Bitcoin reached $48,000, making it a two-month high, while altcoins showed mixed performance. Bitcoin’s dominance increased, reflecting strong market sentiment amidst geopolitical tensions.

What to Know:

- Bitcoin reached $48,000, marking a two-month high, while altcoins showed mixed performance.

- Bitcoin’s dominance increased, reflecting strong market sentiment amidst geopolitical tensions.

- XRP experienced a slight dip, highlighting the nuanced reactions across different cryptocurrencies to broader market movements.

Bitcoin has recently surged, hitting levels not seen since mid-November, while the altcoin market presents a mixed landscape. This movement underscores Bitcoin’s continued influence on the broader crypto market, even as individual altcoins react differently. The increase in Bitcoin’s dominance suggests a flight to relative safety amid prevailing market conditions.

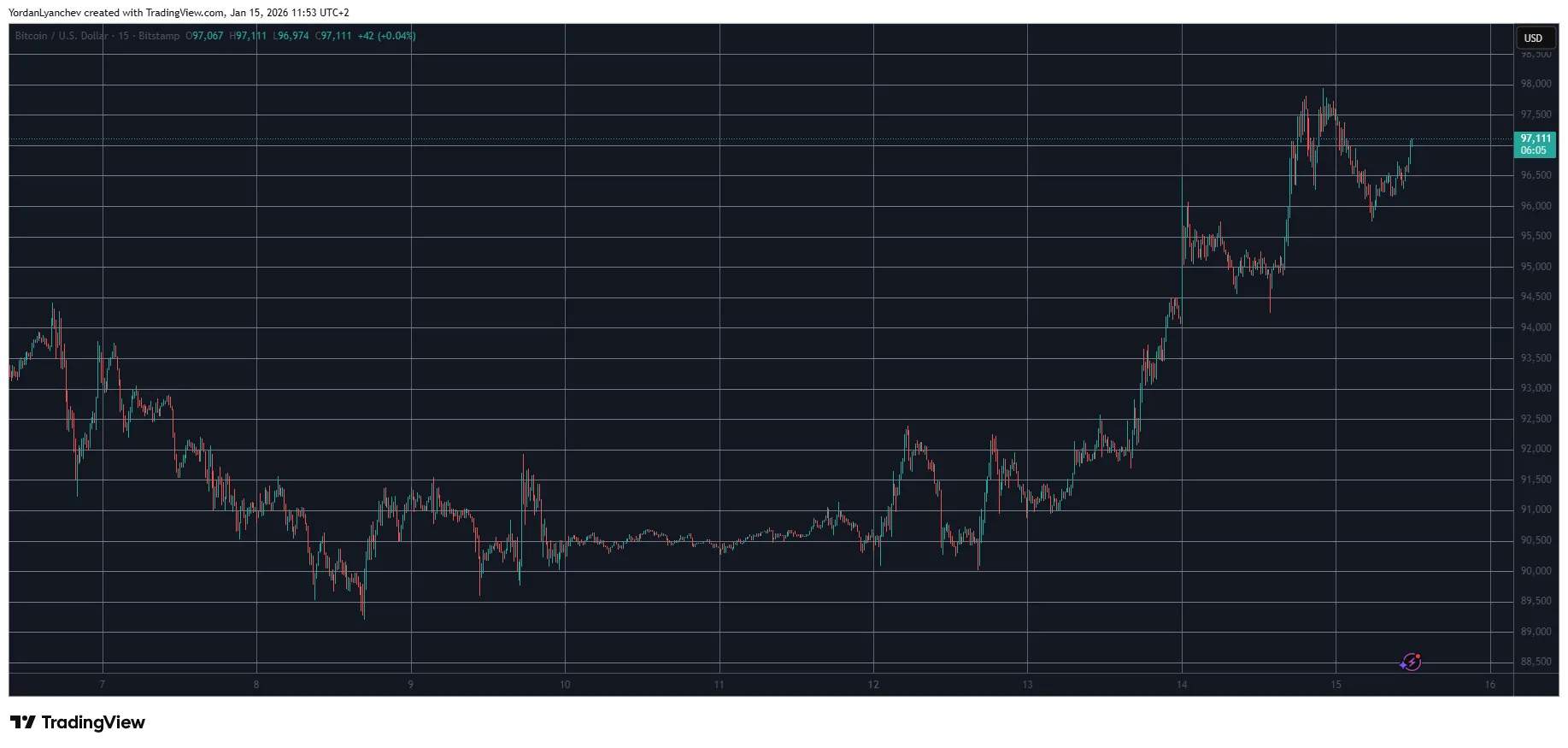

Bitcoin Approaches $48,000

Bitcoin’s price ascent, which began earlier in the week, saw the cryptocurrency touch $48,000, a level not reached in approximately two months. This rally follows a period of consolidation where Bitcoin recovered from a dip below $40,000. The renewed bullish momentum indicates strong buying pressure and renewed investor confidence in Bitcoin’s prospects.

Altcoins Show Mixed Performance

While Bitcoin has been making gains, the altcoin market has shown varied performance. Ethereum is trading above $3,350, with analysts eyeing a move towards $3,400. However, several altcoins, including XRP, DOGE, ADA, LINK, and XLM, have experienced declines over the past day. This divergence highlights the nuanced nature of the crypto market, where individual assets respond differently to overall trends.

Market Dominance Shifts Towards Bitcoin

As Bitcoin’s price has increased, so has its dominance over the altcoin market. Bitcoin’s dominance has risen to 57.5%, indicating that it is outperforming many altcoins in the current market environment. This shift in dominance often occurs during periods of uncertainty or when Bitcoin is leading a market rally, as investors seek the relative stability of the leading cryptocurrency.

Broader Market Trends

The total crypto market capitalization has increased to $1.76 trillion, reflecting the overall positive sentiment in the market. However, the mixed performance of altcoins suggests that investors are becoming more selective, favoring assets with strong fundamentals or those perceived as having higher growth potential. The performance of Bitcoin ETFs could also be a factor, as they provide an accessible onramp for institutional investment.

Implications for XRP and Liquidity

XRP’s recent dip contrasts with Bitcoin’s surge, highlighting the differing market dynamics at play. For XRP, maintaining liquidity and demonstrating utility remain key factors for future growth. Ripple’s ongoing legal battles and its efforts to expand its use cases in cross-border payments will likely influence XRP’s performance in the coming months. The overall health of the altcoin market and investor sentiment towards specific projects will continue to play a crucial role.

Conclusion

Bitcoin’s recent surge to $48,000 underscores its position as a leading cryptocurrency, while the mixed performance of altcoins reflects the nuanced nature of the market. Investors should remain vigilant, considering both broader market trends and the specific factors influencing individual assets like XRP. The evolving regulatory landscape and the continued development of blockchain technology will further shape the future of the crypto market.

Related: XRP Signals: What Derivatives Data Shows

Source: Original article

Quick Summary

Bitcoin reached $48,000, marking a two-month high, while altcoins showed mixed performance. Bitcoin’s dominance increased, reflecting strong market sentiment amidst geopolitical tensions. XRP experienced a slight dip, highlighting the nuanced reactions across different cryptocurrencies to broader market movements.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.