Bitcoin’s price action is currently range-bound due to fragmented liquidity and structural stagnation despite bullish indicators. Low inter-exchange flow and concentrated liquidity on Binance contribute to increased price sensitivity and potential for volatility.

What to Know:

- Bitcoin’s price action is currently range-bound due to fragmented liquidity and structural stagnation despite bullish indicators.

- Low inter-exchange flow and concentrated liquidity on Binance contribute to increased price sensitivity and potential for volatility.

- ETF flows are influenced more by macro expectations than crypto-specific fundamentals, adding to market uncertainty.

Bitcoin’s (BTC) market in late 2025 is characterized by structural stagnation, with price movements trapped between $81,000 and $93,000 despite positive indicators such as substantial ETF holdings and low exchange reserves. This stagnation arises from a disconnect between market data and trading behavior, where liquidity is present but not effectively flowing. The market’s inability to translate demand into sustained directional movement highlights underlying issues in its plumbing.

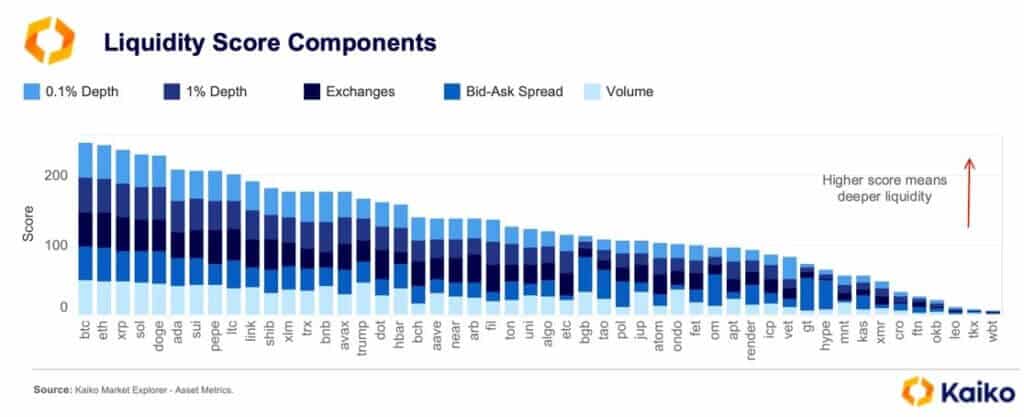

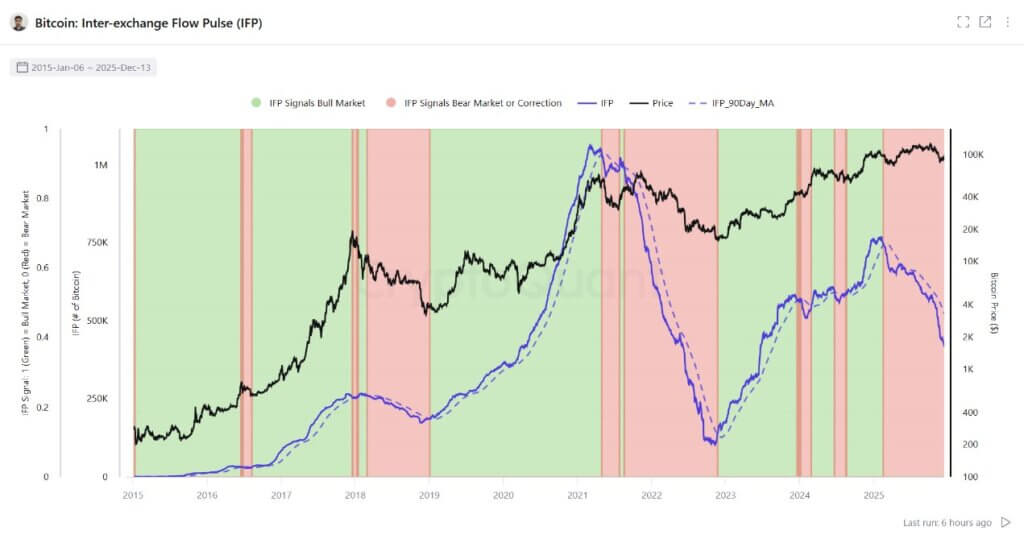

The concentration of Bitcoin reserves on Binance, despite overall low exchange reserves, is a critical factor. This centralization means that any significant flow, whether from ETF redemptions or macro-driven selling, is funneled through a single point, increasing the potential for volatility. The weakened Inter-Exchange Flow Pulse (IFP) further exacerbates this issue, as reduced arbitrage activity results in thinner order books and greater price sensitivity to individual orders.

