Bitcoin’s YTD performance is currently negative, trading below its yearly opening price after a volatile period. Open interest in Bitcoin futures has significantly declined since the October 10 crash, suggesting a deleveraging of the market.

What to Know:

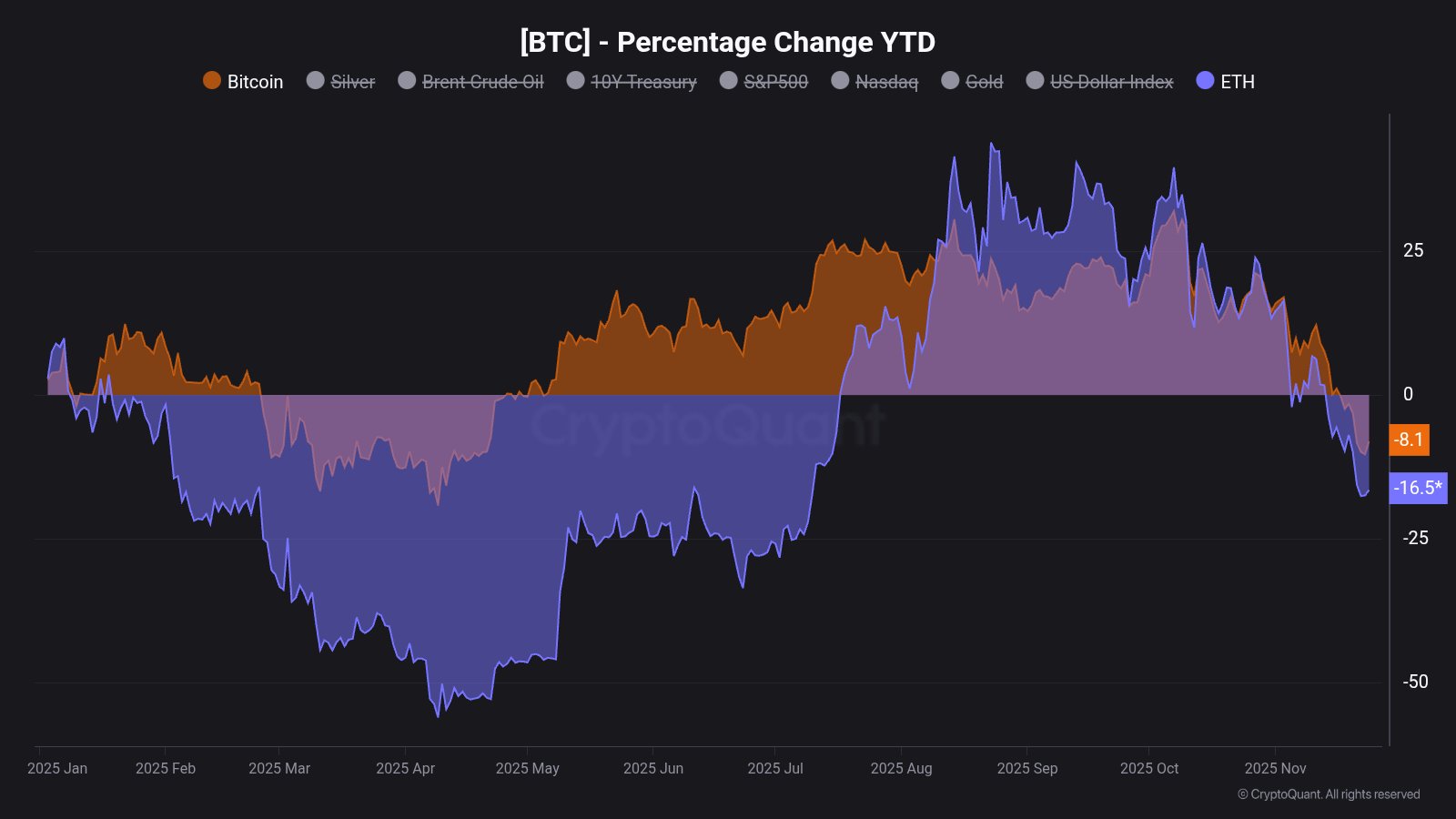

- Bitcoin’s YTD performance is currently negative, trading below its yearly opening price after a volatile period.

