XRP’s struggle to maintain momentum above the $1.50 level raises concerns about its short-term bullish potential. Cardano Foundation’s approval of a 500,000 ADA withdrawal for DeFi liquidity indicates the growing importance of on-chain governance and transparency.

What to Know:

- XRP’s struggle to maintain momentum above the $1.50 level raises concerns about its short-term bullish potential.

- Cardano Foundation’s approval of a 500,000 ADA withdrawal for DeFi liquidity highlights the growing importance of on-chain governance and transparency.

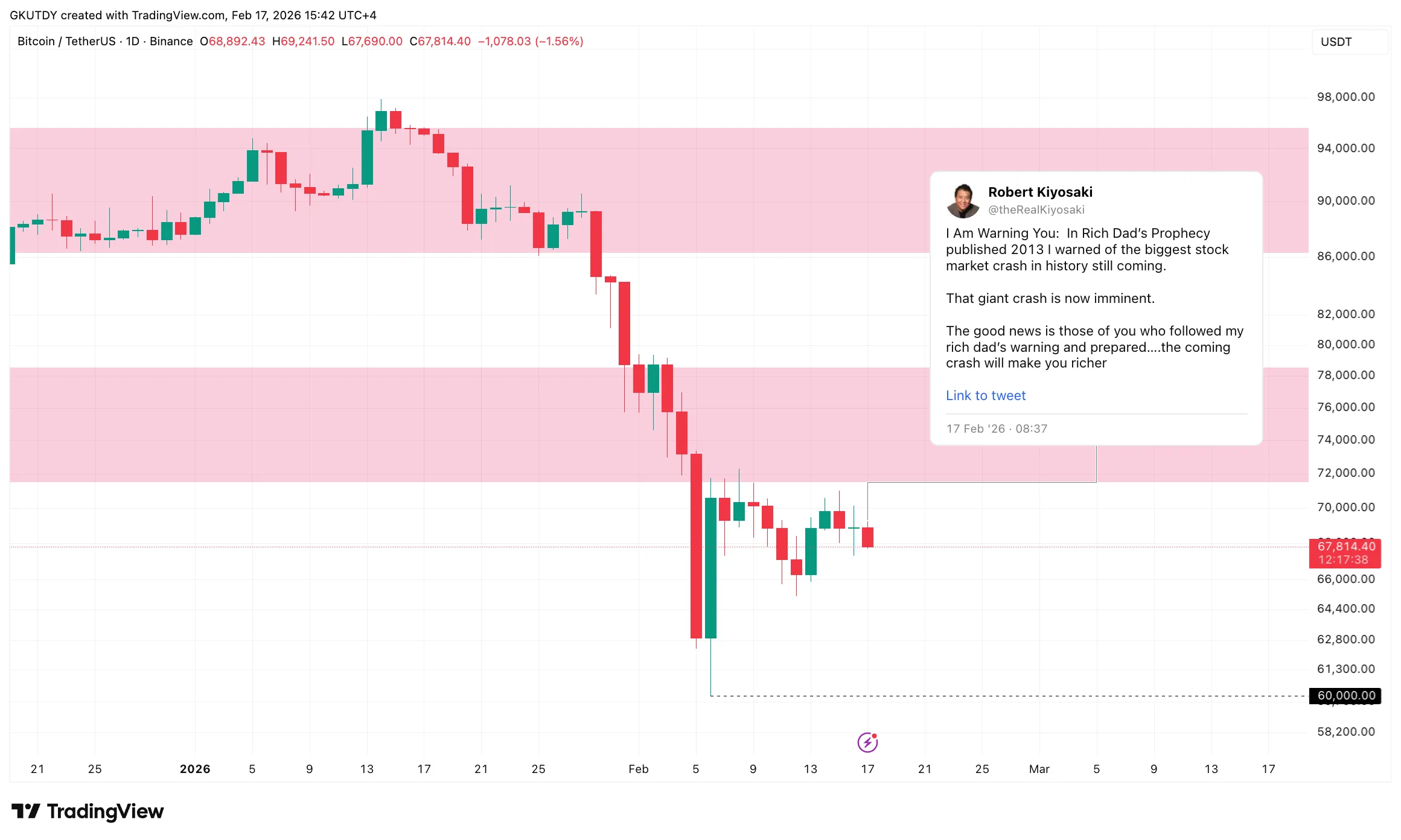

- Robert Kiyosaki’s reiterated bullish stance on Bitcoin amid market consolidation underscores the narrative of BTC as a hedge against traditional market instability.

