Bitcoin recently hit a multi-month low, driven by market corrections and excessive leverage. Ethereum and other altcoins, including XRP and SOL, have also experienced significant price drops. High liquidation volumes indicate substantial risk and volatility in the current crypto market environment.

What to Know:

- Bitcoin recently hit a multi-month low, driven by market corrections and excessive leverage.

- Ethereum and other altcoins, including XRP and SOL, have also experienced significant price drops.

- High liquidation volumes indicate substantial risk and volatility in the current crypto market environment.

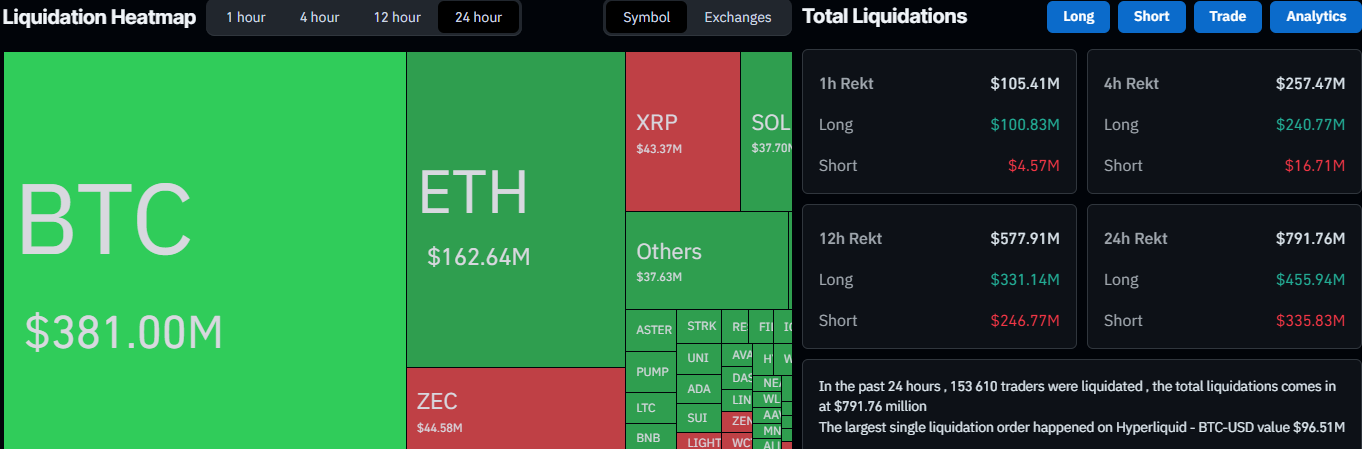

The crypto market is currently experiencing a significant downturn, with Bitcoin leading the decline to a multi-month low. Ethereum has also dipped below a key support level, and liquidations are surging due to high leverage among traders. This correction raises concerns about the short-term stability of the crypto market.

The recent drop in Bitcoin’s price below $92,000 marks its lowest point since April 24, representing a seven-month low for the leading cryptocurrency. Unlike previous market downturns triggered by specific events, this correction appears to be driven primarily by excessive leverage and broader market corrections. This suggests a need for caution and risk management among traders.

Ethereum’s decline, along with that of other altcoins like XRP and Solana, reflects a widespread downturn affecting the broader crypto market. The high volume of liquidations, with nearly $800 million wiped out in a single day, underscores the risks associated with leveraged trading. Monitoring these trends is crucial for understanding market sentiment and potential recovery points.

The current market conditions highlight the inherent volatility and risks associated with crypto investments. While the absence of a specific trigger suggests a market-driven correction, it also emphasizes the importance of prudent trading strategies and risk management. Investors should closely monitor market trends and regulatory developments to navigate these challenging times.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin recently hit a multi-month low, driven by market corrections and excessive leverage. Ethereum and other altcoins, including XRP and SOL, have also experienced significant price drops. High liquidation volumes indicate substantial risk and volatility in the current crypto market environment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.