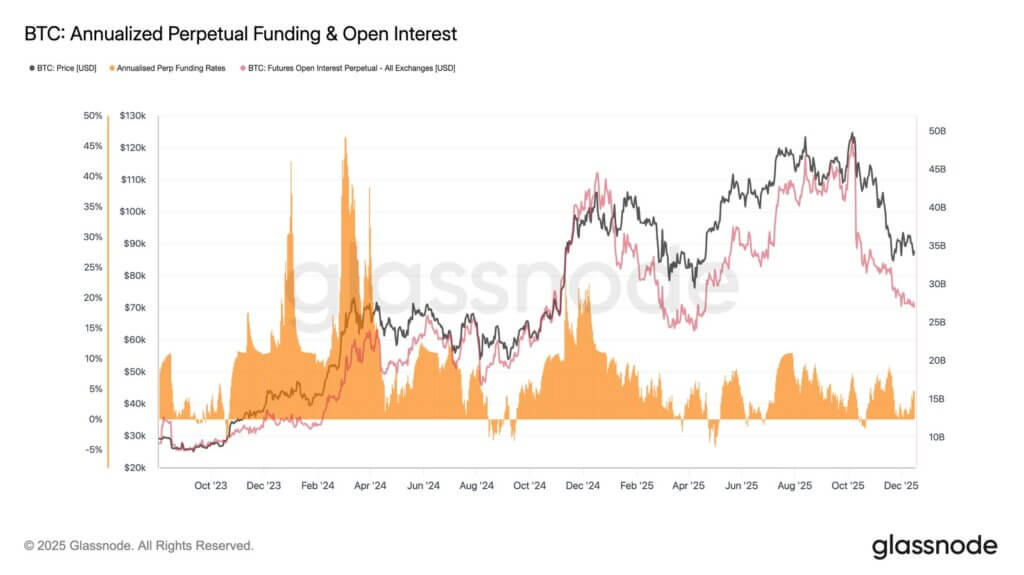

Derivatives markets are also playing a role in suppressing volatility. Perpetual futures open interest has decreased, and funding rates remain neutral, indicating a lack of strong directional conviction among traders. Options positioning further constrains price movement, with significant gamma positioning pinning Bitcoin within the $81,000-$93,000 range until contract expirations.

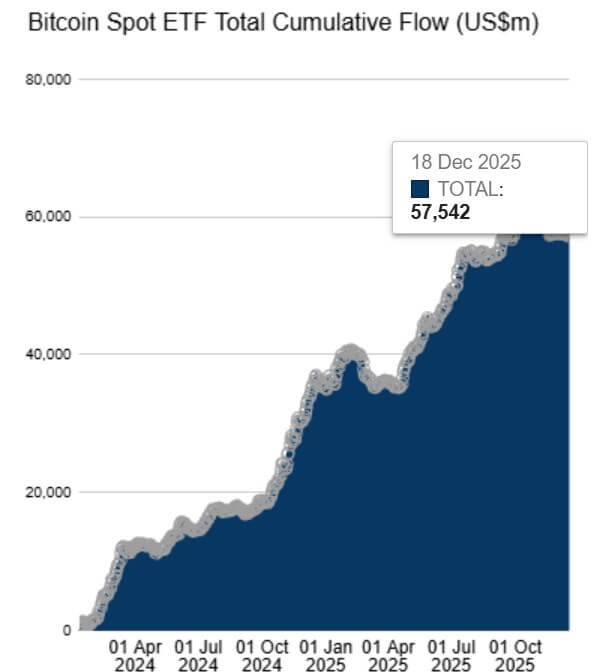

While US spot Bitcoin ETFs hold a significant portion of the market cap, their impact on price is inconsistent. Daily ETF flows exhibit high volatility, influenced more by macro expectations and rate policy than by crypto-native fundamentals. This makes the ETF channel structurally important but not a reliable driver of sustained upward price movement.

In conclusion, Bitcoin’s current market state is defined by structural stagnation, where fragmented liquidity and external economic factors limit price appreciation. While the underlying infrastructure is robust, it requires improved liquidity flow and reduced concentration to break out of its current range-bound state. Investors should monitor macro catalysts and shifts in market structure that could trigger the next directional move.

Related: XRP Liquidation Imbalance Signals Volatility

Source: Original article

Quick Summary

Bitcoin’s price action is currently range-bound due to fragmented liquidity and structural stagnation despite bullish indicators. Low inter-exchange flow and concentrated liquidity on Binance contribute to increased price sensitivity and potential for volatility. ETF flows are influenced more by macro expectations than crypto-specific fundamentals, adding to market uncertainty.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.