Crypto markets rebounded as US liquidity improved. Institutional interest is shifting towards Ethereum ETFs. Macroeconomic factors and liquidity remain key risks.

What to Know:

- Crypto markets rebounded as US liquidity improved.

- Institutional interest is shifting towards Ethereum ETFs.

- Macroeconomic factors and liquidity remain key risks.

The crypto market experienced a notable recovery, driven by shifts in U.S. liquidity dynamics that favored risk assets. Bitcoin surged, reclaiming the $90,000 level, while Ethereum surpassed $3,000, signaling renewed investor confidence. This rally offers a respite after a period of market stagnation and declining asset values.

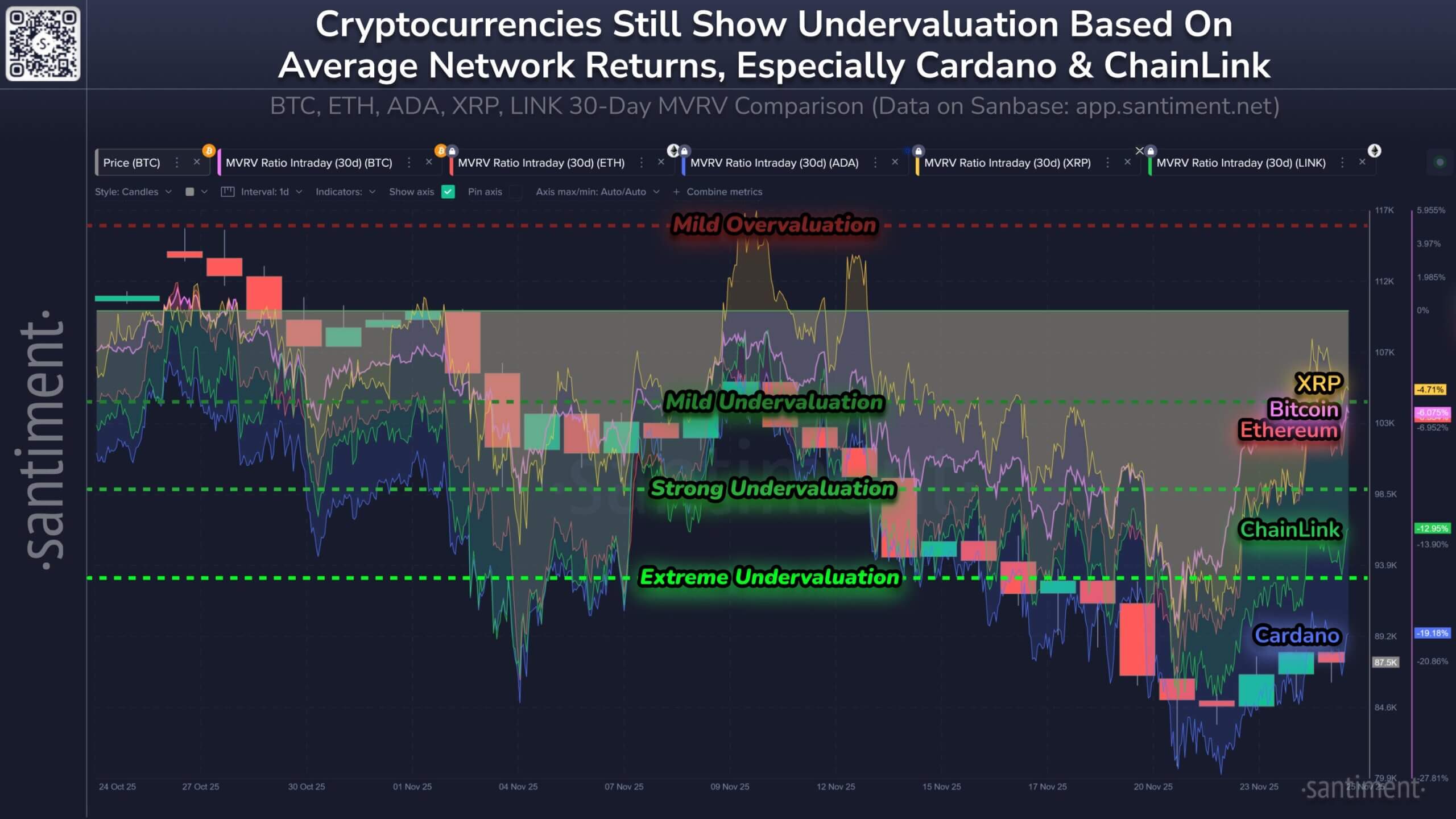

Recent data indicated that many crypto investors were experiencing losses, with average wallet investments in major digital assets showing negative returns. This week’s market capitalization increase seems less influenced by crypto-specific news and more by a broader fiscal stimulus and increased institutional risk appetite.

