Bitcoin’s recent price drop to $60,000 was driven by a combination of factors, including ETF outflows and leveraged position liquidations. On-chain data reveals significant realized losses and increased whale deposits on exchanges, suggesting large holders contributed to the selloff.

What to Know:

- Bitcoin’s recent price drop to $60,000 was driven by a combination of factors, including ETF outflows and leveraged position liquidations.

- On-chain data reveals significant realized losses and increased whale deposits on exchanges, suggesting large holders contributed to the selloff.

- Broader macro risk-off sentiment and cross-asset deleveraging further tightened liquidity, exacerbating Bitcoin’s price decline.

Bitcoin experienced a sharp correction, briefly touching $60,000, sparking concerns among investors and traders. The drop triggered a wave of speculation, but a combination of ETF outflows, leveraged liquidations, and on-chain data provides a clearer picture. Understanding these dynamics is crucial for navigating the current market environment.

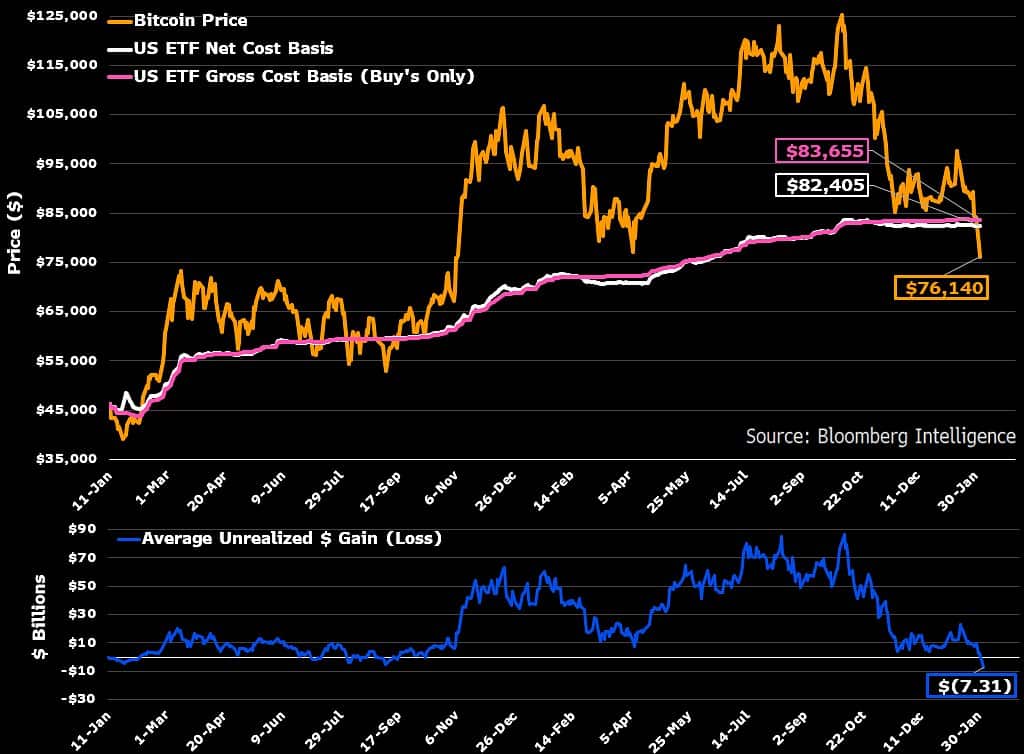

The decline was fueled by continuous selling pressure from U.S. spot Bitcoin ETFs, which have experienced net outflows exceeding $6 billion over the past four months. This shift from steady inflows to persistent outflows removed a key source of support, making the market more vulnerable to downside pressure.

James Seyffart, a Bloomberg ETF analyst, pointed out that Bitcoin ETF holders are currently facing their largest unrealized losses since the ETFs launched in January 2024.

As Bitcoin’s price breached critical levels, cascading liquidations of leveraged positions further amplified the downward momentum. Data from CoinGlass indicated that over $1.2 billion in leveraged positions were liquidated, accelerating the selloff.

