SBI Holdings has launched on-chain bonds that grant holders an equivalent amount of XRP, merging traditional finance with crypto exposure. This initiative leverages blockchain for bond issuance, management, and settlement, targeting retail investors in Japan.

What to Know:

- SBI Holdings has launched on-chain bonds that grant holders an equivalent amount of XRP, merging traditional finance with crypto exposure.

- This initiative leverages blockchain for bond issuance, management, and settlement, targeting retail investors in Japan.

- The integration of XRP rewards could drive demand and further institutional adoption of the asset.

SBI Holdings, a key partner of Ripple, has announced the launch of on-chain bonds that provide holders with an equivalent amount of XRP. This move represents a significant step in bridging traditional fixed-income products with digital assets, offering investors a regulated avenue for XRP exposure. The structure allows individual investors in Japan to purchase blockchain-based bonds that automatically deliver an equivalent amount of XRP upon subscription.

SBI Launches First-Ever On-Chain Bonds

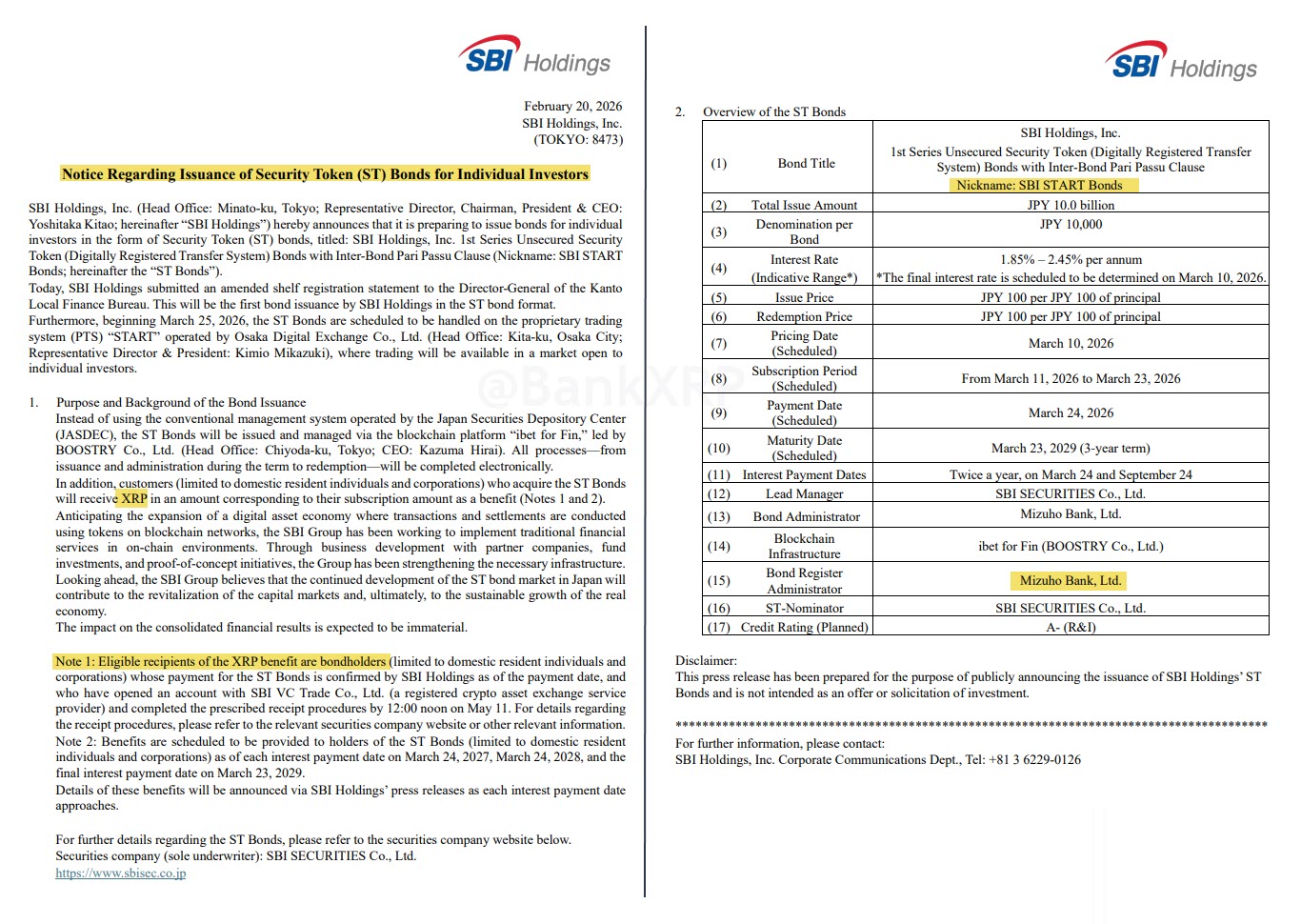

SBI Holdings has unveiled its first Series ST Bonds, totaling JPY 10 billion ($64.52 million), specifically designed for retail investors. Unlike conventional methods, these bonds are issued, managed, and settled entirely on the blockchain, utilizing the “ibet for Fin” platform developed by BOOSTRY. This approach bypasses Japan’s traditional securities settlement systems, streamlining the process and potentially reducing costs.

The bonds will be traded on the START proprietary trading system operated by Osaka Digital Exchange, with secondary market trading slated to commence on March 25, 2026. This development marks a notable advancement in leveraging blockchain technology for financial instruments, potentially setting a precedent for future issuances.

XRP Incentive Structure

A key feature of these bonds is the integrated XRP reward mechanism. Bondholders receive XRP tokens equivalent to their subscription amount shortly after payment confirmation. To be eligible, investors must hold an account with SBI VC Trade and complete the necessary procedures by May 11. This immediate distribution of XRP provides an attractive incentive for investors.

Additionally, SBI will distribute further XRP benefits on each interest payment date in March 2027, March 2028, and March 2029. This long-term incentive structure promotes sustained participation and reinforces XRP’s integration into tokenized financial products. Such incentives could play a crucial role in driving demand and adoption of the bonds.

