Bitcoin ETFs are dramatically reshaping the blockchain ecosystem, as the focus keyword ‘Bitcoin ETFs’ indicates a key shift in how the network operates. Despite Bitcoin trading near historic highs, its underlying network activity is surprisingly muted.

Bitcoin ETFs are dramatically reshaping the blockchain ecosystem, as the focus keyword ‘Bitcoin ETFs’ highlights a key shift in how the network operates. Despite Bitcoin trading near historic highs, its underlying network activity is surprisingly muted.

On-Chain Activity Slows Despite Record Bitcoin Prices

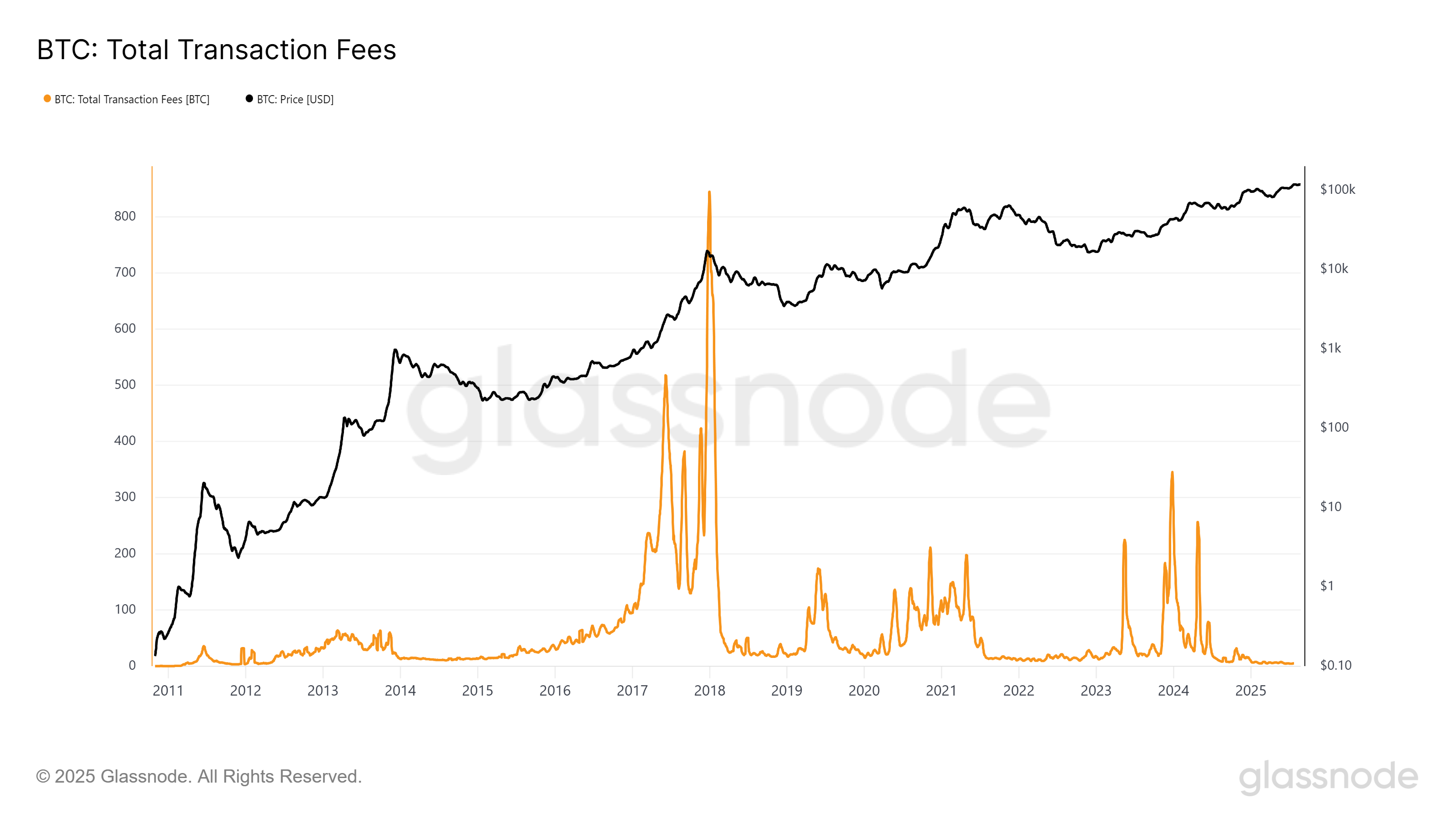

While Bitcoin’s value remains elevated, data from Glassnode reveals that transaction fees on the Bitcoin network have plummeted, nearing levels not seen in over a decade. Historically, bull markets led to congestion and high fees as traders competed for blockspace. But this year, prices have climbed while transaction fees have dropped—signaling a major shift in how demand flows across the ecosystem.

Glassnode data shows collapsing transaction fees despite a strong bull market in Bitcoin’s price.

According to a Galaxy Research report, average daily fees have declined more than 80% since April 2024. Today, it’s common for up to 15% of blocks to clear with fees as low as 1 satoshi per vbyte. Nearly half of all blocks aren’t even full, highlighting weak on-chain demand and a quiet mempool.

ETF Influence and Blockchain Demand Diverge

This discrepancy points to a core transformation: institutional investors and spot ETFs now command more than 1.3 million BTC. Once transferred to these custodians, cryptocurrencies often remain idle, rarely re-entering circulation. As a result, a large segment of the market is effectively removed from the transactional economy, dampening on-chain activity.

Simultaneously, retail users—once dominant players on Bitcoin’s blockchain—have migrated to alternative platforms like Solana. With its faster processing and lower costs, Solana has become the hub for digital collectibles and speculative tokens, including NFTs and memecoins.

Miners Face Financial Strain from Low Fees

This changing landscape is particularly tough on miners. After April’s halving event, block rewards dropped from 6.25 to 3.125 BTC. Combined with vanishing transaction fees—which comprised less than 1% of miner revenues in July—this has severely impacted profitability.

