CME Group is expected to introduce round-the-clock Bitcoin and Ethereum futures trading in early 2026, subject to regulatory approval. The shift to 24/7 futures trading could significantly reshape liquidity flow between traditional finance and crypto-native platforms.

What to Know:

- CME Group is expected to introduce round-the-clock Bitcoin and Ethereum futures trading in early 2026, subject to regulatory approval.

- The shift to 24/7 futures trading could significantly reshape liquidity flow between traditional finance and crypto-native platforms.

- With the introduction of continuous trading, the “CME gap” feature, which traders use to anticipate price moves, may disappear or lose its predictive power.

In an exciting development for the crypto market, the CME Group is set to embrace the non-stop trading nature of cryptocurrencies. By early 2026, pending regulatory endorsement, the leading US-regulated futures market plans to extend its Bitcoin and Ethereum futures to 24/7 trading. This strategic move aligns CME Group with the operational model of crypto exchanges, potentially initiating a major transformation in liquidity flow between traditional finance and crypto-native venues.

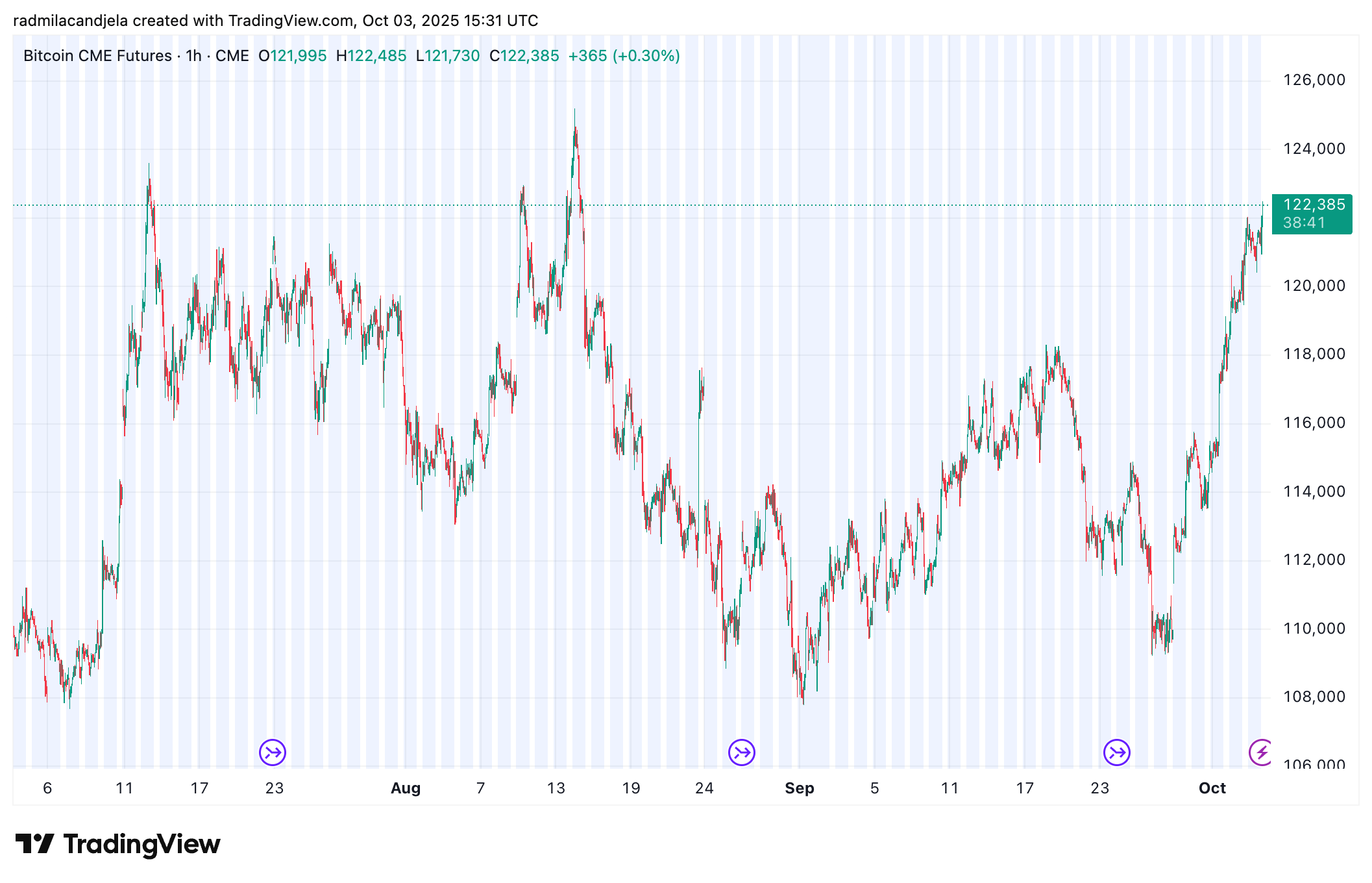

Currently, CME futures operate from Sunday through Friday with daily maintenance pauses, mirroring the exchange’s equities and commodities model. This approach results in periods when global spot market trades on platforms like Binance, Coinbase, and Deribit without a corresponding CME market. This has created a structural feature known as the “CME gap”. Price movements during weekends or CME off-hours typically start the week with noticeable chart gaps that traders expect to fill. By 2026, these gaps may become obsolete or lose their predictive power.

CME Group’s impact on the crypto market is already substantial. In Q3 2025, the exchange reported near-record crypto futures activity, with an average daily volume close to 20,000 contracts across Bitcoin and Ethereum. Specifically, for Bitcoin, CME’s share of open interest consistently ranks in the top five globally, often capturing 20-25% of USD-margined futures activity. This is a significant departure from 2017, when CME introduced its first Bitcoin contracts in a market predominantly controlled by unregulated platforms.

Transitioning these futures to 24/7 trading directly addresses client demand. Traditional institutions, including asset managers and corporates, have frequently expressed concerns about their inability to hedge risk during crypto’s most volatile periods: weekends and Asian trading hours. A CME contract operating parallel to Binance’s perpetual futures or Deribit’s options would enable a portfolio manager in New York or London to offset exposure without the need for offshore accounts. This also implies that dealers managing ETF flows can maintain balanced basis trades and arbitrage strategies at all hours.

