Ripple Treasury executed a substantial burn of RLUSD on Ethereum, signaling active supply management. Bitcoin’s year-end price sets the stage for a potential January surge, fueled by historical trends and optimistic market outlooks.

What to Know:

- Ripple Treasury executed a substantial burn of RLUSD on Ethereum, signaling active supply management.

- Bitcoin’s year-end price sets the stage for a potential January surge, fueled by historical trends and optimistic market outlooks.

- Bitwise’s filing for a ZEC Strategy ETF introduces a new narrative for privacy coins within traditional financial products.

The digital asset space closes out 2025 with a confluence of intriguing developments, from stablecoin supply adjustments to bullish Bitcoin forecasts and a surprising ETF filing targeting privacy coins. While no single event guarantees immediate market upheaval, the collective impact shapes the narrative heading into January. These developments reinforce the ongoing integration of crypto into traditional finance and hint at 2026 as a year of potential ETF-driven acceleration.

Ripple Burns RLUSD, Tightening Supply

Ripple’s recent burn of 21,804,950 RLUSD on Ethereum marks a significant supply reduction for its stablecoin. The movement of these tokens to Ethereum’s “null address” effectively removes them from circulation. While RLUSD maintains its peg near $1 with a circulating supply of approximately 1.33 billion, this burn is a noteworthy event. Such actions by a stablecoin treasury often indicate proactive supply management, response to redemption activity, or general balance sheet optimization. If Ripple continues to strategically manage RLUSD’s supply through burns, it could establish a transparent on-chain narrative, offering market participants clear signals regarding the stablecoin’s health and stability. This kind of visibility is key as stablecoins face increasing scrutiny.

