Despite several market corrections and negative headlines, the underlying crypto infrastructure continued to develop and mature throughout 2025. The approval and adoption of spot Bitcoin ETFs marked a significant milestone, attracting substantial inflows and increasing institutional participation.

What to Know:

- Despite several market corrections and negative headlines, the underlying crypto infrastructure continued to develop and mature throughout 2025.

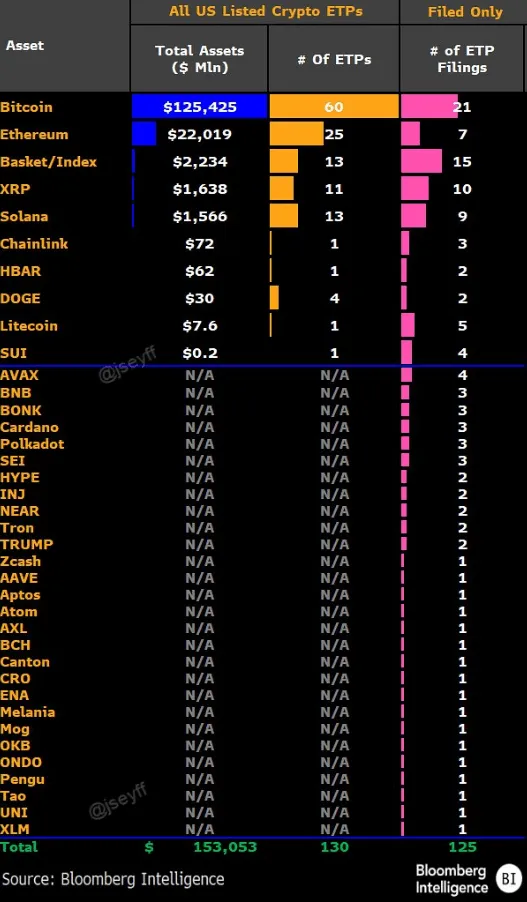

- The approval and adoption of spot Bitcoin ETFs marked a significant milestone, attracting substantial inflows and increasing institutional participation.

- Global regulatory frameworks became clearer, fostering innovation and providing a more certain environment for crypto businesses.

The year 2025 was marked by repeated claims of crypto’s demise, but these pronouncements belied the continued development and integration of digital assets into the global financial system. Despite flash crashes, tariff-induced liquidations, and altcoin volatility, the underlying infrastructure of the crypto market strengthened. This year saw significant regulatory advancements and the mainstreaming of crypto investment vehicles.

The first major “crypto is dead” moment arrived in January, triggered by a Chinese AI model called DeepSeek, which sparked a cross-asset sell-off that heavily impacted crypto markets. Bitcoin experienced a sharp decline, along with AI-linked tokens, causing analysts to question the fragility of the crypto rally. However, this event was ultimately viewed as a stress test of the increasingly institutionalized crypto market.

October brought the most significant liquidation event in crypto history, driven by President Trump’s unexpected tariff announcement. The ensuing market turmoil erased billions in leveraged positions and caused a sharp decline in Bitcoin and other cryptocurrencies. While this event highlighted the fragility of crypto leverage, it also demonstrated the resilience of the underlying market structure, as regulated products and custodians continued to function effectively.

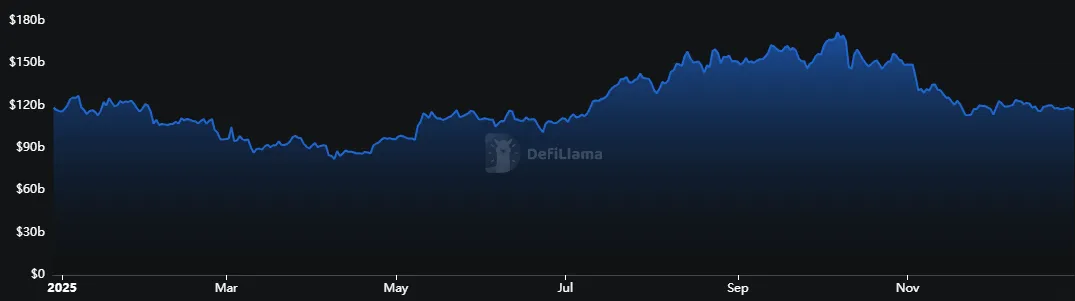

Altcoins, AI tokens, and memecoins experienced significant volatility throughout the year, with many projects losing substantial value. While this carnage highlighted the speculative nature of certain segments of the crypto market, it also served as a mechanism for weeding out unsustainable projects. The underlying infrastructure, including DeFi platforms, continued to evolve and mature.

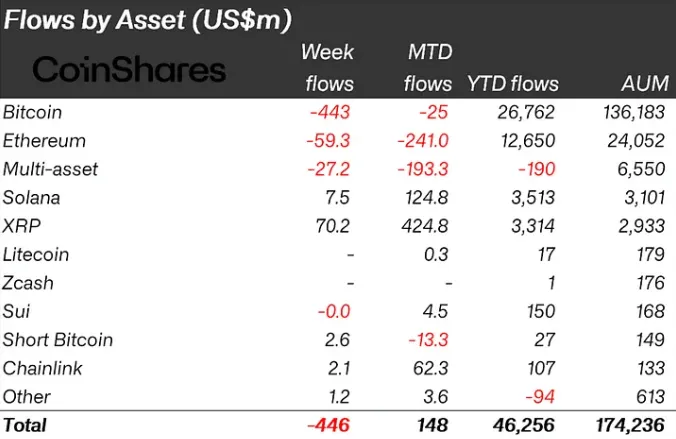

Despite a fourth-quarter slump that led to renewed “crypto winter” headlines, several factors pointed to the continued maturation of the market. Bitcoin ETFs maintained significant inflows, and major financial institutions like Vanguard began allowing clients to trade crypto ETFs. Furthermore, regulatory clarity improved, with governments worldwide moving towards comprehensive frameworks that prioritize innovation.

In conclusion, while 2025 presented numerous challenges and setbacks for the crypto market, it also marked a year of significant progress in terms of infrastructure development, regulatory clarity, and institutional adoption. Despite repeated claims of its demise, crypto emerged stronger and more integrated into the global financial system.

Related: Solana Whale Signals Rally; MSTR Scrutiny

Source: Original article

Quick Summary

Despite several market corrections and negative headlines, the underlying crypto infrastructure continued to develop and mature throughout 2025. The approval and adoption of spot Bitcoin ETFs marked a significant milestone, attracting substantial inflows and increasing institutional participation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.