Publicly listed mining companies are now seeking alternate revenue streams. For instance, many are entering high-performance computing (HPC) and artificial intelligence (AI) hosting services. This strategic pivot is meant to offset heavy operational costs and diversify income sources.

As discussed in this CoinDesk analysis, electricity expenses and hardware depreciation continue to weigh heavily on firms that haven’t diversified. Bitdeer and BitFuFu remain highly vulnerable, while peers like Hive, Core Scientific, and TeraWulf reported gains from new business lines during Q2.

Market analysts at Rittenhouse Research argue that Galaxy Digital’s departure from mining altogether may become a blueprint for the sector’s future—a strategy increasingly rewarded by equity markets.

Market Data and Broader Developments

Despite the underlying network challenges, Bitcoin traded at $113,286.95—down 1.79%—after briefly dipping to a six-week low around $110,600. Ethereum remained stable at $4,779, buoyed by Jerome Powell’s dovish comments at Jackson Hole that hint at possible interest rate cuts.

Gold prices rose to $3,371 on the same remarks, and Japan’s Nikkei 225 climbed 1.08% as investor sentiment shifted.

Related: Cardano Bull Setup Points to December Rally

- Why raising a crypto VC fund is harder now — even in a bull market (The Block)

- Why Luca Netz Will Be ‘Disappointed’ If Pudgy Penguins Doesn’t IPO Within 2 Years (Decrypt)

- KPMG Sees Strong Second Half for Canadian Fintechs After Crypto & AI Rally (CoinDesk)

The contrast is striking: while Bitcoin’s network shows signs of stagnation, financial markets appear to be shifting confidence toward AI and data infrastructure ventures. Galaxy’s business shift and the broader miner diversification trend underscore a future where security and scalability may no longer rely solely on on-chain demand.

Quick Summary

Bitcoin ETFs are dramatically reshaping the blockchain ecosystem, as the focus keyword ‘Bitcoin ETFs’ highlights a key shift in how the network operates. Despite Bitcoin trading near historic highs, its underlying network activity is surprisingly muted.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.