Bitcoin’s dominance is increasing, signaling a shift away from altcoins. Institutional investors favor Bitcoin due to its liquidity and safety. Altcoins face headwinds from selling pressure and token dilution.

What to Know:

- Bitcoin’s dominance is increasing, signaling a shift away from altcoins.

- Institutional investors favor Bitcoin due to its liquidity and safety.

- Altcoins face headwinds from selling pressure and token dilution.

Bitcoin’s strengthening grip on the crypto market highlights a potential shift in investor sentiment. Data indicates Bitcoin’s dominance is rising, while altcoins are trending downwards in the current market cycle. This suggests a preference for Bitcoin’s unique characteristics over speculative altcoins.

Institutional flows are increasingly favoring liquidity and safety, which benefits Bitcoin. Mainstream distribution mechanisms like spot exchange-traded funds (ETFs) and institutional custody products are designed for large allocators. These allocators prioritize assets with deep liquidity, minimal slippage, and protection from headline risk, typically leading them to Bitcoin.

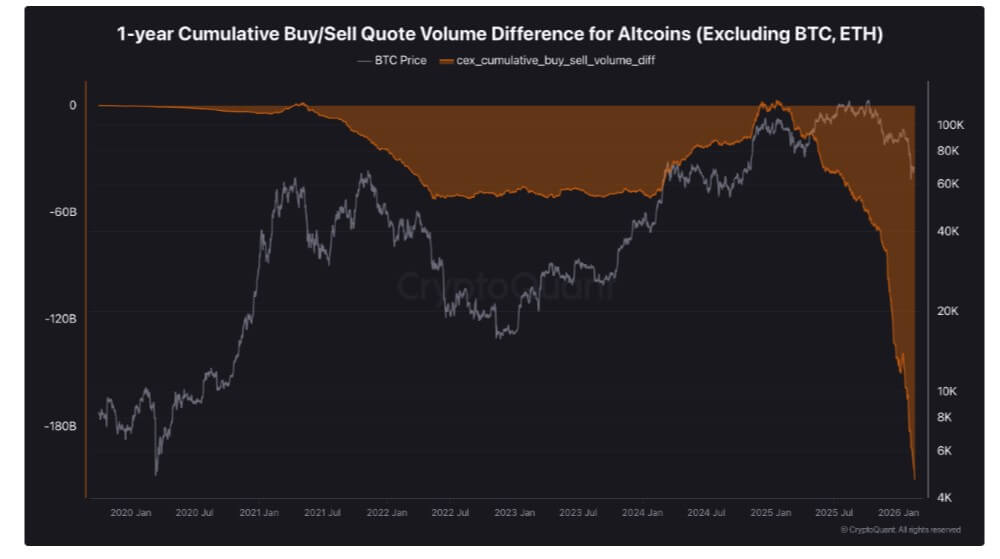

Altcoins face significant headwinds from intense selling pressure and substantial token dilution. CryptoQuant data shows a cumulative buy-and-sell difference for altcoins (excluding Bitcoin and Ethereum) of -$209 billion since January 2025. This prolonged net selling indicates a lack of institutional accumulation for smaller tokens.

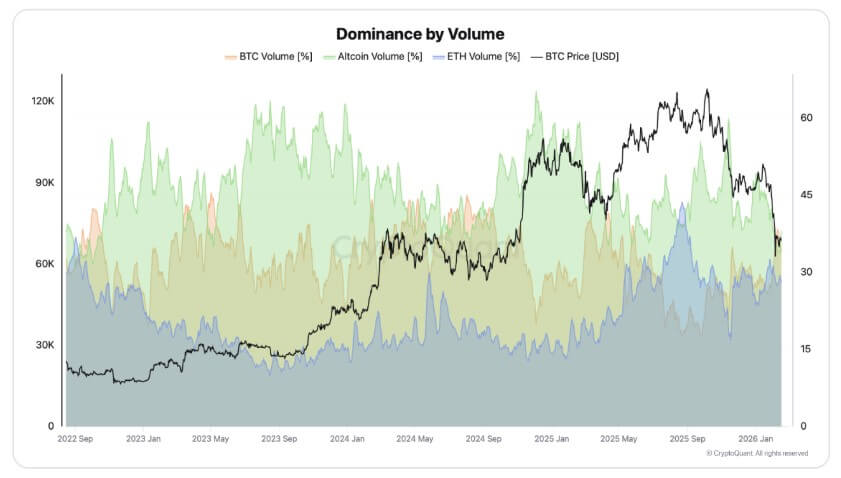

Trading volumes signal a flight to quality in the current bear market, with investors rotating capital toward Bitcoin. Binance data shows Bitcoin trading volume regaining dominance, accounting for 36.8% of total exchange volume on Feb. 7. This contrasts with November, when altcoins accounted for 59.2% of Binance’s trading volume, highlighting a shift toward Bitcoin during market stress.

If historical patterns hold, a massive capital rotation from altcoins into Bitcoin could occur in the coming months. Analysts at CEX.io project that between $740 billion and $1.2 trillion in trading volume could shift from altcoins into Bitcoin. This consolidation could significantly increase Bitcoin’s volume share.

In conclusion, the cryptocurrency market is currently experiencing a flight to quality, with Bitcoin positioned to benefit from increased dominance and capital rotation. Factors such as institutional investment, regulatory developments, and market volatility are contributing to this trend, potentially reshaping the landscape for altcoins.

Related: XRP on Flare Yield Surpasses Supply Target

Source: Original article

Quick Summary

Bitcoin’s dominance is increasing, signaling a shift away from altcoins. Institutional investors favor Bitcoin due to its liquidity and safety. Altcoins face headwinds from selling pressure and token dilution. Bitcoin’s strengthening grip on the crypto market highlights a potential shift in investor sentiment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.