Bitcoin experienced a price dip, falling below $66,000 before recovering to $67,000, while altcoins also faced downward pressure. The market’s reaction to resistance levels and overall trading volumes indicate a struggle for sustained bullish momentum.

What to Know:

- Bitcoin experienced a price dip, falling below $66,000 before recovering to $67,000, while altcoins also faced downward pressure.

- The market’s reaction to resistance levels and overall trading volumes indicate a struggle for sustained bullish momentum.

- XRP experienced notable losses among larger-cap cryptocurrencies, impacting its trading price and potentially affecting liquidity dynamics.

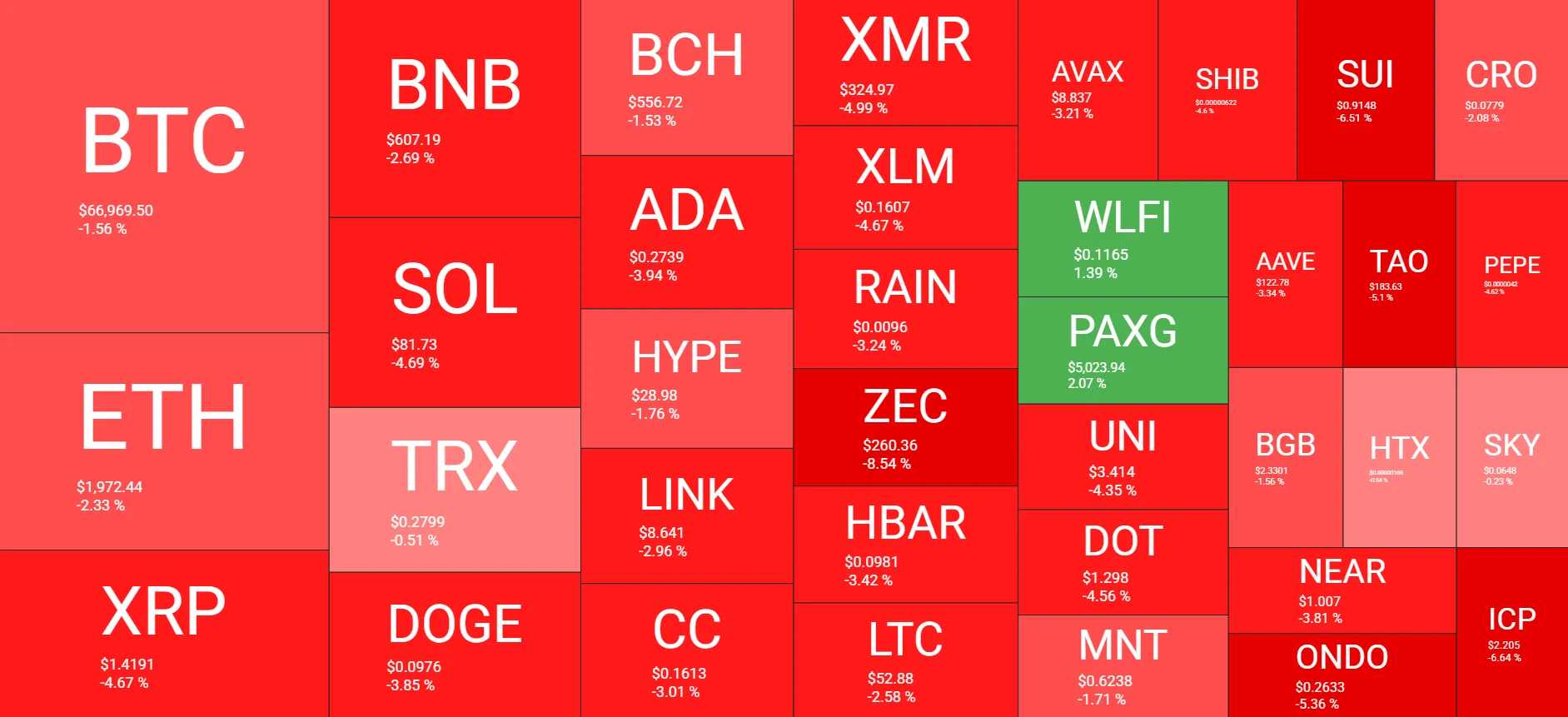

Cryptocurrency markets have exhibited signs of instability, with Bitcoin struggling to maintain its position above key support levels. The initial recovery seen earlier in the month has faced resistance, leading to renewed bearish sentiment. Altcoins have largely followed suit, with several experiencing significant declines.

