Franklin Templeton’s XRP ETF now holds 118 million XRP, making it substantial institutional exposure to the cryptocurrency. The ETF provides a regulated avenue for investors to gain exposure to XRP without the complexities of direct ownership and custody.

What to Know:

- Franklin Templeton’s XRP ETF now holds 118 million XRP, marking substantial institutional exposure to the cryptocurrency.

- The ETF provides a regulated avenue for investors to gain exposure to XRP without the complexities of direct ownership and custody.

- Despite market volatility, the ETF’s launch and holdings signal growing acceptance of XRP among institutional investors, influencing market dynamics and potential price stability.

Franklin Templeton’s digital assets arm has provided new insight into its XRP exchange-traded fund, revealing a significant allocation to the cryptocurrency. The fund, trading under the ticker XRPZ, aims to offer investors exposure to XRP through a regulated investment vehicle, bypassing the need for direct purchase and self-custody. This move underscores the growing institutional interest in digital assets and the evolving landscape of crypto investment products.

118 Million XRP on the Books

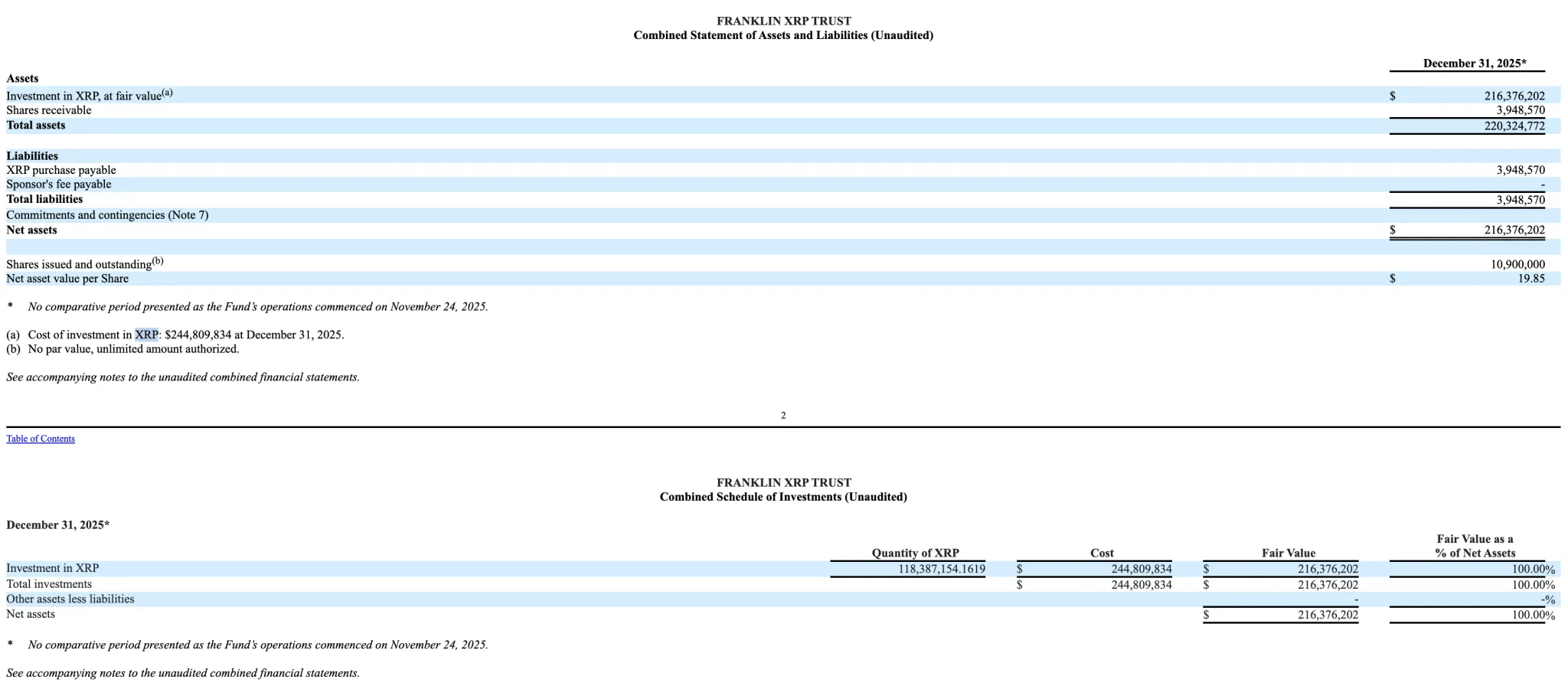

According to the fund’s initial quarterly report filed with the SEC, the trust began operations on November 24, 2025, holding 118,387,154 XRP valued at approximately $216.37 million as of December 31, 2025. The cost basis was around $244.8 million with 10.9 million shares outstanding, resulting in a Net Asset Value (NAV) per share of $19.85. The filing confirms that 100% of the fund’s net assets were allocated to XRP at year-end, emphasizing its focus on this single digital asset.

Website Data Shows Growing Assets

Recent data from Franklin Templeton’s website indicates that the fund’s total net assets have grown to $243.60 million as of February 17, 2026. However, the NAV has dipped to $16.08, with a year-to-date return of -18.54%. Since its inception in late November 2025, the XRP ETF has experienced a -23.20% decline in returns. These figures reflect the inherent volatility of the crypto market and the impact of XRP’s price fluctuations on the fund’s performance.

Institutional XRP Exposure Expands

The substantial holdings—over 118 million XRP within weeks of launch—highlight the increasing institutional access to XRP through regulated channels. Other ETFs, including those from Bitwise, Canary Capital, Grayscale, and 21Shares, have also accumulated significant XRP positions. Collectively, XRP ETFs have seen $1.23 billion in inflows, with $1.06 billion in total assets. This collective accumulation suggests a broader trend of institutional investors seeking exposure to XRP through regulated investment products.

Market Dynamics and Future Outlook

The introduction of XRP ETFs by Franklin Templeton and other firms marks a significant step in the evolution of crypto investment products. By providing a regulated and accessible avenue for institutional and retail investors, these ETFs can potentially increase liquidity and price stability for XRP. However, it’s important to acknowledge the inherent risks associated with crypto investments, including market volatility and regulatory uncertainty. As the market matures and regulatory frameworks become clearer, XRP ETFs may play an increasingly important role in shaping the future of digital asset investments.

The launch and performance of Franklin Templeton’s XRP ETF provide valuable insights into the evolving dynamics of the crypto market. While the ETF’s performance has been affected by market volatility, its substantial XRP holdings and the broader trend of institutional inflows into XRP ETFs signal growing acceptance of the digital asset. As the market continues to mature, these regulated investment products are likely to play a key role in shaping the future of crypto investments.

Related: Bitcoin Fights $68K: Market Watch

Source: Original article

Quick Summary

Franklin Templeton’s XRP ETF now holds 118 million XRP, marking substantial institutional exposure to the cryptocurrency. The ETF provides a regulated avenue for investors to gain exposure to XRP without the complexities of direct ownership and custody.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.