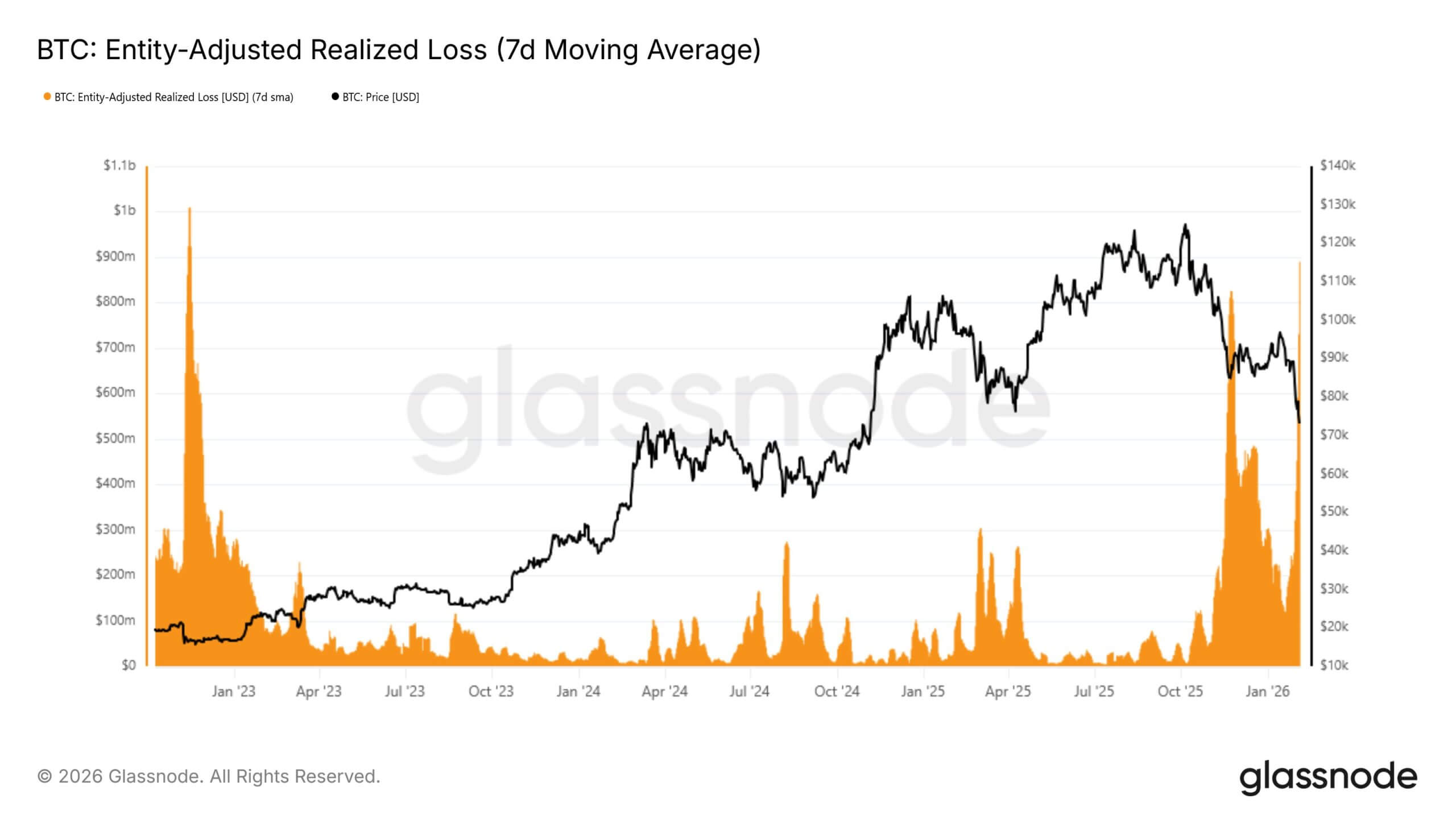

On-chain data offers additional insights into the market dynamics during this period. Glassnode data highlighted significant realized losses, reaching $889 million on Feb. 4, the highest since November 2022.

