Solana leadership is publicly downplaying ecosystem tribalism, signaling a shift toward interoperability and cross-chain collaboration which could benefit XRP. Shiba Inu (SHIB) continues its multi-year downtrend, with technical charts suggesting the possibility of another zero being added to its price.

What to Know:

- Solana leadership is publicly downplaying ecosystem tribalism, signaling a shift toward interoperability and cross-chain collaboration which could benefit XRP.

- Shiba Inu (SHIB) continues its multi-year downtrend, with technical charts suggesting the possibility of another zero being added to its price.

- Bitcoin’s recent price action resulted in a massive short squeeze, liquidating a significant amount of bearish positions and potentially setting the stage for a more balanced market.

The digital asset market is closing out the year with interesting undercurrents. XRP, a perennial lightning rod, is finding unexpected support. SHIB is grinding lower. And Bitcoin just executed a textbook short squeeze. These crosscurrents offer a glimpse into shifting sentiment and evolving market structure as we head into the new year, especially as institutional interest and regulatory clarity continue to shape the landscape.

Solana’s Stance on Ecosystem Tribalism

A recent exchange involving the founder of Solana took an unexpected turn when he characterized infighting with other ecosystems like XRP and Cardano as “incredibly bearish.” This departure from the typical zero-sum mentality highlights a growing recognition that interoperability and collaboration are vital for the long-term health of the digital asset space. The shift toward embracing bridges, shared liquidity, and cross-chain deployments could signal a more mature phase in the market’s evolution.

This sentiment has direct implications for XRP, which has often faced criticism from Bitcoin and Ethereum proponents. Solana’s acknowledgment of the negative impact of tribalism suggests a potential re-evaluation of XRP’s role within the broader ecosystem. While not a technical endorsement, it recognizes the importance of capital flow and market efficiency, aligning with the increasing institutional focus on liquidity and settlement solutions.

SHIB’s Persistent Downtrend

Shiba Inu (SHIB) continues to exhibit a concerning technical pattern, with its price consistently trending downward. The monthly chart reveals a series of failed recovery attempts, each followed by lower highs and increased selling pressure. This persistent weakness suggests a lack of confidence among investors, with volume spikes failing to trigger sustained rallies.

The absence of any specific catalyst, such as an exploit or delisting, further underscores the organic nature of SHIB’s decline. The asset is simply unwinding its speculative peak, a common occurrence in the digital asset market. For institutional investors, SHIB’s trajectory serves as a reminder of the risks associated with meme coins and the importance of fundamental analysis when evaluating long-term investment opportunities.