Bitcoin Eyes $100,000 Amidst Seasonal Tailwinds

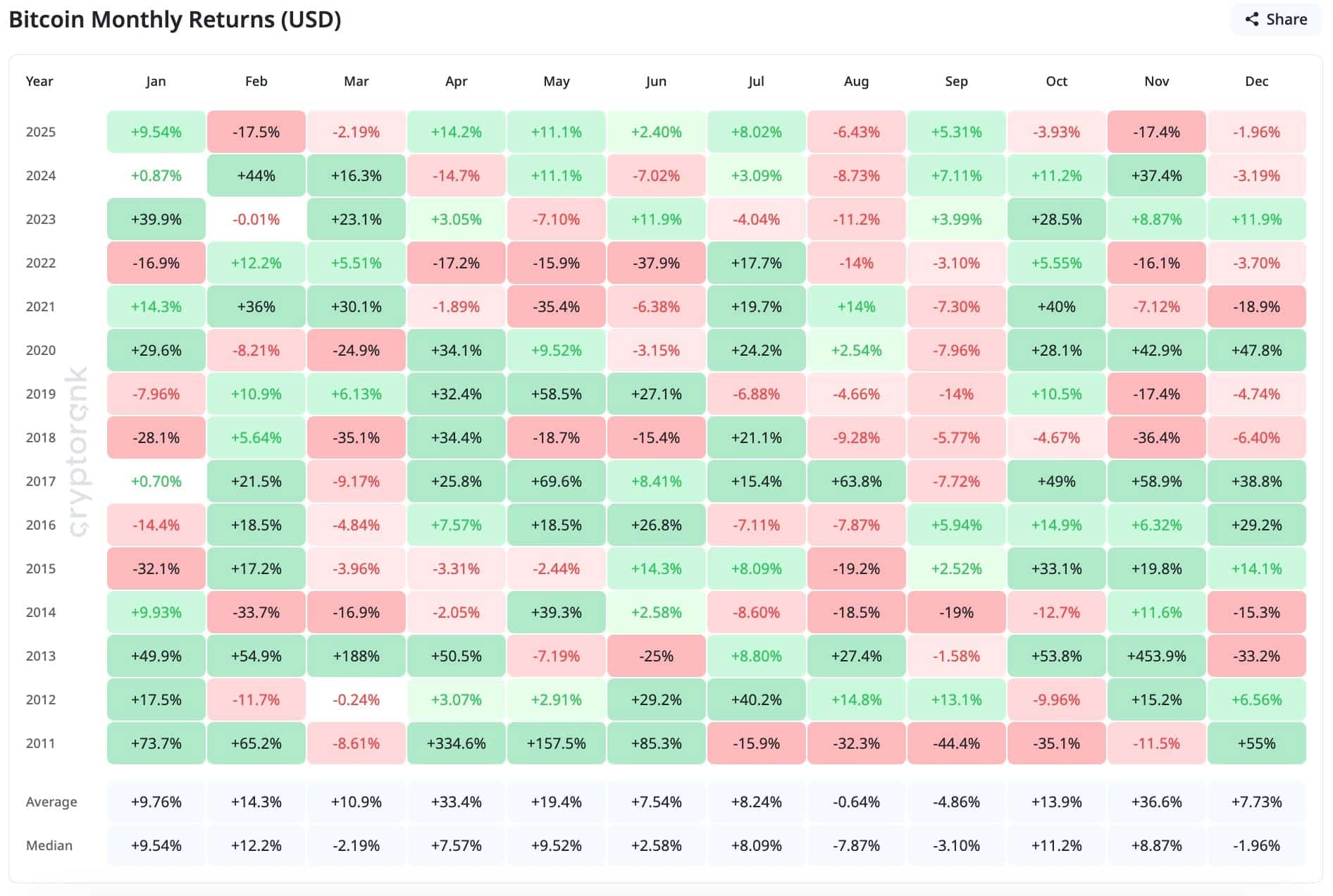

Bitcoin closed the year trading around $88,800, fueling discussions of a potential surge to $100,000 in January. Achieving this target would require a roughly 12.6% increase, a move well within Bitcoin’s historical volatility. CryptoRank’s data reveals that January has historically been a positive month for Bitcoin, with an average return of 9.76%.

Bitwise’s recent predictions further support this bullish outlook, suggesting Bitcoin may break its traditional four-year cycle due to factors like diminishing halving impact, anticipated rate cuts, and increased institutional adoption via ETFs. The firm notes that Bitcoin funds have absorbed significantly more BTC than has been issued since January 2024, creating a supply-demand imbalance that has driven prices higher. The convergence of these factors makes the $100,000 target seem increasingly attainable.

Bitwise Files for Zcash (ZEC) Strategy ETF

Bitwise’s filing for a ZEC Strategy ETF has injected new life into the privacy coin sector. This move is part of a broader filing that includes other digital assets.

While a strategy-focused ETF differs from a spot ETF and doesn’t guarantee approval, it signals Bitwise’s belief in a viable market for Zcash within traditional finance. The market has traditionally viewed privacy coins with skepticism due to regulatory concerns and challenges in integrating them into traditional financial systems. The ETF news has already impacted ZEC’s price, which currently trades around $526.59. The market now perceives a higher floor for ZEC, supported by the ETF narrative, at least until market sentiment shifts.

Looking Ahead to Crypto in 2026

The year 2026 is shaping up to be a pivotal year for crypto, potentially marking a transition from hype-driven trading to adoption-based valuations. Continued expansion of ETF access could elevate Bitcoin’s status, transforming the $100,000 level from a headline to a support level.

Stablecoins are likely to attract increased regulatory attention, leading to greater scrutiny of treasury actions like RLUSD burns as indicators of stability and redemption management. The ETF landscape may further diversify, encompassing strategy-based products and niche assets, potentially benefiting privacy coins like ZEC. However, regulatory hurdles and liquidity shocks remain key risks that could disrupt this optimistic outlook.

In conclusion, the recent developments in the crypto market, including Ripple’s stablecoin management, Bitcoin’s bullish momentum, and Bitwise’s ZEC ETF filing, collectively paint a picture of a maturing asset class. These events point towards greater integration with traditional finance and set the stage for a potentially transformative year in 2026, contingent on navigating regulatory challenges and maintaining market liquidity.

Related: XRP Targets $8; Signals Bullish Forecast

Source: Original article

Quick Summary

Ripple Treasury executed a substantial burn of RLUSD on Ethereum, signaling active supply management. Bitcoin’s year-end price sets the stage for a potential January surge, fueled by historical trends and optimistic market outlooks. Bitwise’s filing for a ZEC Strategy ETF introduces a new narrative for privacy coins within traditional financial products.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.