Crypto markets experienced a sharp correction, with Bitcoin falling to a six-week low. Geopolitical tensions, particularly concerns about a potential conflict involving Iran, are weighing on risk sentiment. XRP and other altcoins experienced declines, impacting liquidity across the crypto market.

What to Know:

- Crypto markets experienced a sharp correction, with Bitcoin falling to a six-week low.

- Geopolitical tensions, particularly concerns about a potential conflict involving Iran, are weighing on risk sentiment.

- XRP and other altcoins experienced declines, impacting liquidity across the crypto market.

Cryptocurrency markets tumbled on Tuesday, with Bitcoin leading the decline as it touched a six-week low. The correction rippled through the altcoin market, triggering substantial liquidations. Geopolitical uncertainty appears to be a significant factor influencing investor sentiment.

Market Overview

Bitcoin’s price slumped to just over $85,000, marking a notable pullback from recent highs. Ethereum also faced selling pressure, falling to $2,800 after failing to sustain levels above $3,000. XRP experienced a 3.5% decline, while Solana (SOL) saw a 3.7% drop. The broader altcoin market mirrored this downward trend, reflecting a risk-off sentiment among investors.

Liquidations Surge

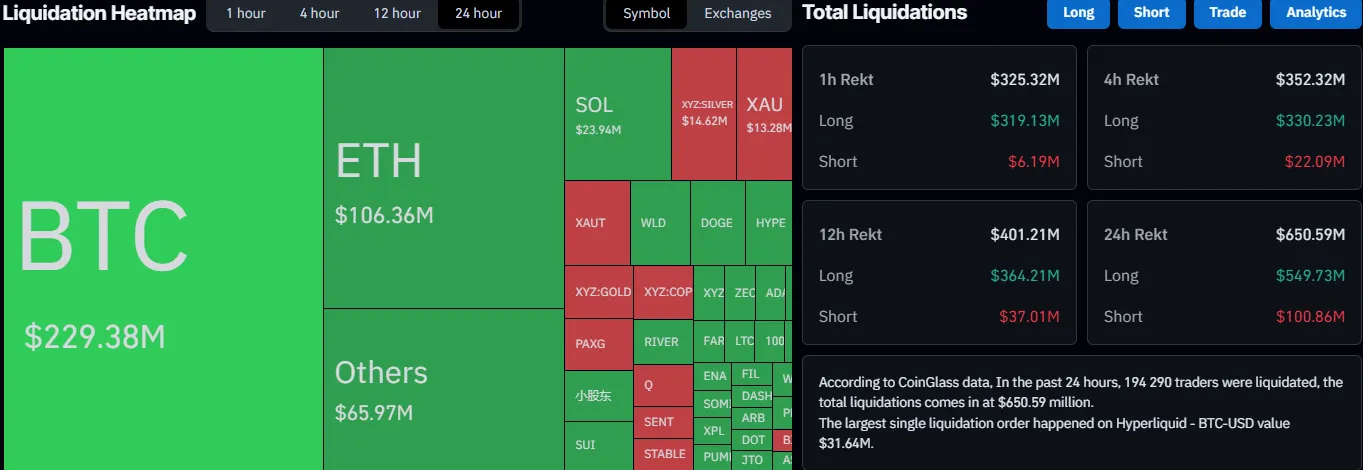

The market downturn triggered a surge in liquidations, with over $650 million worth of leveraged positions wiped out. A significant portion of these liquidations occurred within a single hour, indicating the speed and severity of the market correction. Over 190,000 trades were liquidated, with one position on Hyperliquid worth over $31 million.

Geopolitical Concerns

Rising geopolitical tensions, particularly those involving the United States and Iran, are contributing to market uncertainty. Reports of the U.S. deploying the Abraham Lincoln Carrier Strike Group to the Middle East have heightened concerns about a potential escalation of conflict. This has led investors to reduce exposure to risk assets, including cryptocurrencies.

Traditional Markets React

The impact of geopolitical tensions is also evident in traditional markets. Oil prices have climbed, with U.S. crude oil jumping by over 2.5% and Brent nearing $70 a barrel. Gold initially surged to new all-time highs but later experienced a sharp correction. This mixed performance in traditional safe-haven assets suggests a complex interplay of factors influencing investor behavior.

Impact on XRP and Liquidity

The decline in XRP, along with other altcoins, has implications for overall market liquidity. Reduced liquidity can amplify price swings and increase volatility, making it more challenging for institutional investors to execute large trades. The approval and launch of spot Bitcoin ETFs have been expected to improve overall market structure, but geopolitical risks could still disrupt this.

Conclusion

Cryptocurrency markets are currently facing headwinds from geopolitical tensions and a broader risk-off sentiment. While the long-term outlook for digital assets remains positive, investors should exercise caution and closely monitor developments in both the crypto and geopolitical landscapes.

Related: Bitcoin Price Forecast: Support at Risk?

Source: Original article

Quick Summary

Crypto markets experienced a sharp correction, with Bitcoin falling to a six-week low. Geopolitical tensions, particularly concerns about a potential conflict involving Iran, are weighing on risk sentiment. XRP and other altcoins experienced declines, impacting liquidity across the crypto market.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.