Bitcoin faced rejection above $90,000, leading to a decline below $87,000, impacting broader market sentiment. The crypto market is experiencing a downturn, influenced by Bitcoin’s volatility and altcoin performance.

What to Know:

- Bitcoin faced rejection above $90,000, leading to a decline below $87,000, impacting broader market sentiment.

- The crypto market is experiencing a downturn, influenced by Bitcoin’s volatility and altcoin performance.

- XRP has slipped below the $1.90 support level, reflecting the overall market’s bearish trend.

The cryptocurrency market is showing signs of weakness as Bitcoin struggles to maintain its momentum above $90,000. A recent rejection at this level triggered a sell-off, pulling BTC below $87,000 and casting a shadow over the broader altcoin market. As the year comes to a close, investors are closely watching key support levels and market dynamics.

Bitcoin’s Struggle Below $87K

Bitcoin experienced significant volatility following the release of positive US CPI data. Initially, BTC surged to $89,500 but quickly reversed, falling to a multi-week low of $84,400 within hours. Although bulls attempted to regain ground, pushing Bitcoin above $90,000 briefly, the bears swiftly countered, driving the price down. Bitcoin is currently trading below $87,000, with a market capitalization of $1.730 trillion. Its dominance over altcoins remains above 57%.

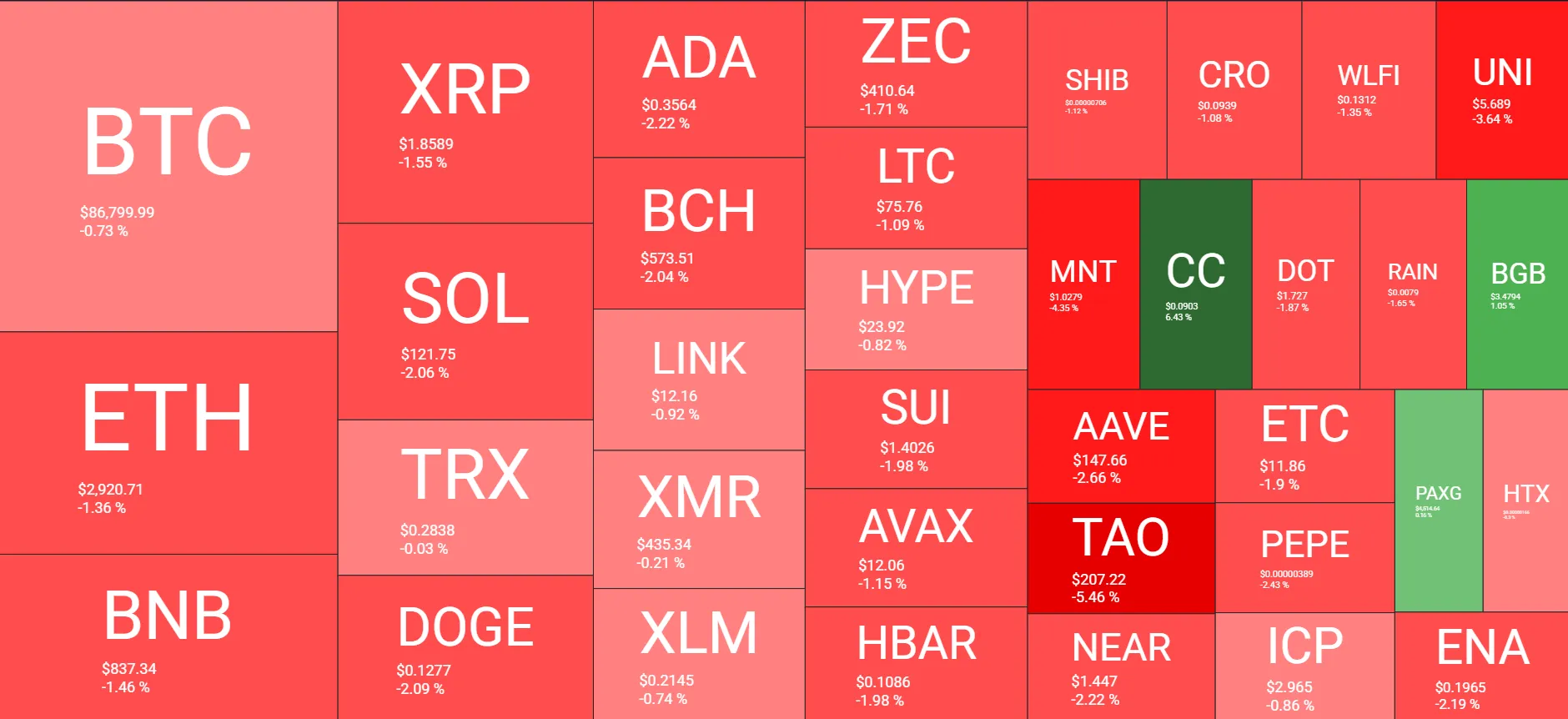

Altcoins Experience Downward Pressure

The altcoin market is mirroring Bitcoin’s struggles, with most major cryptocurrencies trading in the red. Ethereum, after reaching $3,060, has declined to $2,920. BNB has also faced resistance, falling from $870 to $835. XRP has broken below the $1.90 support level, indicating further bearish sentiment. Other altcoins like SOL, DOGE, ADA, BCH, and ZEC are also experiencing losses, while some exceptions like CC show positive gains.

XRP’s Liquidity and Market Position

XRP’s recent price action is indicative of broader market concerns. The failure to maintain support above $1.90 could lead to increased selling pressure. Investors are closely monitoring XRP’s liquidity and its ability to recover in the face of negative market sentiment. The outcome of the SEC case against Ripple continues to be a significant factor influencing XRP’s market behavior.

Broader Market Trends and Analysis

The total crypto market capitalization has decreased by over $100 billion since Monday’s peak, now standing at $3.020 trillion. This decline reflects a widespread risk-off sentiment among investors. Market participants are closely watching for potential catalysts, such as institutional adoption and regulatory developments, that could shift the market’s direction. The performance of Bitcoin ETFs and their impact on market liquidity remain key areas of focus.

Conclusion

The cryptocurrency market is currently facing headwinds, with Bitcoin’s struggles impacting altcoin performance. XRP’s break below the $1.90 support highlights the pervasive bearish sentiment. Investors should remain vigilant and closely monitor market developments, including Bitcoin’s price action and potential regulatory changes, to navigate the current market conditions effectively.

Related: XRP Prediction Targets 2026

Source: Original article

Quick Summary

Bitcoin faced rejection above $90,000, leading to a decline below $87,000, impacting broader market sentiment. The crypto market is experiencing a downturn, influenced by Bitcoin’s volatility and altcoin performance. XRP has slipped below the $1.90 support level, reflecting the overall market’s bearish trend.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.