The Federal Reserve lowered key interest rates, triggering a notable market reaction. Bitcoin experienced a temporary dip following the rate cut, aligning with historical patterns. Over $700 million in liquidations occurred, impacting over 150,000 traders.

What to Know:

- The Federal Reserve lowered key interest rates, triggering a notable market reaction.

- Bitcoin experienced a temporary dip following the rate cut, aligning with historical patterns.

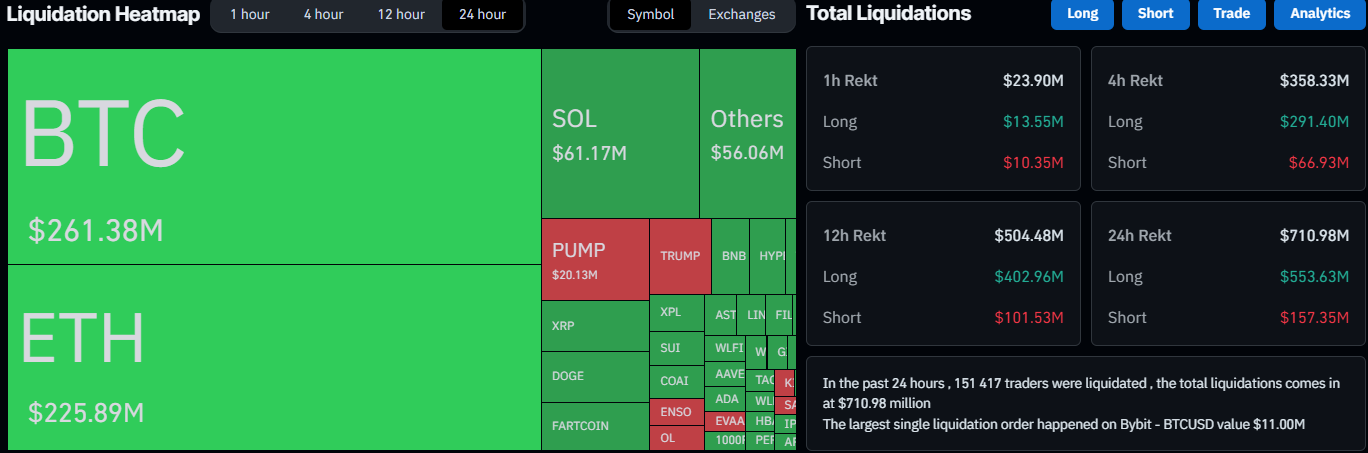

- Over $700 million in liquidations occurred, impacting over 150,000 traders.

The crypto market experienced a sharp correction as the US Federal Reserve implemented a widely anticipated interest rate cut. Bitcoin initially dipped, aligning with historical trends observed after previous FOMC meetings, before showing signs of recovery. This volatility led to substantial liquidations across the market, impacting a significant number of traders.

Despite the initial downturn, analysts suggest the dip may have fulfilled a CME gap, potentially setting the stage for future gains. Altcoins, including XRP and Ethereum, mirrored Bitcoin’s movements, undergoing corrections of their own. These corrections present potential entry points for investors eyeing long-term growth in these assets.

BITCOIN HISTORY REPEATS UNTIL IT DOESN’T.

Every FOMC meeting this year triggered a $BTC dump:

10%. 6%. 8%. The pattern is clear.Today’s meeting?

The setup is the same. The outcome doesn’t have to be.Position accordingly. pic.twitter.com/LqIqO145R2

— Merlijn The Trader (@MerlijnTrader) October 29, 2025

The immediate aftermath saw liquidations surge, with a single position on Bybit accounting for $11 million. Such events highlight the inherent risks in leveraged trading, especially during periods of heightened market sensitivity. Prudent risk management remains crucial for navigating these fluctuations.

As the market absorbs the impact of the rate cut, attention shifts to the potential for sustained growth in Bitcoin and altcoins. The approval of Bitcoin ETFs and clearer regulatory frameworks could further stabilize the market. Investors should closely monitor these developments for informed decision-making.

In conclusion, while the immediate reaction to the Fed’s decision sparked volatility, the crypto market’s underlying fundamentals remain strong. Strategic investors may find opportunities amidst the turbulence, provided they exercise caution and stay informed.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

The Federal Reserve lowered key interest rates, triggering a notable market reaction. Bitcoin experienced a temporary dip following the rate cut, aligning with historical patterns. Over $700 million in liquidations occurred, impacting over 150,000 traders.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.