merely an issuance endpoint.

The tokenized US Treasuries market is nearing $11 billion, driving a shift in focus from simply issuing these assets to effectively distributing and utilizing them. XRP Ledger (XRPL) has recently garnered attention, signaling its ambition to play a significant role in this evolving landscape. Whether XRPL can evolve into a true venue for Real World Assets (RWAs) or remain just another issuance point is the key question.

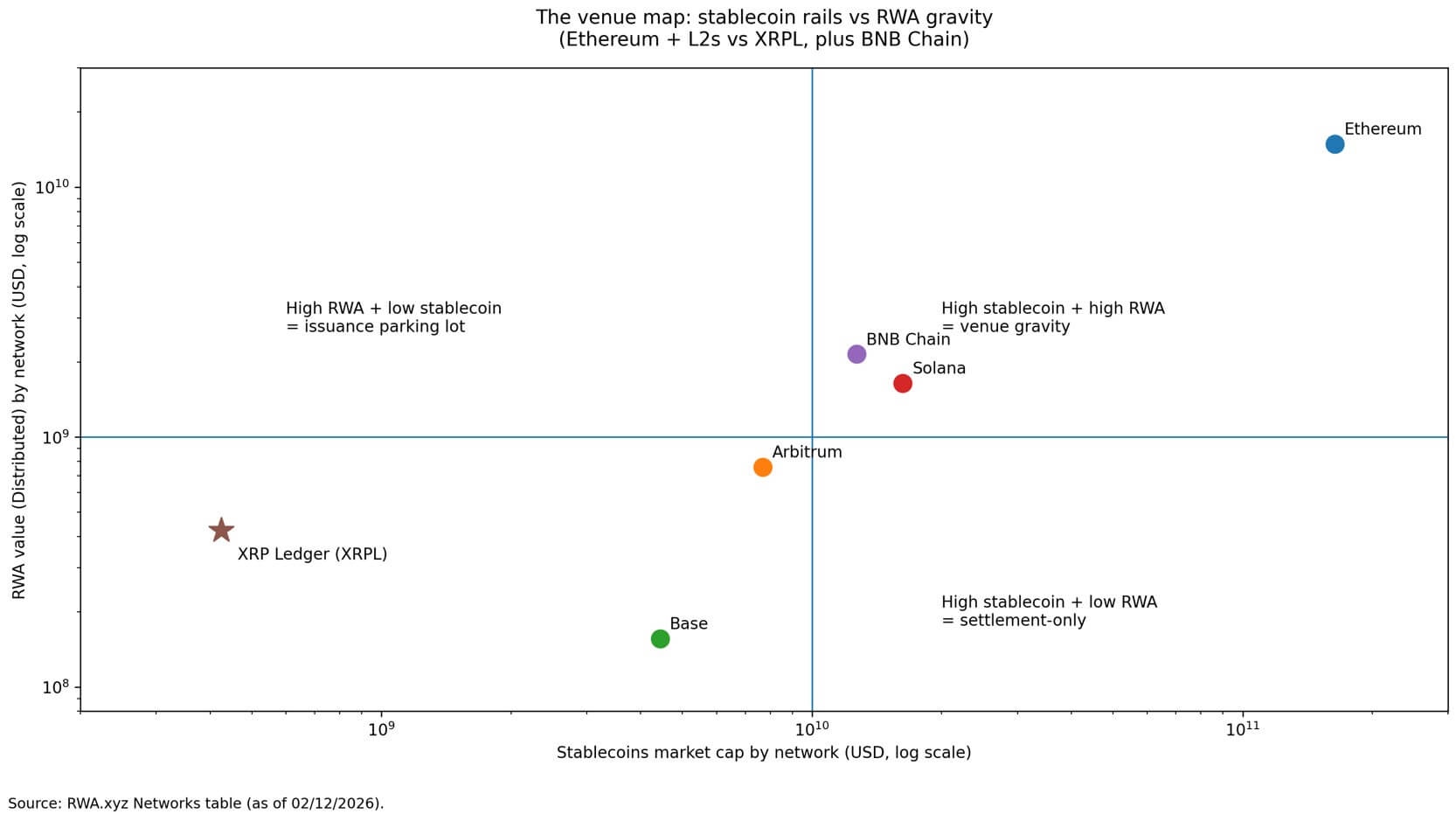

The credibility of XRPL hinges on whether regulated issuers and asset managers actively choose it over crypto-native platforms. Distribution and usage are also critical, requiring meaningful balances and transfers to occur directly on XRPL, not just initial launches. Financial utility is essential, as these assets need to be used for settlement and collateral to establish XRPL as a durable venue.

Aviva Investors and Ripple have announced a partnership to tokenize traditional fund structures on XRPL, signaling a move towards large-scale production over the coming years. This collaboration focuses on tokenized funds and traditional fund structures, marking an institutional distribution narrative. A tangible measure of success would be the launch of a named tokenized fund product, complete with a prospectus, terms, and a growing holder base on XRPL.

