Digital asset investment products experienced a fourth consecutive week of outflows, totaling $173 million, while XRP saw $33.4 million in inflows. The outflows reflect broader caution in the US market amid macro uncertainty, contrasting with positive sentiment in Europe and Canada.

What to Know:

- Digital asset investment products experienced a fourth consecutive week of outflows, totaling $173 million, while XRP saw $33.4 million in inflows.

- The outflows reflect broader caution in the US market amid macro uncertainty, contrasting with positive sentiment in Europe and Canada.

- XRP’s continued inflows suggest sustained investor confidence, potentially influenced by regulatory clarity and ongoing developments within Ripple.

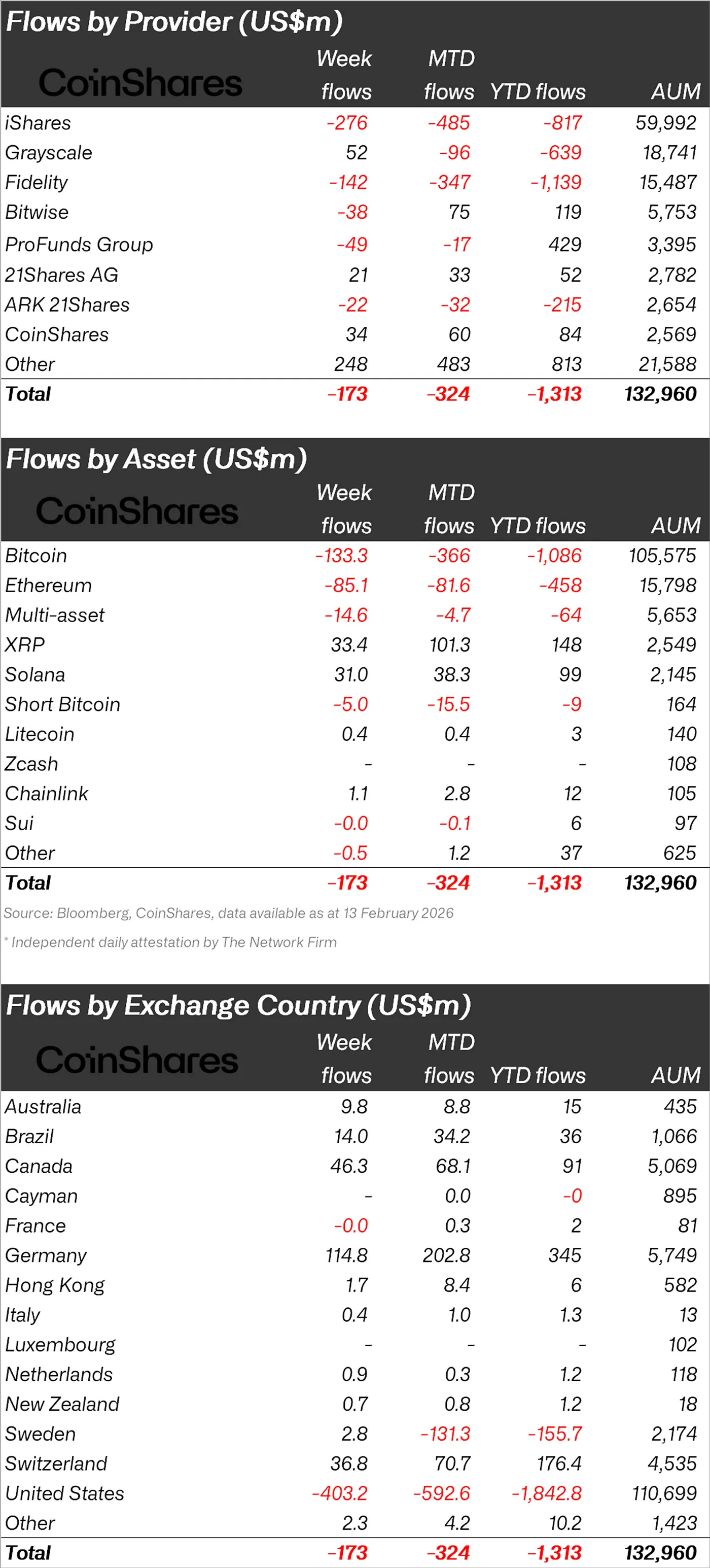

Digital asset investment products continue to face headwinds, marked by persistent outflows over the past month. According to CoinShares’ latest weekly report, $173 million exited the space last week, extending the four-week outflow total to $3.74 billion. Despite this overall bearish trend, XRP has emerged as a notable exception, attracting significant inflows and demonstrating relative strength.

Four Weeks of Market Pressure

The week began with an initial burst of optimism, as digital asset products saw $575 million in inflows. However, this sentiment quickly reversed, leading to $853 million in outflows as market prices softened. A slightly weaker-than-expected CPI reading towards the end of the week did provide some relief, triggering $105 million in inflows on Friday and hinting at the market’s sensitivity to macroeconomic data.

Trading activity also reflected the cautious mood, with ETP volumes dropping to $27 billion, a significant decrease from the previous week’s record $63 billion. This decline suggests reduced participation and a more risk-averse approach among investors.

Regional Divergences in Investor Sentiment

A closer look at the regional breakdown reveals a clear divergence in sentiment. The United States was the primary driver of outflows, accounting for $403 million in withdrawals. This suggests US investors are exhibiting heightened caution, potentially influenced by regulatory uncertainty and macroeconomic headwinds. In contrast, Europe and Canada collectively posted $230 million in inflows, with Germany leading the way at $114.8 million, followed by Canada at $46.3 million, and Switzerland at $36.8 million.

