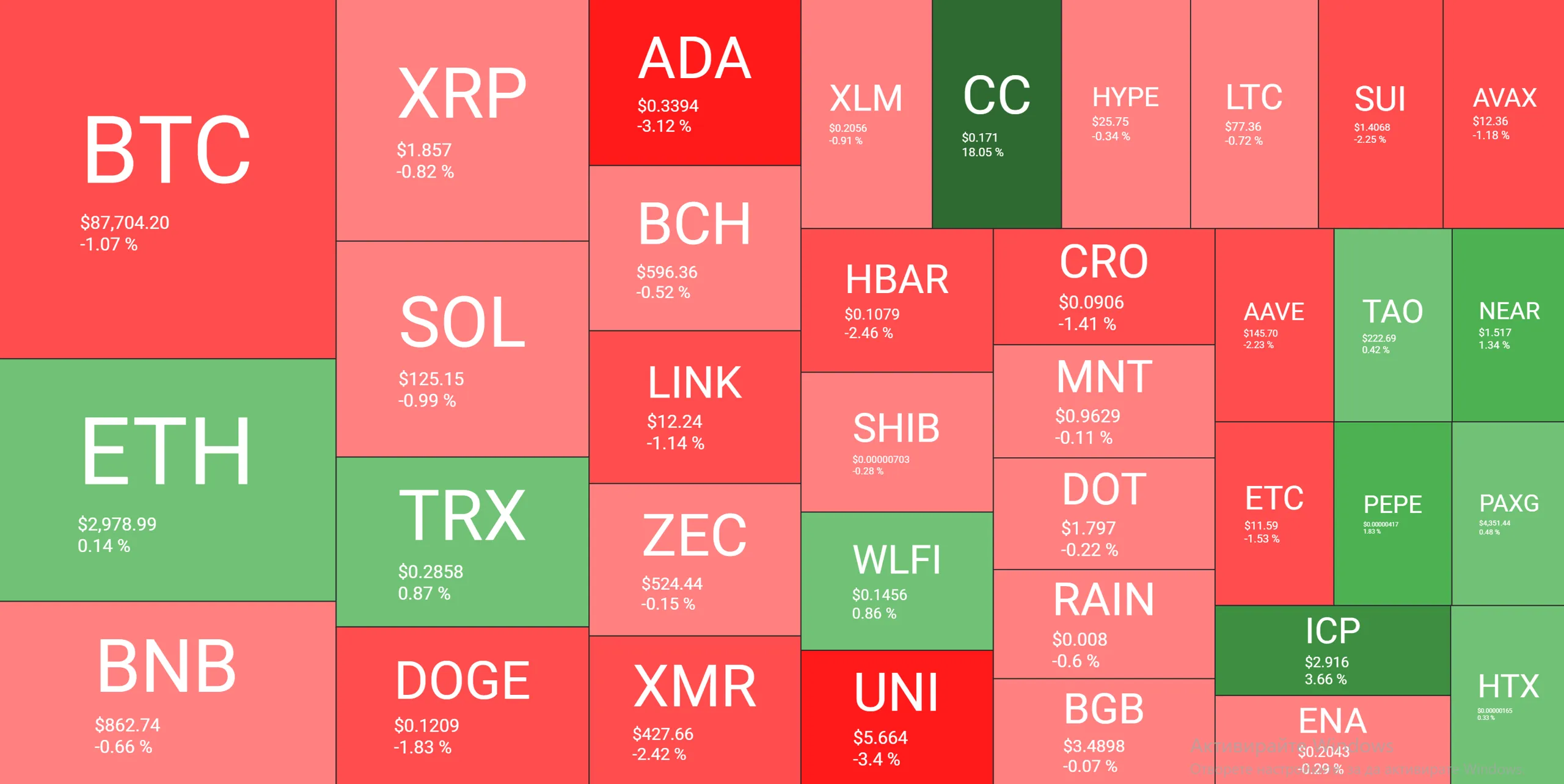

Bitcoin concluded the year with a 7% decline, facing resistance at $90,000. The broader crypto market saw mixed performance, with Canton’s CC experiencing a notable surge. XRP experienced a slight decline alongside BNB and SOL, while ETH saw minor gains.

What to Know:

- Bitcoin concluded the year with a 7% decline, facing resistance at $90,000.

- The broader crypto market saw mixed performance, with Canton’s CC experiencing a notable surge.

- XRP experienced a slight decline alongside BNB and SOL, while ETH saw minor gains.

Bitcoin’s struggle to break the $90,000 resistance level has led to a disappointing end to the year, with a 7% annual decline. While Bitcoin faced headwinds, select altcoins, like Canton’s CC, have shown impressive gains, diverging from the overall market trend. This mixed performance highlights the nuanced nature of the current crypto landscape, with specific assets bucking the broader market sentiment.

Bitcoin’s Year-End Struggle

Throughout December, Bitcoin consolidated within a tightening range, initially between $94,500 and $84,500, before narrowing to $86,000 and $90,000. Attempts to breach the $90,000 mark were consistently met with resistance, resulting in a retreat to below $88,000. This price action underscores the ongoing uncertainty surrounding Bitcoin’s short-term trajectory, with buyers struggling to establish a sustained upward momentum.

Altcoin Performance: A Mixed Bag

While Bitcoin struggled, the altcoin market presented a mixed picture. Canton’s CC stood out with a remarkable 130% monthly surge, trading above $0.17. ICP also showed strength, gaining over 3.5%. However, most other large-cap altcoins experienced declines, with Cardano’s ADA, UNI, DOGE, LINK, HBAR, CRO, and XMR all posting losses.

XRP and Other Major Cryptocurrencies

XRP experienced a slight dip alongside BNB and SOL, while Ethereum and Tron recorded minor gains. This subdued performance among major altcoins reflects the cautious sentiment prevailing in the market, as investors await clearer signals regarding future price movements. The overall crypto market cap decreased by $20 billion, falling below $3.060 trillion.

Implications for Liquidity and Market Structure

Bitcoin’s inability to sustain a rally above $90,000 may impact overall market liquidity. Uncertainty in the market often leads to decreased trading volumes. The divergence in performance between Bitcoin and select altcoins could lead to a rotation of capital, as investors seek opportunities in assets with stronger momentum. These shifts can influence market structure and liquidity dynamics across different exchanges and trading pairs.

Potential Impact of Bitcoin ETFs

The approval and launch of Bitcoin ETFs could significantly alter the market dynamics. These ETFs would provide institutional and retail investors with a more accessible way to gain exposure to Bitcoin, potentially driving increased demand and liquidity. However, the impact of ETFs on XRP and other altcoins remains uncertain, as capital flows could concentrate on Bitcoin initially.

Conclusion

Bitcoin’s year-end struggles highlight the challenges it faces in overcoming key resistance levels. While select altcoins have demonstrated impressive gains, the broader market remains cautious. The potential impact of Bitcoin ETFs and the evolving market structure will be key factors to watch in the coming months, as investors navigate this complex landscape.

Related: XRP Unlock Signals Future Liquidity

Source: Original article

Quick Summary

Bitcoin concluded the year with a 7% decline, facing resistance at $90,000. The broader crypto market saw mixed performance, with Canton’s CC experiencing a notable surge. XRP experienced a slight decline alongside BNB and SOL, while ETH saw minor gains.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.