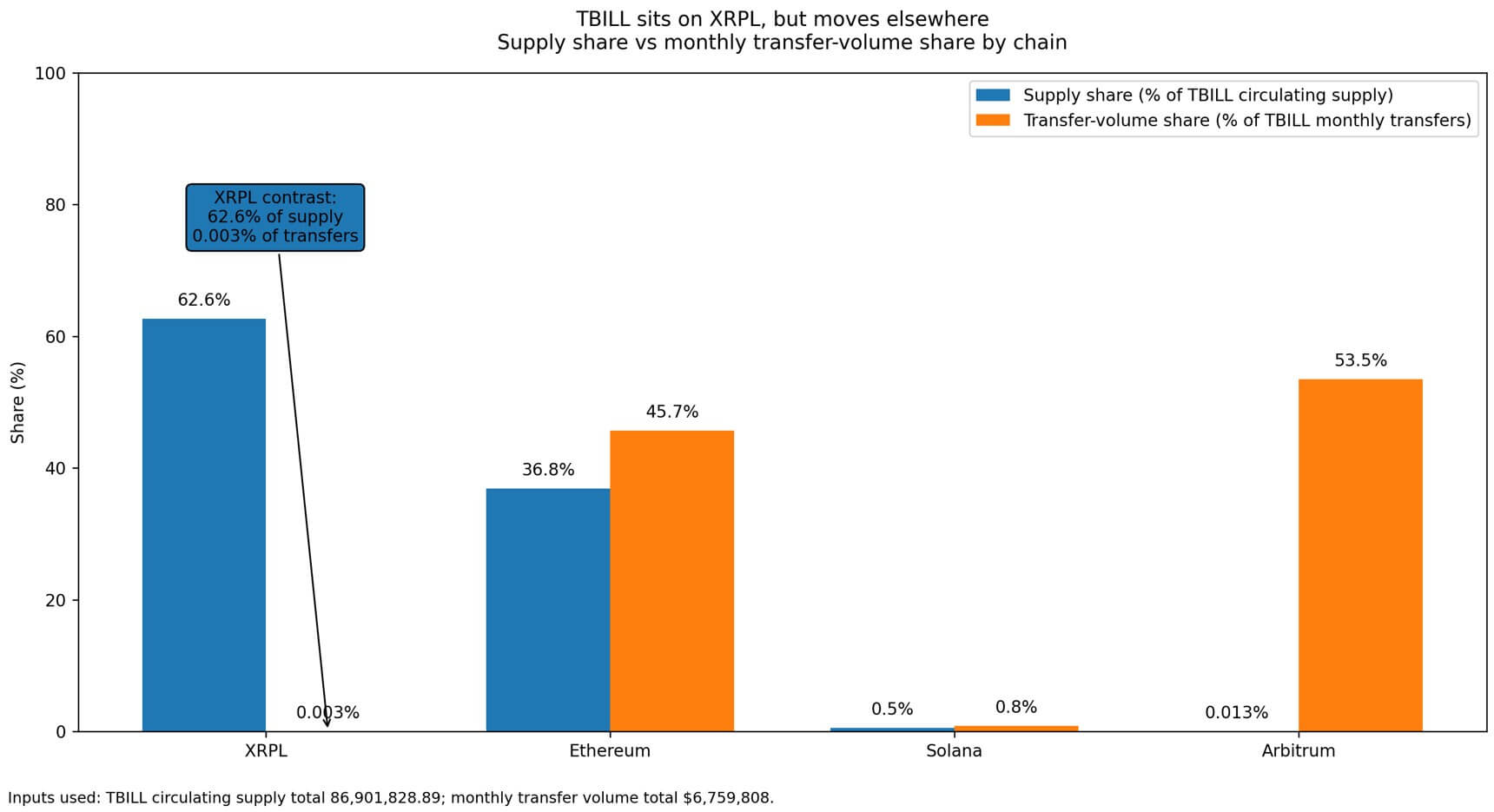

OpenEden’s TBILL token, backed by short-dated US Treasuries, presents an interesting case study. Currently, approximately 62.6% of TBILL’s supply resides on XRPL. However, the actual usage paints a different picture, with only a fraction of the monthly transfer volume occurring on XRPL compared to Ethereum and Arbitrum.

XRPL’s approach emphasizes built-in compliance tools and rapid settlement, which may appeal to institutions prioritizing operational simplicity over DeFi composability. The platform already focuses on payments, making it a natural fit for stablecoins and treasury tokens. The integration of Uniswap Labs and Securitize, enabling trading of BlackRock’s BUIDL on UniswapX, highlights Ethereum’s robust on-chain liquidity infrastructure.

The next 90 days will be crucial in determining whether XRPL is establishing itself as a genuine venue or simply hosting an issuance narrative. Key indicators to watch include TBILL chain transfer share, XRPL stablecoin transfer volume, and the trend in XRPL’s distributed asset value. While XRPL shows promise with its supply skew and stablecoin momentum, the ultimate test will be its ability to drive real settlement and collateral flows.

Related: XRP Liquidity Signals Hidden Asset Potential

Source: Original article

Quick Summary

Tokenized US Treasuries are approaching $11 billion, shifting the focus to distribution and utility. XRP Ledger (XRPL) is making strides in the tokenized asset arena, signaling its intent to become a key venue. The true test lies in whether XRPL can become a genuine RWA venue, or merely an issuance endpoint.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.