New spot Sui ETFs experienced a weak debut, highlighting the challenge of generating liquidity for lower-ranked altcoins. Market cap rank strongly correlates with ETF trading volume, with top-tier assets like Solana and XRP commanding significantly more activity.

What to Know:

- New spot Sui ETFs experienced a weak debut, highlighting the challenge of generating liquidity for lower-ranked altcoins.

- Market cap rank strongly correlates with ETF trading volume, with top-tier assets like Solana and XRP commanding significantly more activity.

- Distribution, rather than regulatory approval or infrastructure, is the primary factor determining the success of altcoin ETFs.

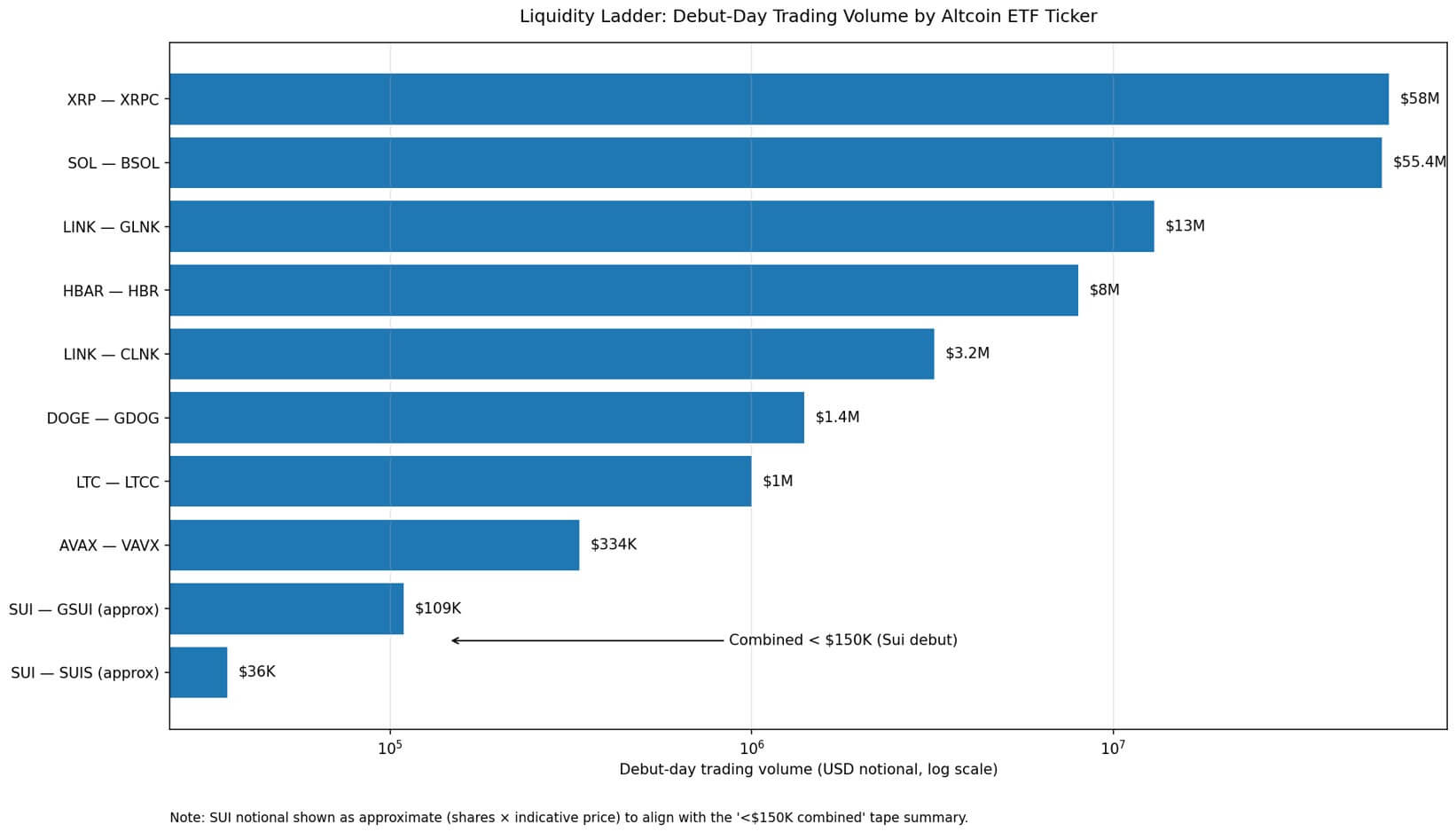

The launch of two spot Sui ETFs on February 18 revealed the challenges faced by altcoins in the ETF market. Despite being staking-enabled and positioned as a high-throughput alternative to Ethereum, the combined notional volume for both ETFs barely registered, coming in under $150,000. This lackluster debut underscores the importance of market capitalization and investor demand in driving ETF success.

Debut-day trading volume serves as a crucial indicator of investor readiness and market interest. It reflects the willingness of market makers, advisor comfort levels, retail platform visibility, and natural two-way flow from the open. The performance of Sui’s ETFs highlights the uphill battle faced by smaller altcoins in attracting significant trading activity.