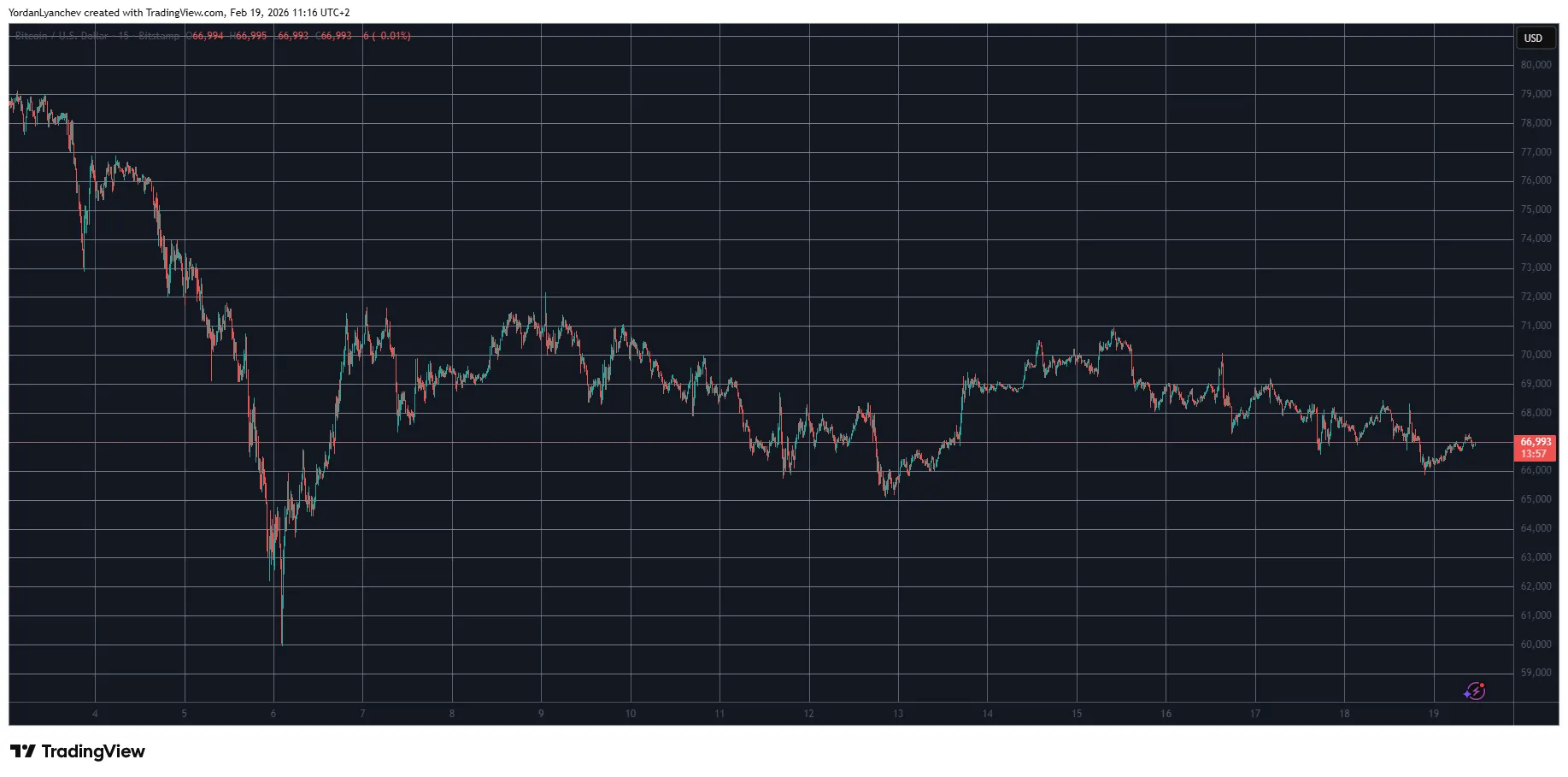

Bitcoin’s Struggle at $67,000

Bitcoin’s price movements have been volatile, with the cryptocurrency unable to sustain gains above the $71,000-$72,000 resistance range. After multiple rejections at this level, BTC experienced a dip to $67,000, and briefly touched $66,000. Despite a slight rebound, Bitcoin remains down, with its market capitalization falling below $1.340 trillion. The asset’s dominance is under pressure, hovering below 56.5%.

Altcoin Market Under Pressure

The altcoin market is showing weakness, with the majority of cryptocurrencies trading in the red. Ethereum’s brief stint above $2,000 proved unsustainable, and the asset has since fallen back below this level. XRP and Solana (SOL) have experienced the most significant losses among larger-cap altcoins, with XRP trading just above $1.40 and SOL dropping to $82.

XRP’s Underperformance

XRP has been among the weakest performers in the market. This decline could be attributed to various factors, including profit-taking after recent gains, regulatory uncertainty, or broader market sentiment. The impact on XRP’s liquidity and trading volumes warrants attention, as it may affect market participants’ ability to efficiently execute trades.

Broader Market Impact

The overall cryptocurrency market capitalization has decreased by $50 billion, falling to $2.370 trillion. This contraction reflects the widespread selling pressure across the market, driven by concerns over Bitcoin’s inability to break through resistance levels and the subsequent decline in altcoin values. The market’s reaction to these conditions highlights the interconnectedness of various digital assets and the influence of Bitcoin’s performance on the broader crypto space.

Looking Ahead

Market participants should closely monitor Bitcoin’s ability to establish a firm foothold above $67,000 and potentially retest higher resistance levels. Further, developments in regulatory clarity, institutional adoption, and macroeconomic factors could also influence market sentiment and price action.

Related: XRP: CEO Signals Key Moment

Source: Original article

Quick Summary

Bitcoin experienced a price dip, falling below $66,000 before recovering to $67,000, while altcoins also faced downward pressure. The market’s reaction to resistance levels and overall trading volumes indicate a struggle for sustained bullish momentum. XRP experienced notable losses among larger-cap cryptocurrencies, impacting its trading price and potentially affecting liquidity dynamics.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.