Recent market downturns in crypto and equities stem from shifting interest rate expectations and repositioning in tech and AI sectors. Bitcoin and other cryptocurrencies are currently behaving as high-beta expressions of broader macroeconomic trends impacting growth equities.

What to Know:

- Recent market downturns in crypto and equities stem from shifting interest rate expectations and repositioning in tech and AI sectors.

- Bitcoin and other cryptocurrencies are currently behaving as high-beta expressions of broader macroeconomic trends impacting growth equities.

- Monitoring correlations between crypto, equities, ETF flows, and stablecoin market values is crucial for assessing the depth and duration of the current sell-off.

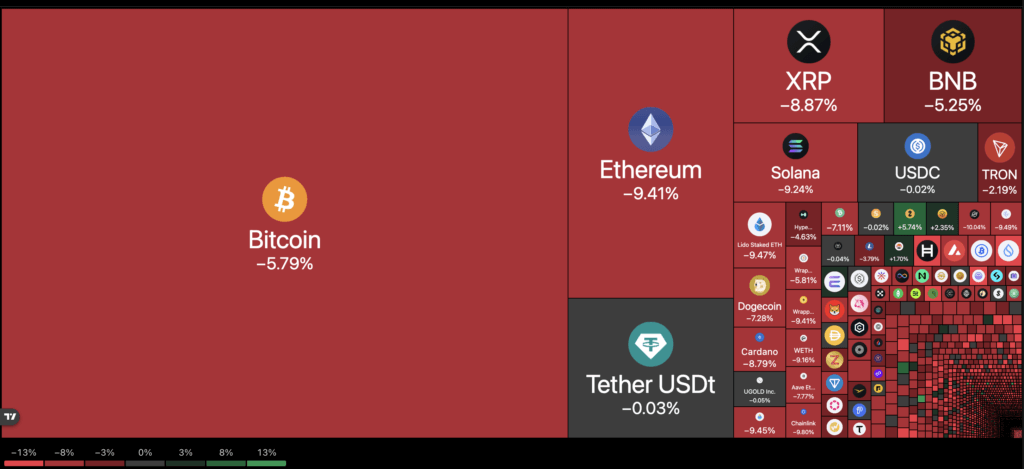

The crypto market recently experienced a notable downturn, mirroring similar pressures in equity markets, particularly within the tech sector. This synchronized movement underscores the interconnectedness of digital assets with traditional financial markets, influenced by macroeconomic factors. Examining the dynamics between Bitcoin, XRP, and other cryptocurrencies alongside traditional assets provides crucial insights for investors navigating these volatile conditions.

The recent sell-off can be attributed to a recalibration of interest rate expectations, with the Federal Reserve signaling a potentially prolonged period of tight monetary policy. Higher real yields are compressing valuations of growth stocks and long-duration assets, impacting tech giants and subsequently, cap-weighted indices like the S&P 500. This shift is prompting a rotation towards defensive sectors as investors re-evaluate risk premiums.

Concerns around fiscal negotiations, potential government shutdowns, and tighter fiscal conditions in Europe add further uncertainty, impacting cross-border capital flows and amplifying market volatility. This macro environment directly affects crypto markets, influencing funding, leverage, and risk appetite both on-chain and in derivatives markets. The performance of Bitcoin and altcoins like XRP is increasingly tied to these broader economic signals.

As real yields rise and equity volatility increases, multi-asset funds and crossover traders often reduce their exposure across the board, impacting crypto holdings. Even crypto-native flows are affected as stablecoin yields compete with Treasury rates, increasing the opportunity cost of capital. The approval and performance of Bitcoin ETFs will play a crucial role in shaping market sentiment and attracting institutional investment.

Looking ahead, the trajectory of crypto markets hinges on the evolution of macro repricing, including regulatory developments and potential shifts in monetary policy. Monitoring the correlations between equities, crypto, ETF flows, and stablecoin market values will be essential for gauging whether the current sell-off is a temporary correction or a more profound shift in risk appetite. As the market adapts, understanding these cross-asset signals will be key to navigating the evolving landscape.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Recent market downturns in crypto and equities stem from shifting interest rate expectations and repositioning in tech and AI sectors. Bitcoin and other cryptocurrencies are currently behaving as high-beta expressions of broader macroeconomic trends impacting growth equities.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.