Bitcoin’s Short Squeeze

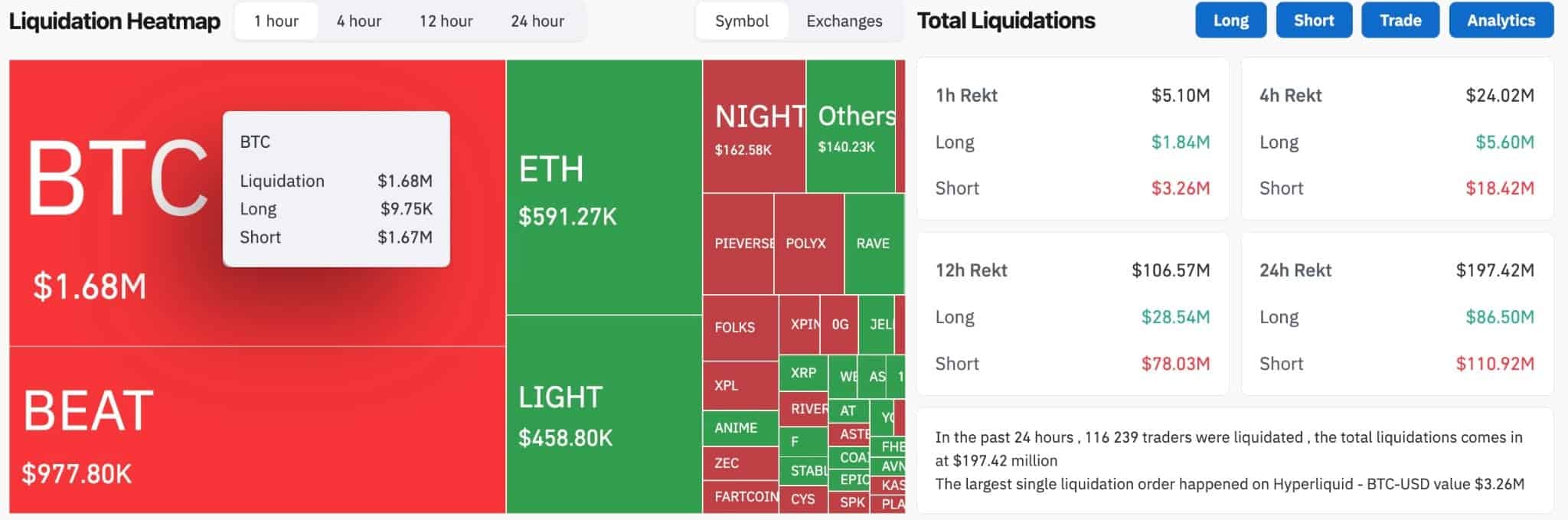

Bitcoin recently experienced a significant short squeeze, with liquidation data revealing a massive imbalance favoring the expulsion of bearish positions. This event, characterized by a 17,128% liquidation differential, highlights the dangers of overleveraged short positions in a volatile market. The forced buying triggered by margin calls and stop-loss orders exacerbated the price surge, leading to substantial losses for short sellers.

While short squeezes can create temporary upward momentum, they do not necessarily signal a sustained bullish trend. Rather, they represent a reset of market positioning, clearing out excess leverage and paving the way for a more balanced environment. For Bitcoin to continue its upward trajectory, fresh capital inflows, increased spot demand, or a favorable shift in the macro environment will be required.

Regulatory Outlook and Market Maturation

The evolving regulatory landscape continues to play a pivotal role in shaping the digital asset market. Increased scrutiny from regulatory bodies, such as the SEC, has led to greater compliance efforts and a focus on establishing clear legal frameworks. This regulatory push has both positive and negative implications. While it can create short-term uncertainty and volatility, it also fosters greater institutional confidence and long-term stability.

The emergence of Bitcoin ETFs, for example, represents a significant step toward mainstream adoption, providing institutional investors with a regulated and accessible means of gaining exposure to the asset class. As regulatory clarity improves and institutional participation increases, the digital asset market is likely to become more efficient, liquid, and resilient.

Derivatives Market Influence

The derivatives market, particularly Bitcoin futures and options, exerts a considerable influence on spot prices. The interplay between leverage, margin requirements, and liquidation levels can amplify price swings and create opportunities for sophisticated trading strategies. Institutional investors often utilize derivatives to hedge their positions, manage risk, and generate alpha.

The recent short squeeze in Bitcoin underscores the importance of understanding derivatives market dynamics. Overcrowded short positions can create a tinderbox scenario, where a sudden price spike triggers a cascade of liquidations, further fueling the rally. As the digital asset market matures, the role of derivatives is likely to become even more prominent, requiring investors to develop a deep understanding of these complex instruments.

Final Thoughts

As the year draws to a close, the digital asset market presents a mixed bag of signals. Solana’s embrace of cross-chain collaboration offers a glimpse of a more interconnected future, while SHIB’s persistent downtrend serves as a cautionary tale. Bitcoin’s short squeeze highlights the ever-present risks and opportunities in this dynamic space. Navigating this evolving landscape requires a nuanced understanding of market structure, regulatory developments, and the interplay between spot and derivatives markets.

Related: Crypto: Trump Token Sparks Bitcoin Crisis

Source: Original article

Quick Summary

Solana leadership is publicly downplaying ecosystem tribalism, signaling a shift toward interoperability and cross-chain collaboration which could benefit XRP. Shiba Inu (SHIB) continues its multi-year downtrend, with technical charts suggesting the possibility of another zero being added to its price.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.