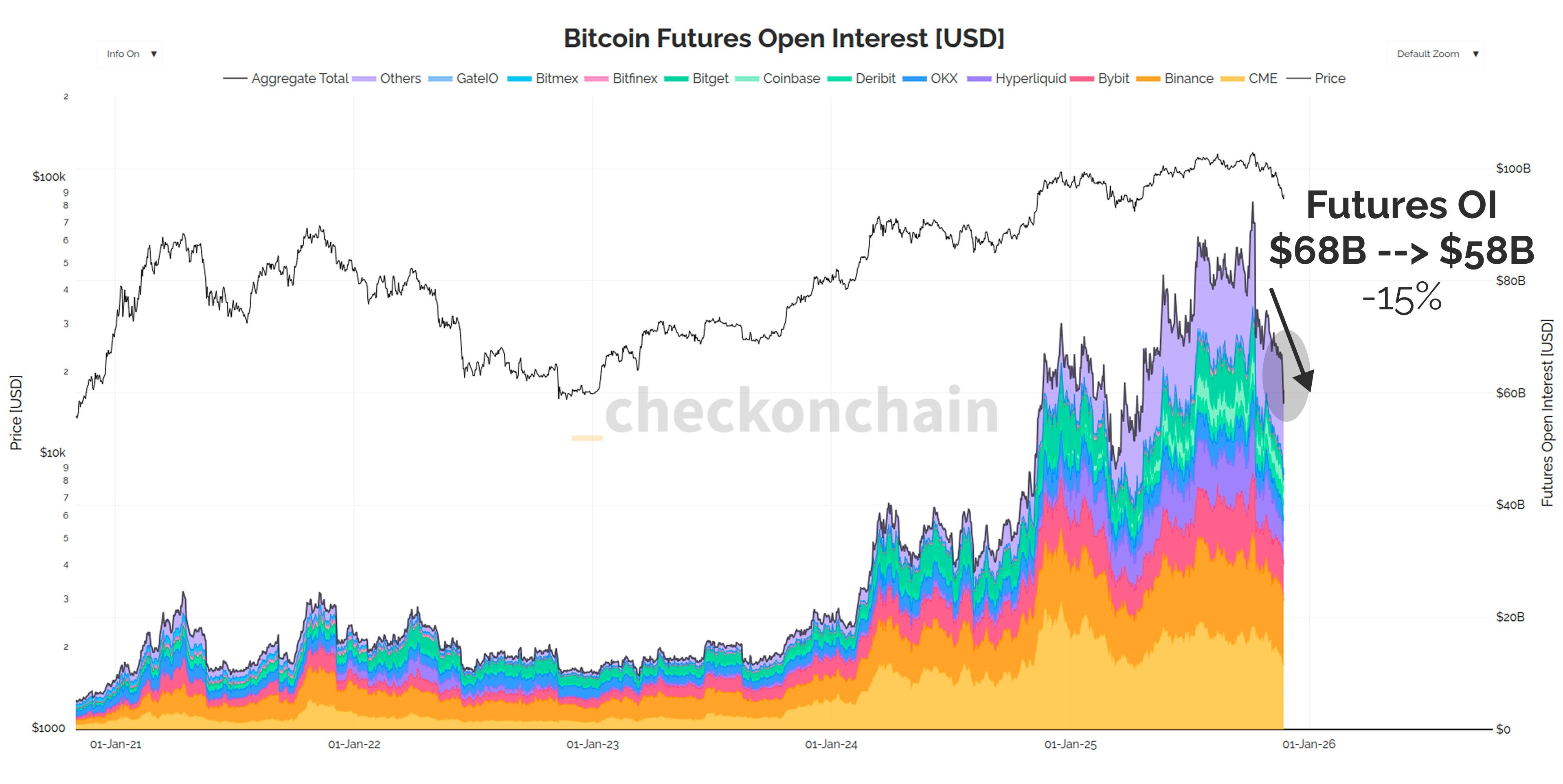

- Open interest in Bitcoin futures has significantly declined since the October 10 crash, suggesting a deleveraging of the market.

- Despite the recent downturn, analysts view the decrease in open interest as a potentially bullish signal, historically preceding trend reversals.

Bitcoin has experienced a turbulent year, marked by significant price swings and a struggle to maintain positive year-to-date (YTD) performance. After a substantial correction that saw it dip to multi-month lows, Bitcoin is now trading below its opening price for the year, a development that has caught the attention of institutional investors closely monitoring the digital asset’s market dynamics and potential for future growth. The recent price action and shifts in open interest are crucial indicators for assessing the cryptocurrency’s near-term trajectory and broader market sentiment.

Despite a recent rebound from a low of around $80,620, Bitcoin remains in the red when viewed from a longer-term perspective. The YTD decline underscores the challenges Bitcoin has faced, including regulatory uncertainties, macroeconomic headwinds, and market corrections. For institutional investors, this YTD performance is a critical metric, influencing portfolio allocation decisions and risk management strategies.

Ethereum is also exhibiting negative YTD performance, further emphasizing the broad challenges within the cryptocurrency market. While Bitcoin’s decline is noteworthy, Ethereum’s steeper drop highlights the varying degrees of volatility and market-specific factors affecting different digital assets. Institutional portfolios often diversify across multiple cryptocurrencies to manage risk, making the relative performance of assets like Bitcoin and Ethereum a key consideration.

The open interest in Bitcoin futures has seen a notable decrease since the market turbulence in October. This decline suggests that a significant amount of leverage has been unwound from the market, as traders closed out positions and reduced their exposure to Bitcoin futures. Lower open interest can reduce the likelihood of sharp price swings caused by cascading liquidations, potentially stabilizing the market.

Analysts interpret the reduction in open interest as a potentially bullish signal for Bitcoin. Historically, such deleveraging events have preceded trend reversals, as the market becomes less susceptible to excessive speculation and forced selling. For institutional investors, this could indicate a more attractive entry point, as the risk of further downside may be diminished. This dynamic is reminiscent of past market cycles where periods of deleveraging were followed by renewed bullish momentum.

The market’s reaction to these developments will be crucial in determining Bitcoin’s short- to medium-term outlook. Investors will be closely watching for signs of renewed accumulation, increased institutional inflows, and positive regulatory developments. How Bitcoin responds to these factors will provide valuable insights into its resilience and ability to regain its upward trajectory.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin’s YTD performance is currently negative, trading below its yearly opening price after a volatile period. Open interest in Bitcoin futures has significantly declined since the October 10 crash, suggesting a deleveraging of the market.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.