Bitcoin ETFs need sustained inflows to maintain price support, according to Bitfinex analysts. A break below the $107,000–$108,000 support level could signal a prolonged consolidation period. Despite recent outflows, some analysts still predict a significant Bitcoin rally by year-end.

What to Know:

- Bitcoin ETFs need sustained inflows to maintain price support, according to Bitfinex analysts.

- A break below the $107,000–$108,000 support level could signal a prolonged consolidation period.

- Despite recent outflows, some analysts still predict a significant Bitcoin rally by year-end.

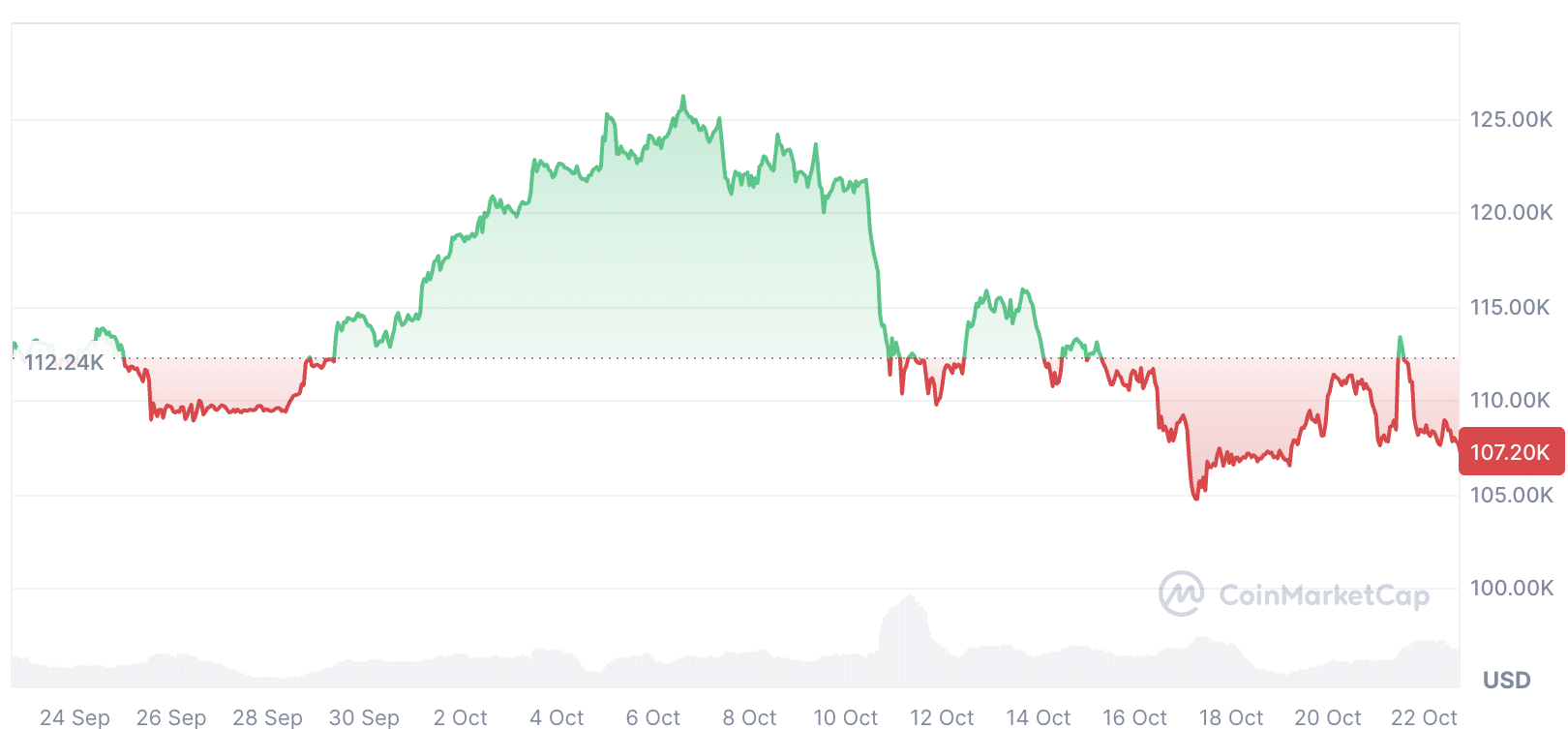

Bitcoin’s price is at a critical juncture, with analysts closely watching the performance of U.S. spot Bitcoin ETFs. Recent outflows have raised concerns about the cryptocurrency’s ability to maintain its current support level. The lack of sustained institutional accumulation could lead to a more prolonged consolidation phase for Bitcoin.

The recent crypto market dip has led to significant net outflows from spot Bitcoin ETFs. According to Bitfinex analysts, the $107,000 to $108,000 zone is becoming increasingly difficult to defend as a support level. This suggests a potential shift in market dynamics, where consistent institutional buying is crucial for price stability.

If Bitcoin’s price moves any lower, it could serve as a key warning signal of a more prolonged consolidation period. Analysts believe that the strength of ETF inflows will be a determining factor. Should weakness persist, it could undermine one of the primary forces behind previous rallies: consistent institutional accumulation.

Despite the recent challenges, some market participants remain optimistic about Bitcoin’s potential for an upswing before the end of the year. Predictions from figures like BitMEX co-founder Arthur Hayes and BitMine chair Tom Lee suggest Bitcoin could reach $250,000. However, others like Galaxy Digital CEO Mike Novogratz suggest that such a surge would require a number of very unlikely events to occur.

In conclusion, the performance of Bitcoin ETFs and the level of institutional investment will be critical in determining Bitcoin’s trajectory. While challenges exist, the potential for regulatory developments and increased adoption could still drive a significant rally, making Bitcoin an asset to watch closely.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin ETFs need sustained inflows to maintain price support, according to Bitfinex analysts. A break below the $107,000–$108,000 support level could signal a prolonged consolidation period. Despite recent outflows, some analysts still predict a significant Bitcoin rally by year-end.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.