Potential Impact for XRP

The introduction of these on-chain bonds could have a notable impact on XRP. Increased demand for the bonds may lead to sustained XRP purchases to support the issuance and future payouts. This dynamic could create a positive feedback loop, driving further adoption and price appreciation for XRP.

Moreover, the initiative could tap into the Japanese yen carry trade, where investors borrow yen at low interest rates and allocate capital to higher-yielding assets. By offering XRP-linked instruments, SBI could attract additional liquidity into the XRP ecosystem. The potential for SBI to scale this offering beyond the initial $65 million could further attract institutional participants, accelerating XRP adoption by embedding the asset into structured financial products.

Institutional Implications and Market Outlook

This move by SBI Holdings could signal a broader trend of integrating digital assets into traditional financial products. By leveraging blockchain technology for bond issuance and incorporating XRP rewards, SBI is pioneering a new model that could be replicated by other institutions. The success of this initiative will be closely watched by market participants, as it could pave the way for increased institutional involvement in the XRP market.

The regulatory posture in Japan, which is relatively favorable towards digital assets, provides a supportive environment for such innovations. As more institutions explore ways to integrate digital assets into their offerings, the market structure for XRP and other cryptocurrencies could evolve, leading to increased liquidity and stability.

Conclusion

SBI Holdings’ launch of on-chain bonds with XRP rewards is a significant development that bridges traditional finance and digital assets. This initiative not only provides retail investors with a regulated avenue for XRP exposure but also has the potential to drive demand and further institutional adoption of the asset. The integration of blockchain technology and the innovative XRP incentive structure could set a precedent for future financial products, marking a notable step in the evolution of the crypto market.

Related: XRP, ETH: Which Altcoins Show Biggest Upside?

Source: Original article

Quick Summary

SBI Holdings has launched on-chain bonds that grant holders an equivalent amount of XRP, merging traditional finance with crypto exposure. This initiative leverages blockchain for bond issuance, management, and settlement, targeting retail investors in Japan. The integration of XRP rewards could drive demand and further institutional adoption of the asset.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.