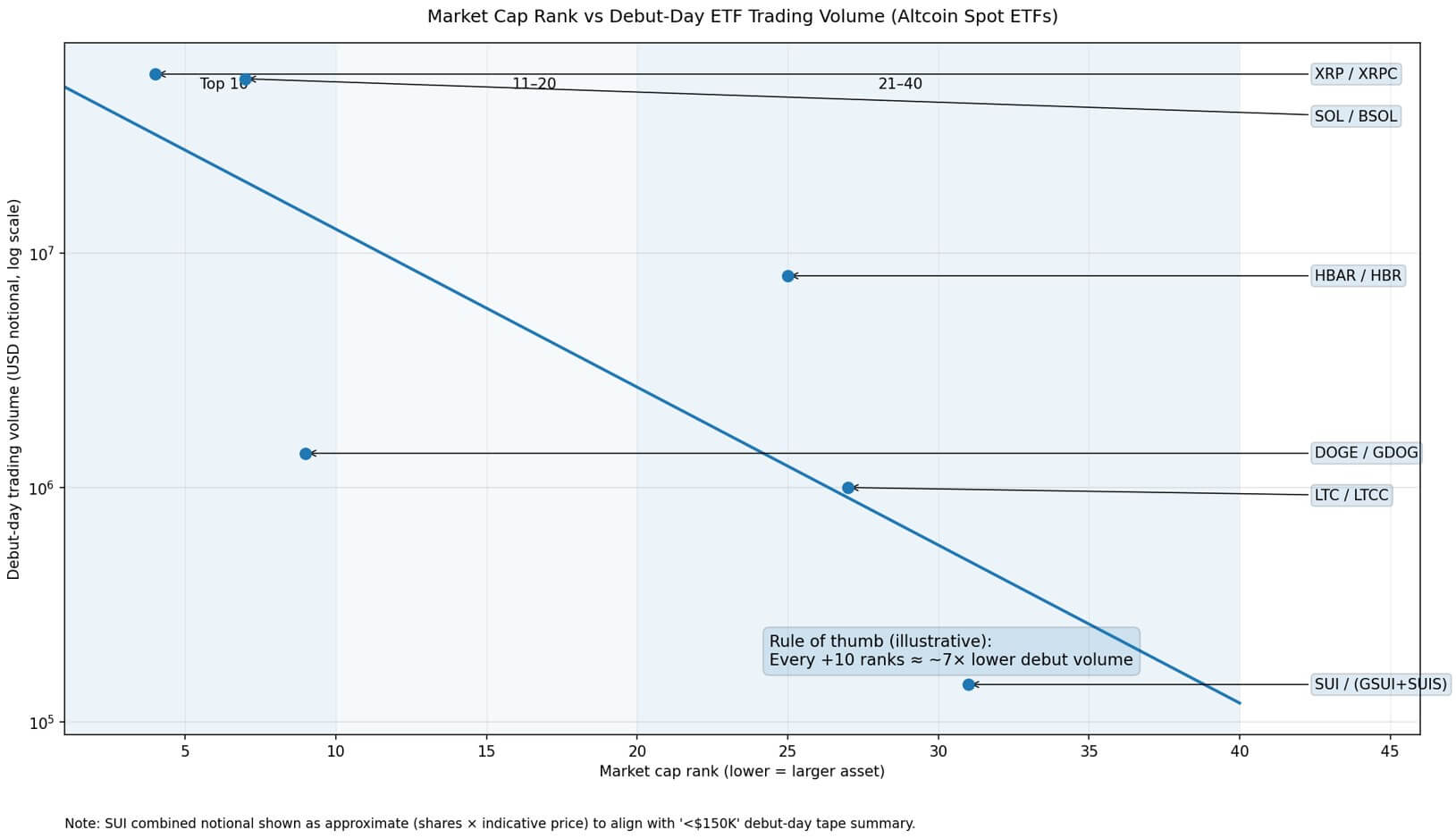

The altcoin ETF market exhibits a clear tiering, with Solana and XRP leading the pack with tens of millions in opening-day volume. These figures indicate institutional-grade liquidity, characterized by tight spreads and active market making. In contrast, mid-tier ETFs like Chainlink and lower-tier products like Litecoin and Dogecoin experience significantly lower volumes, reflecting varying degrees of investor interest and market participation.

Market cap rank is closely linked to debut-day liquidity, with each drop in rank corresponding to a notable decline in trading volume. While Dogecoin’s performance complicates the narrative, it emphasizes that factors beyond market cap, such as familiarity, distribution infrastructure, advisor comfort, and trading culture, play a significant role in driving volume. These elements are key to fostering a robust trading environment for altcoin ETFs.

The Sui ETF launch reveals a ceiling on how far down the market-cap ladder ETF distribution can realistically reach. While the infrastructure and regulatory approval processes are consistent across different ETFs, the missing element is investor demand at a scale sufficient to create sustainable liquidity. This demand tends to cluster around assets considered “committee-safe” by institutional allocators and retail platforms, a status built through venture backing, exchange listings, and regulatory navigation.

Looking ahead, the altcoin ETF market is likely to develop a barbell structure, with a small number of ETFs achieving genuine liquidity and institutional adoption. The remainder will become tradeable but thin, catering to niche allocators but lacking the competitive edge in spreads, volume, and advisor mindshare. This pattern mirrors the broader ETF market, where a long tail of sub-scale products often face closures due to insufficient assets or trading interest.

In conclusion, the Sui ETF debut serves as a valuable case study, illustrating the challenges of launching ETFs for lower-ranked altcoins. While regulatory approval and infrastructure are essential, distribution and investor demand are the primary drivers of success. As the crypto ETF market evolves, a concentration of capital in a few top-tier names is expected, highlighting the importance of market positioning and investor confidence.

Related: Crypto: $500K Penalty for Yield Evasion

Source: Original article

Quick Summary

New spot Sui ETFs experienced a weak debut, highlighting the challenge of generating liquidity for lower-ranked altcoins. Market cap rank strongly correlates with ETF trading volume, with top-tier assets like Solana and XRP commanding significantly more activity.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.