Bitcoin ETF investments are capturing increasing attention from major Wall Street players and global financial institutions, as newly disclosed filings from the U.S. Securities and Exchange Commission (SEC) reveal massive stakes in these financial instruments.

Bitcoin ETF investments are capturing increasing attention from major Wall Street players and global financial institutions, as newly disclosed filings from the U.S. Securities and Exchange Commission (SEC) reveal massive stakes in these financial instruments.

Hedge fund Brevan Howard expanded its footprint in the iShares Bitcoin Trust (IBIT) by nearly doubling its holdings during Q2. According to a filing, the firm held 37.9 million IBIT shares at the end of June, up from 21.5 million in March. That position, worth over $2.6 billion based on June 28’s closing price, places Brevan Howard among the top institutional holders of IBIT.

Goldman Sachs also ramped up its bitcoin ETF holdings, now owning $3.3 billion worth in IBIT and Fidelity’s Wise Origin Bitcoin Trust (FBTC). Additionally, it disclosed a $489 million position in the iShares Ethereum Trust (ETHA), according to a separate filing.

While Goldman’s exposure likely reflects client-directed investments via its asset management division, Brevan Howard—with its crypto-centric division called BH Digital—retains a direct presence in blockchain initiatives. BH Digital oversees billions in assets and is actively investing in decentralized finance and supporting technologies.

Institutional Support Expands: Harvard, Wells Fargo, and More

Harvard University entered the bitcoin ETF scene with a notable $1.9 billion stake in IBIT, as reported in this article. Similarly, Abu Dhabi’s Mubadala Investment Company reported retaining $681 million in IBIT, strengthening global institutional confidence in BTC-linked ETFs.

Major U.S. banks also expanded their bitcoin ETF exposure. Wells Fargo boosted its IBIT holdings from $26 million to $160 million while maintaining a modest $200,000 position in the Grayscale Bitcoin Fund (GBTC), as per a recent filing.

Cantor Fitzgerald increased its crypto-related assets to over $250 million, diversifying its investments across companies involved in blockchain, such as Strategy (MSTR), Coinbase (COIN), and Robinhood (HOOD). Meanwhile, Jane Street, a global trading firm, revealed it holds $1.46 billion in IBIT, making it the firm’s biggest position after Tesla. The firm also increased exposure to MSTR while reducing its FBTC stake. Related data can be found here.

Spot bitcoin ETFs like IBIT—introduced in January—allow traditional investors to track bitcoin’s market performance without owning the underlying asset. This enables institutions to gain indirect crypto exposure using familiar platforms and custodial frameworks.

European Entrants: Norway’s Strategic Accumulation

European state-backed investors have started adopting a different approach to bitcoin exposure. Rather than holding the digital asset directly, they opt to invest in public companies accumulating BTC on their balance sheets.

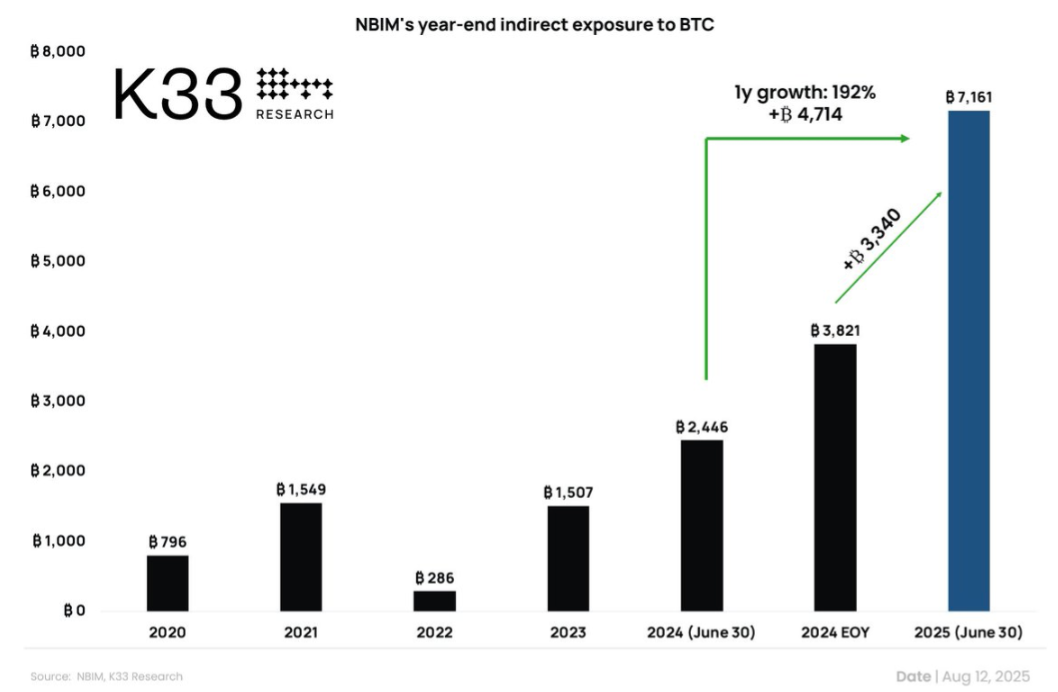

Norway’s Norges Bank Investment Management (NBIM), which oversees the nation’s $2 trillion sovereign wealth fund, illustrates this trend. As per K33 Research, NBIM now indirectly owns 7,161 BTC—a 192% increase year-over-year. This figure is also up 87% since the end of 2024.

Norway’s sovereign wealth fund increases its bitcoin exposure in 2025 through public equities. (Source: NBIM, K33 Research)

Of the 7,161 BTC, the biggest chunk—3,005 BTC—is held through shares in Strategy. The remaining BTC is spread across bitcoin-exposed firms like Marathon Digital, Block, Coinbase, and Metaplanet. Even minor positions in companies such as GameStop contribute to this indirect bitcoin ownership.

Despite this increase, bitcoin investments still represent a tiny portion of Norway’s vast portfolio. At a bitcoin market value of $117,502 per token, their holdings equal approximately $841 million—less than 0.05% of the total assets under management.

Related: Cardano Bull Setup Points to December Rally

This surge in institutional bitcoin ETF activity suggests a growing comfort level among legacy investors, though it hasn’t yet driven a strategic paradigm shift. However, the rising stakes indicate that bitcoin’s role in traditional portfolios is evolving rapidly.

Quick Summary

Bitcoin ETF investments are capturing increasing attention from major Wall Street players and global financial institutions, as newly disclosed filings from the U.S. Securities and Exchange Commission (SEC) reveal massive stakes in these financial instruments.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.