XRP’s recent price action, coupled with developments in the Cardano ecosystem and endorsements from prominent financial figures like Robert Kiyosaki, provide a nuanced snapshot of the digital asset landscape. Institutional investors are closely monitoring these dynamics to gauge potential entry points and manage portfolio risk in an evolving market.

XRP’s Bollinger Band Resistance

XRP’s rally to $1.6711 faced strong resistance, with the token struggling to maintain its position above the daily Bollinger midband at $1.49794. This level has acted as a significant barrier, preventing further upward movement. The failure to sustain gains above this threshold suggests a lack of strong buying pressure, potentially leading to a retest of lower support levels.

From an institutional perspective, the inability to breach the $1.50 level raises concerns about XRP’s short-term bullish potential. Traders often use Bollinger Bands to identify potential overbought or oversold conditions, and the current setup suggests that XRP may be facing renewed downside pressure. A break below the lower Bollinger Band at $1.2311 could trigger further sell-offs, impacting liquidity and market sentiment.

Cardano’s DeFi Liquidity Initiative

The Cardano Foundation’s approval of a 500,000 ADA withdrawal for the DeFi Liquidity Budget marks a significant step in the network’s efforts to bolster its decentralized finance ecosystem. This decision, verifiable on-chain through Cardanoscan, underscores Cardano’s commitment to governance transparency. While the foundation supports the initiative, it has also emphasized the need for stronger reporting standards and risk management policies.

For institutional investors, this development highlights the growing importance of on-chain governance and the potential for increased DeFi activity within the Cardano network. However, the foundation’s call for improved transparency and accountability reflects a broader concern about risk management in the DeFi space. Clearer operational rules and more accurate budget modeling will be essential for attracting institutional capital and ensuring the long-term sustainability of Cardano’s DeFi ecosystem.

Kiyosaki’s Bitcoin Endorsement

Robert Kiyosaki, the author of “Rich Dad Poor Dad,” has reiterated his bullish stance on Bitcoin, citing its limited supply and potential as a hedge against traditional market instability. Kiyosaki’s comments come as Bitcoin consolidates near $67,777, with the $60,000 level serving as a key support. He has consistently advocated for Bitcoin as a store of value, particularly in times of economic uncertainty.

Kiyosaki’s perspective aligns with a growing narrative among institutional investors who view Bitcoin as a potential safe-haven asset. While Bitcoin’s volatility remains a concern, its scarcity and decentralized nature appeal to investors seeking alternatives to traditional financial systems. The current price consolidation above $60,000 suggests a degree of stability, but a break above the $73,000-$75,000 resistance zone would be needed to signal a renewed expansion phase.

Market Outlook and Key Levels

Looking ahead, several key levels and developments will likely influence the price action of XRP, Cardano, and Bitcoin. For XRP, a daily close above $1.49794 is crucial to confirm a recovery above $1.50, while continued rejection could lead to a test of $1.2311. Cardano’s ADA token is currently testing the $0.27-$0.29 support zone, and market focus will likely shift to the execution of the DeFi Liquidity Budget and the implementation of stronger transparency measures.

Bitcoin’s ability to hold above $60,000 remains critical, with a break above $73,000 signaling a potential return to expansion. Until then, a sideways trading pattern between $60,000 and $70,000 is the most probable scenario. Institutional investors will be closely monitoring these levels to assess potential entry points and manage risk exposure.

Navigating Market Uncertainty

The digital asset market remains subject to volatility and regulatory uncertainty. Institutional investors must carefully assess risk factors and conduct thorough due diligence before making investment decisions. Diversification, risk management, and a clear understanding of market dynamics are essential for navigating this evolving landscape.

Related: Ethereum CME Gaps Target $2,700

Source: Original article

Quick Summary

XRP’s struggle to maintain momentum above the $1.50 level raises concerns about its short-term bullish potential. Cardano Foundation’s approval of a 500,000 ADA withdrawal for DeFi liquidity highlights the growing importance of on-chain governance and transparency.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.