The Clarity Act, designed to provide regulatory clarity for digital assets, is facing delays due to disagreements over stablecoin yields. Ripple CEO Brad Garlinghouse remains optimistic, increasing his estimated probability of the bill’s passage to 90% by April 2026.

What to Know:

- The Clarity Act, designed to provide regulatory clarity for digital assets, is facing delays due to disagreements over stablecoin yields.

- Ripple CEO Brad Garlinghouse remains optimistic, increasing his estimated probability of the bill’s passage to 90% by April 2026.

- Regulatory clarity could pave the way for XRP to integrate with U.S. banking networks, potentially leading to increased adoption and price appreciation.

The digital asset landscape continues to evolve, with regulatory clarity remaining a key catalyst for institutional adoption. The Clarity Act, aimed at providing a clear framework for digital assets in the U.S., has encountered hurdles, primarily related to disagreements over stablecoin yields. Despite these challenges, Ripple CEO Brad Garlinghouse expresses strong confidence in the bill’s eventual passage, which could unlock significant potential for XRP and the broader crypto market.

Clarity Act Faces Hurdles

The Clarity Act’s progress has been slowed by ongoing debates between banks and crypto companies regarding stablecoin yields. Banks are concerned that yield-bearing stablecoins could siphon funds away from traditional bank accounts, impacting their capital base. This disagreement has stalled the bill, with discussions still in progress among stakeholders and policymakers.

Despite these challenges, Brad Garlinghouse remains optimistic about the Clarity Act’s future. While he initially estimated an 80% chance of passage by April of this year, he has since increased his projection to 90% by April 2026. This revised outlook reflects growing momentum and support for the bill, particularly following positive comments from Senator Bernie Moreno.

XRP’s Regulatory Outlook

XRP currently trades around $1.40, having already benefited from some regulatory clarity following actions taken during the Trump administration, including the resolution of the Ripple vs. SEC lawsuit. However, full regulatory clarity remains elusive, hindering broader adoption and integration with traditional financial systems. The Clarity Act represents a crucial step towards achieving this clarity for XRP and the wider digital asset market.

The passage of the Clarity Act and the subsequent regulatory certainty for XRP could pave the way for its integration with U.S. banking networks. This integration could unlock new use cases for XRP, potentially transforming it into a key component of the financial system. However, predicting the precise impact on XRP’s price remains challenging, as market dynamics and adoption rates will play a significant role.

Potential Price Scenarios for XRP

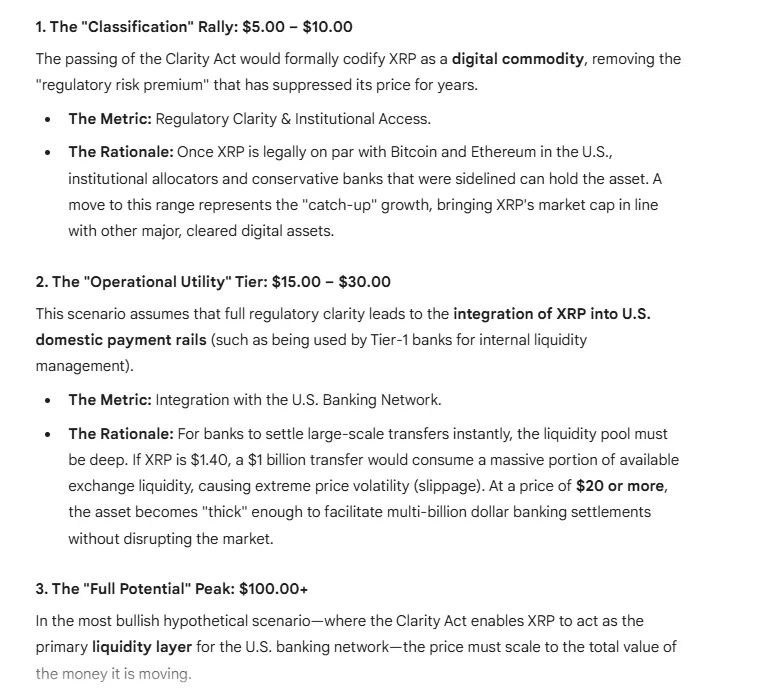

To assess the potential impact of regulatory clarity, Google Gemini outlined several possible price scenarios for XRP based on varying levels of adoption and integration with U.S. banking networks.

In the first scenario, with XRP classified as a digital commodity under the Clarity Act, Gemini suggests a price range of $5.00 to $10.00. This reflects the removal of regulatory uncertainty that has suppressed XRP’s price for years.

The second scenario, with full regulatory clarity leading to XRP’s use in U.S. domestic payment systems, envisions a price range of $15.00 to $30.00. This scenario highlights the importance of liquidity depth, as XRP would need sufficient liquidity to handle large-scale transfers without causing significant price volatility.

The most bullish scenario projects XRP above $100.00, contingent on the Clarity Act enabling XRP to serve as the primary liquidity layer for the U.S. banking network. In this scenario, XRP’s value would need to align with the volume of transactions it facilitates within the financial system.

Conclusion

The Clarity Act represents a pivotal moment for the digital asset industry, with the potential to unlock significant opportunities for XRP and other cryptocurrencies. While challenges remain, the increasing likelihood of the bill’s passage fuels optimism among market participants. Institutional investors are closely monitoring these developments, recognizing the transformative potential of regulatory clarity for the long-term growth and adoption of digital assets. As the regulatory landscape evolves, XRP stands to benefit from increased integration with traditional financial systems, potentially leading to substantial price appreciation.

Related: XRP Meeting Signals DC Crypto Breakthrough

Source: Original article

Quick Summary

The Clarity Act, designed to provide regulatory clarity for digital assets, is facing delays due to disagreements over stablecoin yields. Ripple CEO Brad Garlinghouse remains optimistic, increasing his estimated probability of the bill’s passage to 90% by April 2026. Regulatory clarity could pave the way for XRP to integrate with U.S.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.