The implications of this transition for liquidity are twofold. Firstly, the weekend effect, where spot Bitcoin can swing by thousands of dollars between Friday’s CME close and Sunday’s reopen, may diminish. This would reduce the structural volatility premium built into funding rates and options pricing. Secondly, the spread between CME futures and crypto-native perps, one of the main arbitrage trades in the market, may narrow as institutional liquidity expands into previously uncovered hours.

Trading is set to commence in early 2026, subject to regulatory approval. The short gap matters less for structural positioning and more for tactical flows. Weekend gaps and Friday closes will continue to be monitored, but traders are already starting to anticipate a world without these features. The brief status quo is unlikely to significantly alter market behavior. However, it does offer arbitrage desks and ETF market makers a final opportunity to capitalize on inefficiencies before the always-on era begins.

These changes represent a significant shift for the Bitcoin market. The disappearance of the CME gap, a long-standing technical feature of the market that traders monitor and often trade around, would eliminate one of the few remaining structural divides between institutional and crypto-native markets.

With the introduction of 24/7 CME contracts, Bitcoin’s liquidity will no longer be split into “weekend” and “weekday” regimes. The same hedging and arbitrage flows that currently wait for Sunday evening will be live throughout. This adjustment could ripple into pricing models across the market, reducing premiums built into funding curves by options dealers, ETF arbitrage desks, and basis traders.

Related: Cardano Bull Setup Points to December Rally

By early 2026, these premiums are anticipated to compress, reducing spreads between CME futures and perpetual swaps on offshore exchanges. This also suggests that the long-standing narrative of weekend volatility may begin to fade, being replaced by more continuous price discovery.

Quick Summary

CME Group is expected to introduce round-the-clock Bitcoin and Ethereum futures trading in early 2026, subject to regulatory approval. The shift to 24/7 futures trading could significantly reshape liquidity flow between traditional finance and crypto-native platforms.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.