A community document suggests Ripple’s RLUSD stablecoin could drive XRP’s price to $5 through large institutional buy orders. The proposal indicates RLUSD’s potential role in facilitating smoother transactions, but its practicality is questionable.

What to Know:

- A community document suggests Ripple’s RLUSD stablecoin could drive XRP’s price to $5 through large institutional buy orders.

- The proposal highlights RLUSD’s potential role in facilitating smoother transactions, but its practicality is questionable.

- The viability of the model faces hurdles related to real-world trading behavior, arbitrage, and the fundamental drivers of XRP demand.

A new proposal circulating within the XRP community suggests Ripple’s recently launched RLUSD stablecoin could be a catalyst for pushing XRP’s price as high as $5. The core idea revolves around institutions using RLUSD to execute substantial XRP buy orders, theoretically creating upward price pressure. However, the practicality of this model is under scrutiny, with several factors potentially limiting its effectiveness.

How RLUSD Could Theoretically Boost XRP

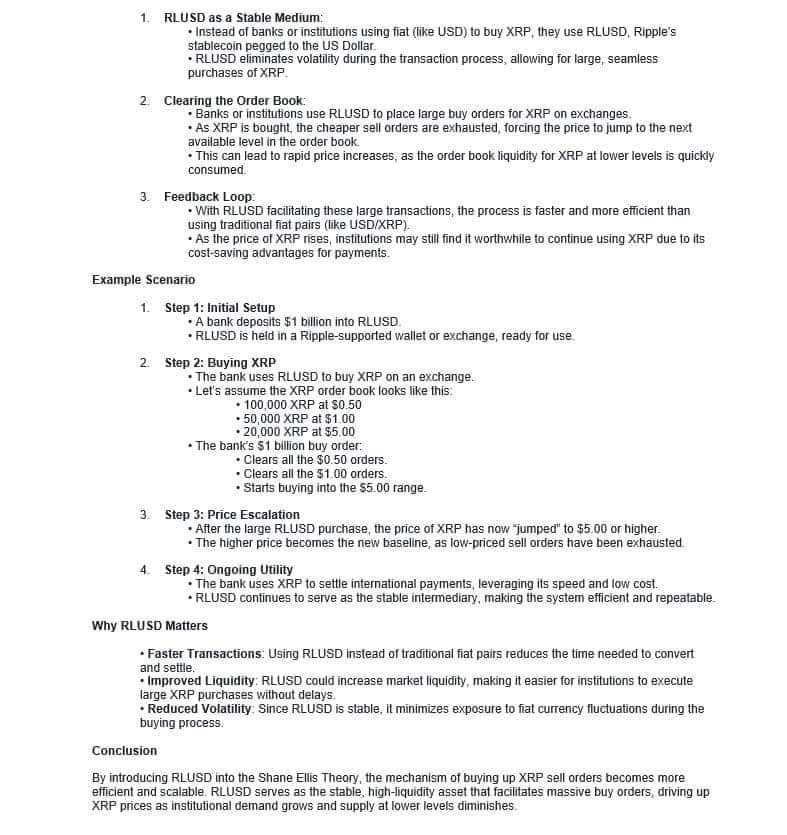

The concept, championed by XRP community figure Xaif, posits that RLUSD could streamline institutional accumulation of XRP. Instead of directly using USD, institutions would convert to RLUSD, purportedly offering stability during large transactions. This stability is intended to allow institutions to make significant XRP purchases without the concern of sudden price fluctuations in their base currency.

The proposal suggests that substantial RLUSD buy orders would quickly absorb available XRP sell orders, driving the price upward. If liquidity is thin, the price could experience rapid and significant jumps. The idea is that RLUSD acts as an intermediary layer, promoting transaction efficiency.

The $5 XRP Scenario

The document outlines a scenario where a bank deposits $1 billion into RLUSD and then uses these funds to purchase XRP. The example assumes an order book with 100,000 XRP available at $0.50, 50,000 at $1.00, and 20,000 at $5. The hypothetical $1 billion buy order would exhaust the supply at $0.50 and $1.00, driving the price toward $5. This new, higher price level would then serve as a reference point for future trading activity.

The post-purchase rationale suggests institutions would then utilize XRP for international payments, leveraging its speed and lower transaction costs. RLUSD would continue to function as a stable asset, simplifying the management of recurring large transactions. It’s a compelling narrative, but one that requires careful examination.

Real-World Trading Dynamics

The primary flaw in this proposal lies in its assumption that institutions execute massive orders directly into public order books. In reality, institutional traders typically break down large orders into smaller increments, employ sophisticated routing strategies, or opt for over-the-counter (OTC) trades. These methods are designed to minimize the impact on market prices and avoid triggering rapid price appreciation.

Furthermore, the model overlooks the role of arbitrage. Should XRP’s price experience a sudden surge from $0.50-$1.00 to $5.00 on one exchange, arbitrageurs would likely step in, capitalizing on price discrepancies across different platforms. This activity would involve introducing new sell orders to take advantage of the inflated price, thereby limiting the extent of the price spike.

Demand vs. Payment Method

The proposal conflates the method of payment with the underlying demand for XRP. Simply switching from USD to RLUSD does not inherently create new demand for XRP. Institutions must have a compelling reason to acquire and hold XRP in the first place. Without genuine demand drivers, such as increased adoption in cross-border payments or other use cases, altering the transaction currency alone is unlikely to sustain a significant price increase.

It’s also worth noting that the broader regulatory posture toward stablecoins and XRP will play a crucial role. Uncertainty around regulatory clarity could impact institutional appetite for RLUSD and, consequently, its potential impact on XRP’s price. Market structure, settlement systems, and derivatives positioning also influence price dynamics, elements not sufficiently addressed in the community proposal.

Conclusion

While the idea of RLUSD driving XRP to $5 is an interesting thought experiment, it relies on several unrealistic assumptions about institutional trading behavior and market dynamics. The proposal does highlight the potential role of stablecoins in facilitating crypto transactions, but it’s crucial to distinguish between payment mechanisms and genuine demand. For now, a sustained move to $5 will likely require more fundamental catalysts than simply changing the currency used for trading.

Related: Bitcoin Price Targets $1 Million, Saylor Says

Source: Original article

Quick Summary

A community document suggests Ripple’s RLUSD stablecoin could drive XRP’s price to $5 through large institutional buy orders. The proposal highlights RLUSD’s potential role in facilitating smoother transactions, but its practicality is questionable.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.