Overnight repurchase agreements (repos) offer insights into dollar liquidity within the financial system, impacting Bitcoin. Bitcoin’s price behavior is increasingly tied to the same forces driving traditional markets.

What to Know:

- Overnight repurchase agreements (repos) offer insights into dollar liquidity within the financial system, impacting Bitcoin.

- Bitcoin’s price behavior is increasingly tied to the same forces driving traditional markets.

- Monitoring repo market signals can provide early clues about the overall health of the financial system and its potential influence on Bitcoin.

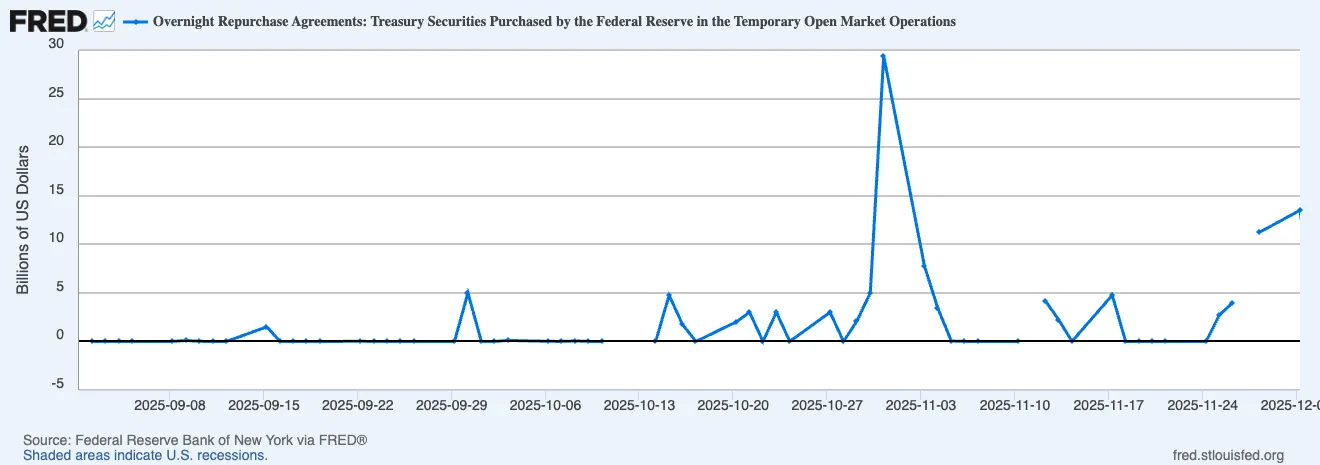

The recent $13.5 billion spike in overnight repos on December 1st serves as a reminder of the intricate relationship between traditional finance and the crypto market, particularly Bitcoin. These often-overlooked operations reveal the ease with which dollars flow through the financial system, directly influencing Bitcoin’s behavior. As Bitcoin becomes more integrated into global risk flows, these shifts become increasingly significant for investors and traders.

Repo usage, especially overnight, has emerged as a key indicator of market sentiment, reflecting the availability and cost of short-term dollars. When the Federal Reserve reports a surge in overnight repo usage, it suggests a heightened demand for short-term dollars among institutions. This demand can stem from caution or simply from the need for ordinary financial lubrication.

