Bitcoin’s correlation with traditional equities, particularly tech stocks, has increased, making it susceptible to broader market risk-off sentiment.

What to Know:

- Bitcoin’s correlation with traditional equities, particularly tech stocks, has increased, making it susceptible to broader market risk-off sentiment.

- The introduction of spot Bitcoin ETFs has created a faster feedback loop, where equity market stress can quickly translate into crypto market volatility through outflows and liquidations.

- Upcoming economic data releases and the Federal Reserve’s policy decisions will be critical in determining Bitcoin’s near-term trajectory as markets assess risk and adjust valuations.

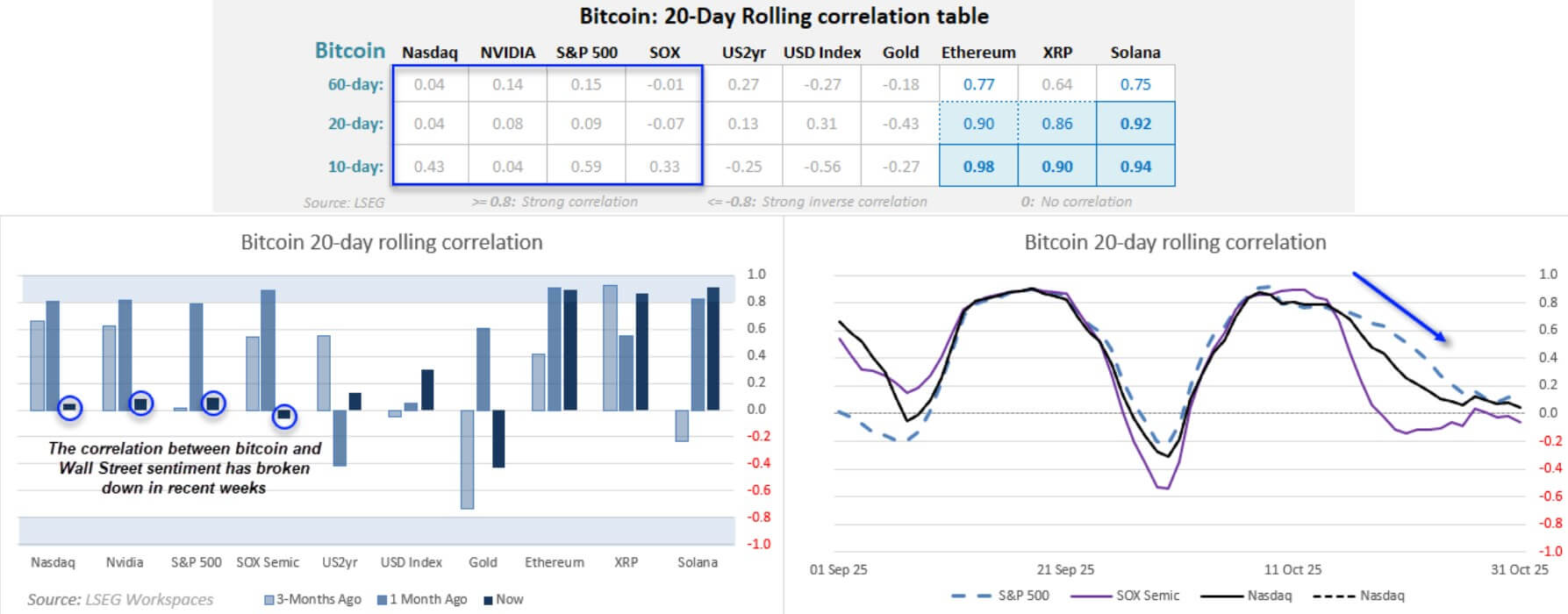

Bitcoin’s performance is increasingly tied to traditional market dynamics, behaving more like a high-volatility tech stock than an uncorrelated asset. Bank of America warns that the S&P 500 remains statistically expensive, potentially leading to P/E compression despite strong earnings growth, which could negatively impact Bitcoin. This shift means Bitcoin is now viewed as liquid beta in multi-asset portfolios, making it vulnerable during periods of risk aversion.

The relationship between Bitcoin and traditional equities has fundamentally shifted, with correlations between Bitcoin and the Nasdaq reaching significant levels. This correlation means that Bitcoin tends to amplify equity moves, especially on down days, undermining its earlier narrative as a diversifier. The “digital gold” thesis has given way to a reality where Bitcoin functions as a high-volatility extension of US tech exposure, often sold first when risk appetite contracts.

Bitcoin’s lack of intrinsic cash flow makes it sensitive to changes in risk premiums and real yields. As markets demand higher returns or real yields rise, assets like Bitcoin, which lack earnings or dividends, tend to reprice lower. This sensitivity means that if the Federal Reserve signals a slower pace of rate cuts, Bitcoin’s implied “duration” gets repriced alongside growth stocks.

The liquidity of Bitcoin makes it a prime target during broader portfolio deleveraging events. During periods of market stress, such as the selloff on Feb. 5, Bitcoin can get caught in broader portfolio deleveraging as managers sell what is liquid and moves easily. This dynamic means that Bitcoin amplifies the initial risk-off impulse because it’s easier to exit than locked-up private positions or illiquid alternatives.

The introduction of spot Bitcoin ETFs has transformed market sentiment into daily observable signals through inflows and outflows. The ETF structure creates a tight feedback loop where equity weakness triggers outflows, pressuring Bitcoin prices, which can then trigger stop-losses and forced selling in leveraged positions. This mechanism differs significantly from the pre-ETF era, where institutional exposure was harder to track and slower to adjust.

The performance of the software sector, particularly in relation to AI investments, also impacts Bitcoin. If the market shifts from viewing AI as universally transformative to questioning the return on AI capital expenditures, the instinct is to sell broad beta exposures. Bitcoin, despite having no direct AI exposure, often gets bucketed into this beta pile due to narrative contagion.

Upcoming events, including Nvidia’s earnings call and key economic data releases, will serve as immediate tests for Bitcoin. These events will determine whether the predicted P/E compression plays out quickly or is delayed by better-than-feared data. The outcomes will significantly influence Bitcoin’s trajectory in the near term.

In conclusion, Bitcoin’s increasing correlation with traditional markets, particularly tech stocks, and the introduction of spot ETFs have made it more susceptible to broader market dynamics. Investors and traders should closely monitor upcoming economic data releases and policy decisions, as these factors will play a crucial role in determining Bitcoin’s performance in the coming weeks.

Related: XRP Bull Run: AI Asks Reveal Buy Signals

Source: Original article

Quick Summary

Bitcoin’s correlation with traditional equities, particularly tech stocks, has increased, making it susceptible to broader market risk-off sentiment. The introduction of spot Bitcoin ETFs has created a faster feedback loop, where equity market stress can quickly translate into crypto market volatility through outflows and liquidations.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.