Bitcoin rebounded to $68,000 after a volatile period influenced by tariff news. Ethereum Classic (ETC) experienced a significant price surge, while other altcoins showed varied performance. Market movements impact liquidity across different cryptocurrencies, including XRP, as capital flows shift.

What to Know:

- Bitcoin rebounded to $68,000 after a volatile period influenced by tariff news.

- Ethereum Classic (ETC) experienced a significant price surge, while other altcoins showed varied performance.

- Market movements impact liquidity across different cryptocurrencies, including XRP, as capital flows shift.

The cryptocurrency market experienced a mixed bag of activity, with Bitcoin recovering from a mid-week dip to trade above $68,000. Altcoins displayed varied performance, with Ethereum Classic (ETC) leading the gains. These market dynamics reflect ongoing adjustments to macroeconomic factors and evolving investor sentiment.

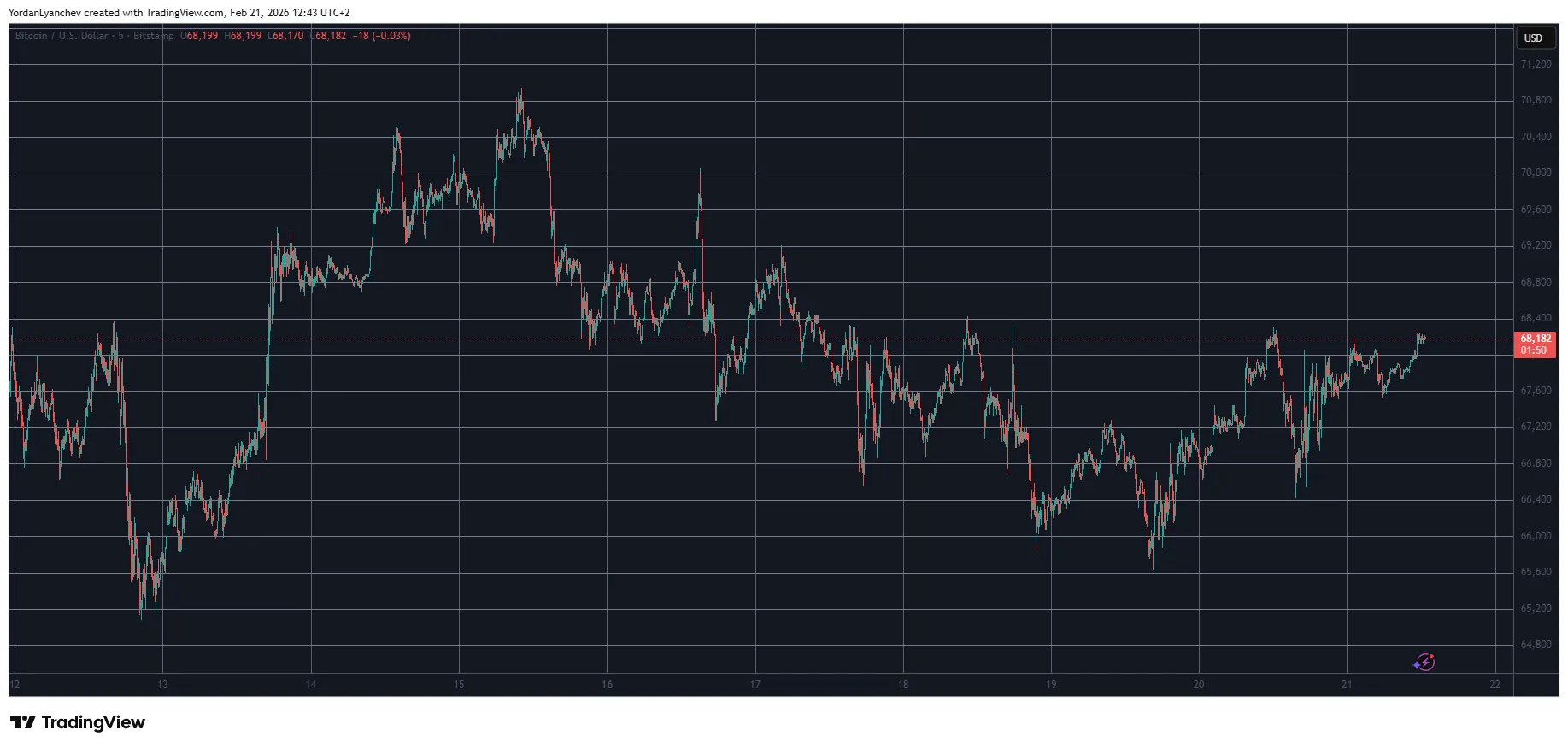

Bitcoin Recovers to $68,000

Bitcoin demonstrated resilience by rebounding from a dip to $65,600, triggered by news of potential tariff changes. The initial drop was sharp, with BTC losing $2,000 in minutes before quickly recovering. This volatility underscores Bitcoin’s sensitivity to global economic news and policy changes.

Altcoin Performance: ETC Leads the Pack

While major altcoins like Ethereum, XRP, Solana, and Tron posted modest gains, Ethereum Classic (ETC) stood out with a 16% surge. Other notable performers included DOT, UNI, and NEAR, indicating sector-specific interest and capital flows within the altcoin market.

Ethereum’s Struggle Below $3,000

Despite overall market recovery, Ethereum continues to face resistance below the $3,000 mark. This level is a key psychological barrier, and sustained trading above it could signal renewed bullish momentum for ETH and the broader altcoin market. ETH’s performance is critical, given its influence on decentralized finance (DeFi) and NFT markets.

XRP’s Steady Movement

XRP has shown relative stability, hovering around $0.55. The cryptocurrency’s performance is closely watched, particularly in light of ongoing regulatory developments and its potential role in cross-border payments. Any significant price movement in XRP could impact liquidity across related trading pairs and exchanges.

Overall Market Capitalization Rebounds

The total cryptocurrency market capitalization has reclaimed the $2.4 trillion mark, reflecting renewed investor confidence. This rebound suggests that despite ongoing volatility, there is sustained interest and capital allocation in the crypto space. The market’s ability to maintain and build upon this level will be crucial for further growth.

Conclusion

The cryptocurrency market is navigating a complex landscape of macroeconomic factors and regulatory developments. Bitcoin’s resilience and the varied performance of altcoins highlight the dynamic nature of the market. Investors should remain vigilant, monitoring both broad market trends and specific developments within individual crypto assets.

Related: XRP: Bollinger Bands Signal Expanding Risk

Source: Original article

Quick Summary

Bitcoin rebounded to $68,000 after a volatile period influenced by tariff news. Ethereum Classic (ETC) experienced a significant price surge, while other altcoins showed varied performance. Market movements impact liquidity across different cryptocurrencies, including XRP, as capital flows shift.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.