This regional split indicates that while US investors are reducing exposure, European and Canadian markets are selectively adding to their positions, possibly reflecting differing regulatory postures and economic outlooks.

Bitcoin and Ethereum See Significant Exits

Bitcoin, the largest cryptocurrency by market capitalization, experienced the most significant outflows, with $133.3 million exiting investment products last week. Interestingly, even short Bitcoin products saw outflows, reaching $15.4 million over the past two weeks, suggesting some skepticism towards continued downside.

Ethereum followed with $85.1 million in outflows, reflecting a broader trend of caution among investors towards major-cap digital assets. These outflows may be attributed to profit-taking after recent rallies or concerns about network congestion and high transaction fees.

XRP Defies the Outflow Trend

XRP continued to buck the trend, attracting $33.4 million in inflows last week. This positive momentum has pushed month-to-date inflows to $101.3 million and year-to-date inflows to $148 million, demonstrating sustained investor interest. In a prior report, CoinShares highlighted that XRP products recorded $63 million in inflows, while Bitcoin saw $264 million in outflows, underscoring XRP’s unique position in the market.

Solana also maintained positive momentum, bringing in $31 million during the week. The continued allocations into XRP and Solana may reflect investor preference for altcoins with specific use cases and growth potential.

Conclusion: Selective Confidence in a Cautious Market

Despite the overall outflows in digital asset investment products, XRP’s continued inflows suggest a level of sustained investor confidence. While broader market sentiment remains cautious due to macro uncertainties and regulatory concerns, specific assets like XRP are attracting capital, potentially driven by positive developments within Ripple and growing clarity around its regulatory landscape. With total assets under management still at $132.96 billion, the data indicates that investors are becoming more selective, favoring assets with strong fundamentals and clear growth prospects.

Related: Bitcoin Falls: Crypto Market Signals Red

Source: Original article

Quick Summary

Digital asset investment products experienced a fourth consecutive week of outflows, totaling $173 million, while XRP saw $33.4 million in inflows. The outflows reflect broader caution in the US market amid macro uncertainty, contrasting with positive sentiment in Europe and Canada.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.