Recent market downturn has led to significant liquidations. Bitcoin’s failure to rally despite positive macro events impacts altcoins. Over-leveraged traders bear the brunt of market corrections.

What to Know:

- Recent market downturn has led to significant liquidations.

- Bitcoin’s failure to rally despite positive macro events impacts altcoins.

- Over-leveraged traders bear the brunt of market corrections.

The cryptocurrency market experienced a significant downturn, leading to substantial liquidations across exchanges. Bitcoin’s inability to sustain gains, even with favorable macroeconomic developments, has intensified concerns among investors. Altcoins, including XRP, have suffered alongside Bitcoin, reflecting the market’s overall bearish sentiment.

Despite positive catalysts such as a Federal Reserve rate cut and easing trade tensions between the U.S. and China, Bitcoin failed to capitalize. The premier cryptocurrency faced rejection at the $116,000 level multiple times, leading to a sharp decline to around $107,500. This price action underscores the challenges Bitcoin faces in maintaining upward momentum.

The ripple effect of Bitcoin’s slump has extended to the altcoin market, with notable declines in Ethereum (ETH) and XRP. This correlation highlights the continued influence of Bitcoin on the broader cryptocurrency market. Investors are closely monitoring these trends as they navigate the volatile landscape.

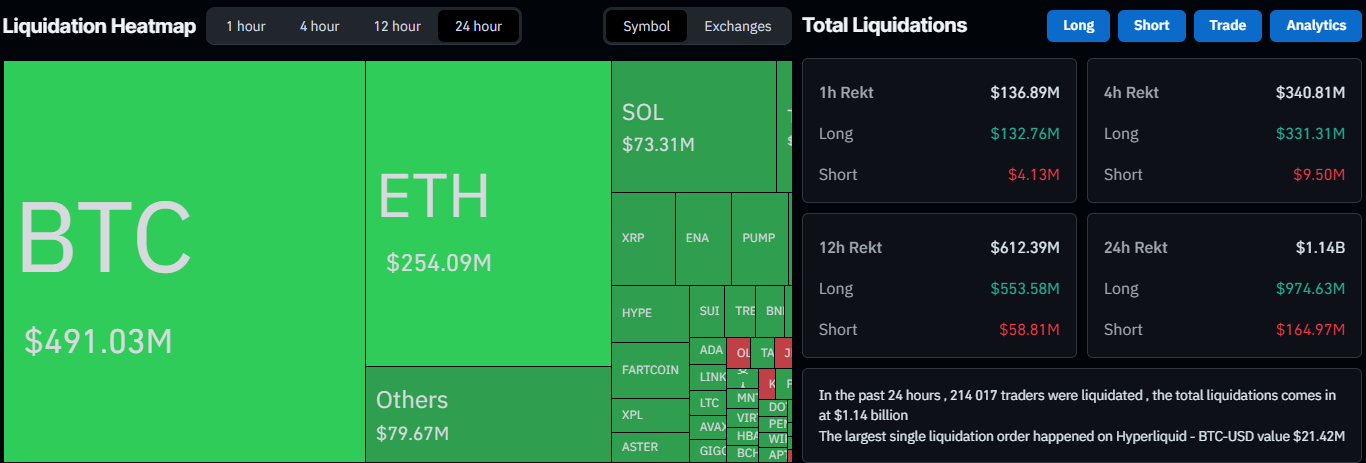

The recent market correction has resulted in over $1.1 billion in liquidations, primarily affecting traders holding long positions. This serves as a reminder of the risks associated with high leverage in cryptocurrency trading. Prudent risk management remains crucial for investors to protect their capital during periods of market volatility.

In conclusion, the cryptocurrency market is currently navigating a challenging phase, marked by price declines and significant liquidations. While positive developments could shift market sentiment, investors should remain vigilant and exercise caution. The potential approval of Bitcoin ETFs and evolving regulatory landscapes could influence future market trends.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Recent market downturn has led to significant liquidations. Bitcoin’s failure to rally despite positive macro events impacts altcoins. Over-leveraged traders bear the brunt of market corrections. The cryptocurrency market experienced a significant downturn, leading to substantial liquidations across exchanges.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.