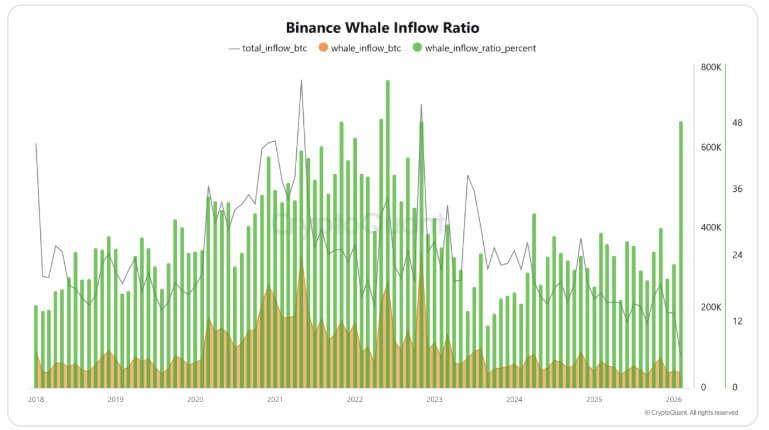

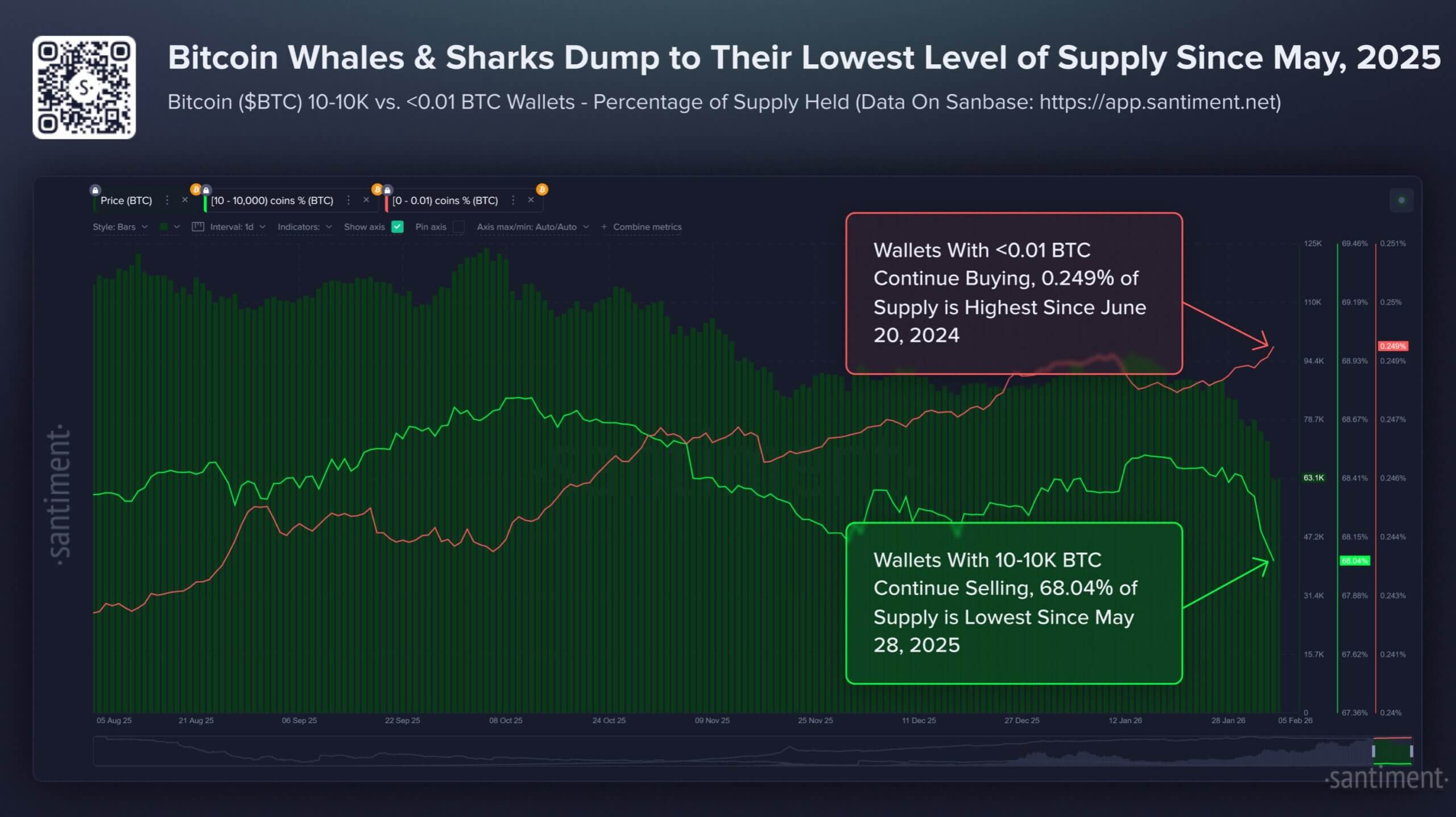

Furthermore, CryptoQuant data revealed a surge in the Exchange Whale Ratio on Binance, reaching its highest level since March 2025, suggesting that large holders were potentially preparing to sell or hedge their positions. The Exchange Whale Ratio (30-day SMA) surged to 0.447.

Broader market conditions also played a significant role in Bitcoin’s price correction. Concerns about the timeline for AI payoffs and potential margin compression in the tech sector contributed to a risk-off environment.

In conclusion, Bitcoin’s recent price volatility underscores the interplay of factors, including ETF dynamics, leveraged trading, whale activity, and macroeconomic sentiment. While the market may experience further fluctuations, understanding these underlying drivers is key for investors and traders seeking to capitalize on future opportunities in the crypto space.

Related: XRP Surges: Crypto Assets Show Positive Signals

Source: Original article

Quick Summary

Bitcoin’s recent price drop to $60,000 was driven by a combination of factors, including ETF outflows and leveraged position liquidations. On-chain data reveals significant realized losses and increased whale deposits on exchanges, suggesting large holders contributed to the selloff.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.