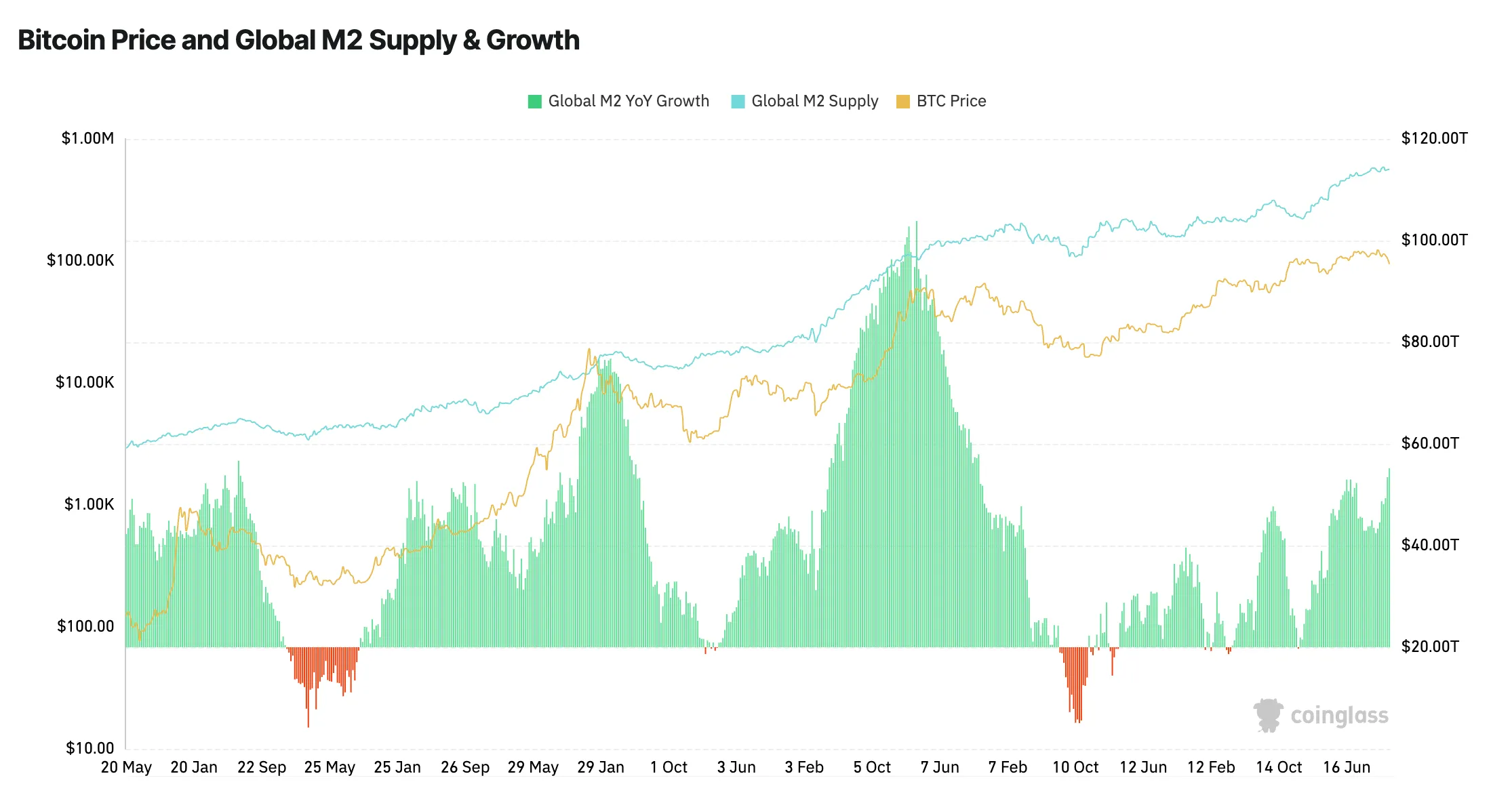

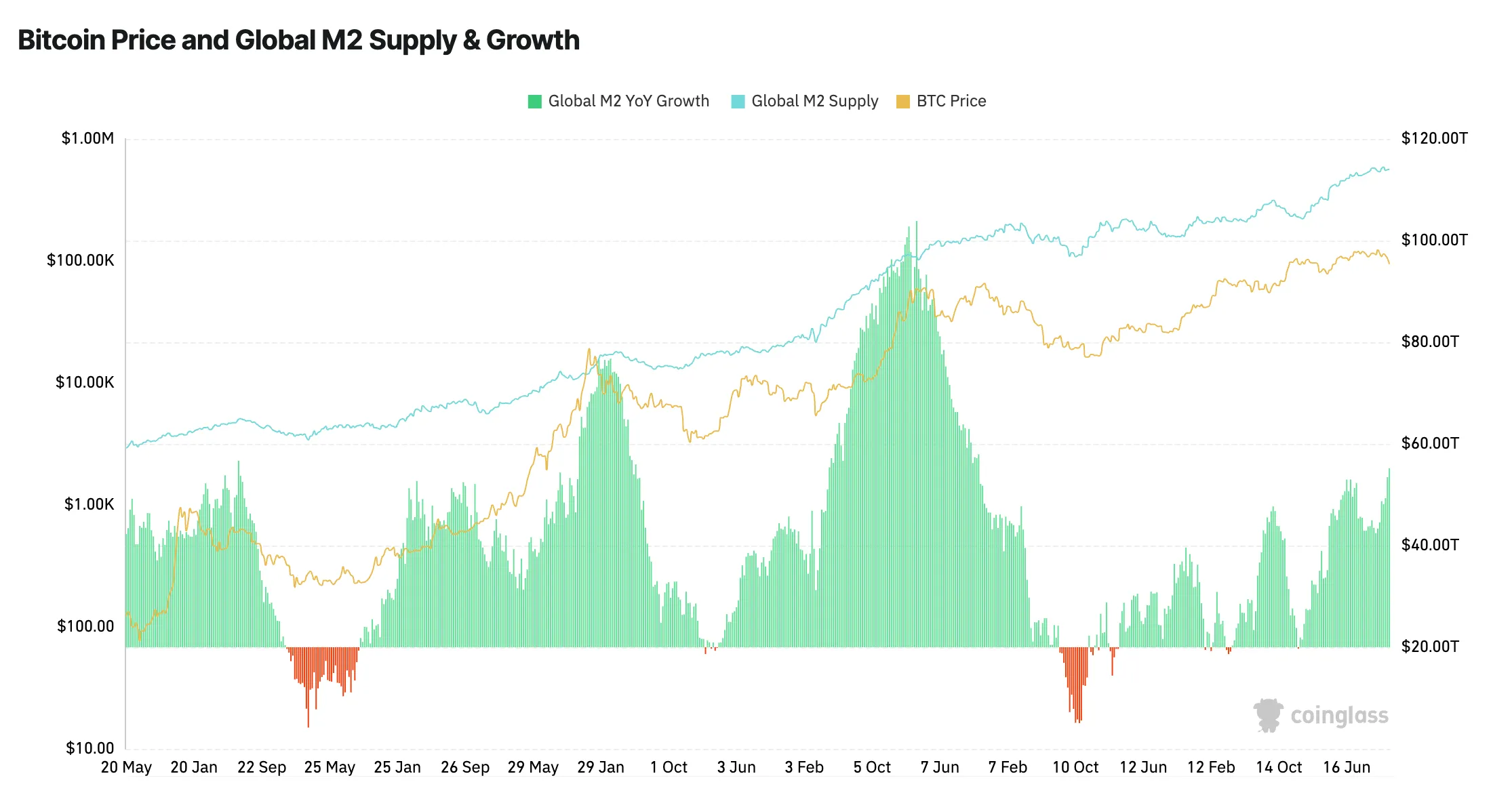

Bitcoin’s price behavior demonstrates its increasing correlation with traditional markets, driven by factors influencing equities, credit, and tech multiples. Improved liquidity, characterized by easier borrowing and relaxed funding markets, encourages risk-taking and benefits Bitcoin as a high-beta asset. Conversely, tightening funding markets can make BTC vulnerable, even without changes to its fundamental value.

The connection between repo spikes and Bitcoin lies in how they shape traders’ sentiment toward holding high-risk assets. A healthy financial system tends to support Bitcoin, while a strained system can pull it lower. This week’s $13.5 billion injection indicates a degree of tension that the Fed had to address, highlighting the importance of monitoring dollar liquidity for potential impacts on risk markets.

Bitcoin’s integration into traditional finance is underscored by the growing presence of funds, market-makers, ETF desks, and systematic traders operating within the same funding ecosystem. This integration means that Bitcoin’s performance is increasingly influenced by factors such as QT runoff, Treasury supply, money-market flows, and the Fed’s balance-sheet tools. Monitoring repo spikes and other subtle signals can provide valuable insights into the overall health of the financial system and its potential impact on Bitcoin’s price movements.

In conclusion, understanding the dynamics of repo markets and their influence on dollar liquidity is crucial for Bitcoin investors and traders. These subtle signals offer early clues about market sentiment and the potential for risk-taking, ultimately impacting Bitcoin’s performance within the broader financial landscape.

Related: XRP Ledger Activity Surge Signals Growing Use

Source: Original article

Quick Summary

Overnight repurchase agreements (repos) offer insights into dollar liquidity within the financial system, impacting Bitcoin. Bitcoin’s price behavior is increasingly tied to the same forces driving traditional markets. Monitoring repo market signals can provide early clues about the overall health of the financial system and its potential influence on Bitcoin.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.