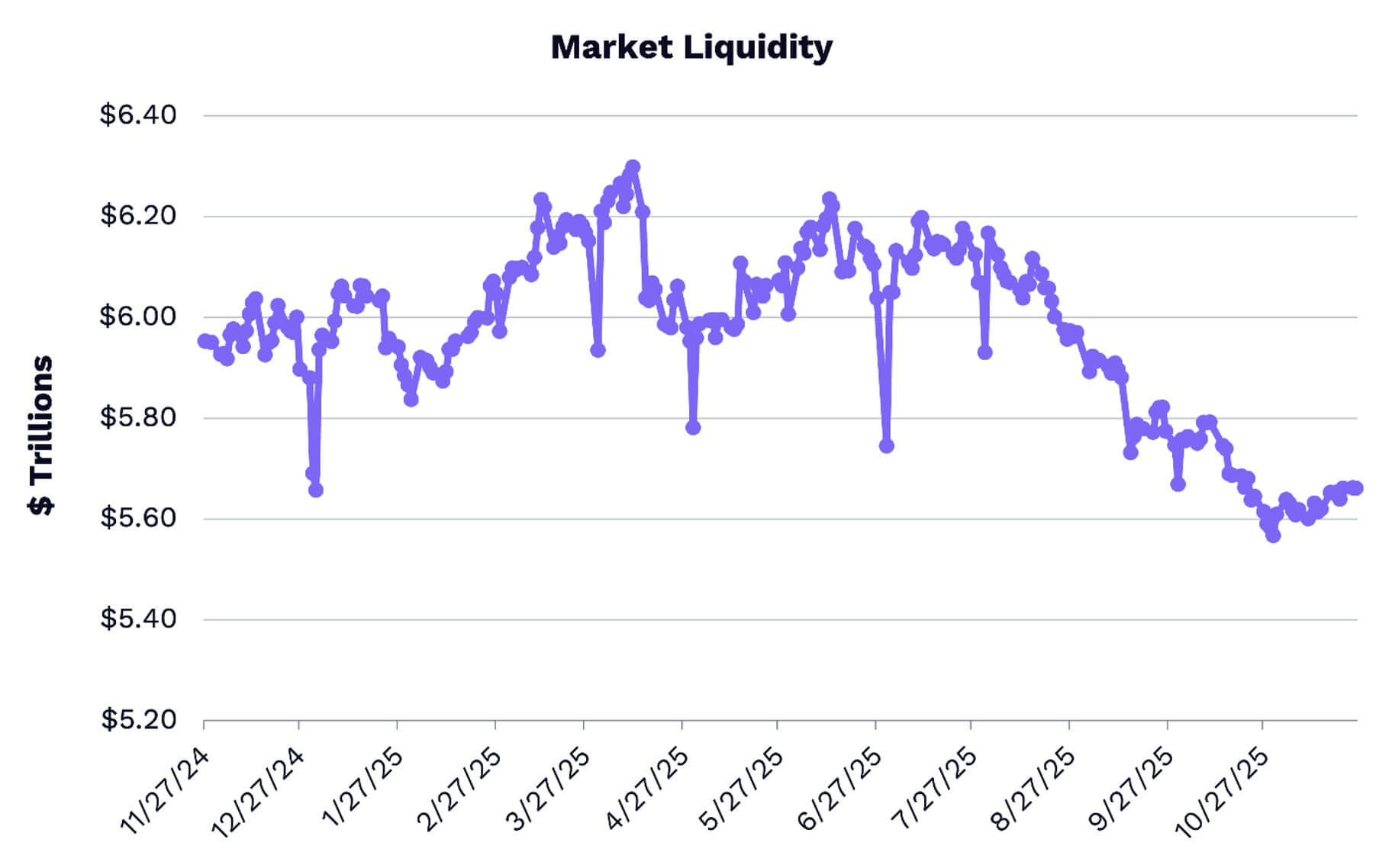

The rally’s primary catalyst was the normalization of liquidity following the end of a recent U.S. government shutdown, which had drained approximately $621 billion from the financial system. As the U.S. Treasury replenishes the system, excess capital is expected to flow back into the banking sector and the broader economy, benefiting risk assets like cryptocurrencies.

Adding to the positive momentum, Federal Reserve officials have hinted at potential rate cuts, shifting away from a “higher for longer” stance. This dovish signal, combined with the anticipated conclusion of Quantitative Tightening (QT), could further reduce headwinds for crypto assets.

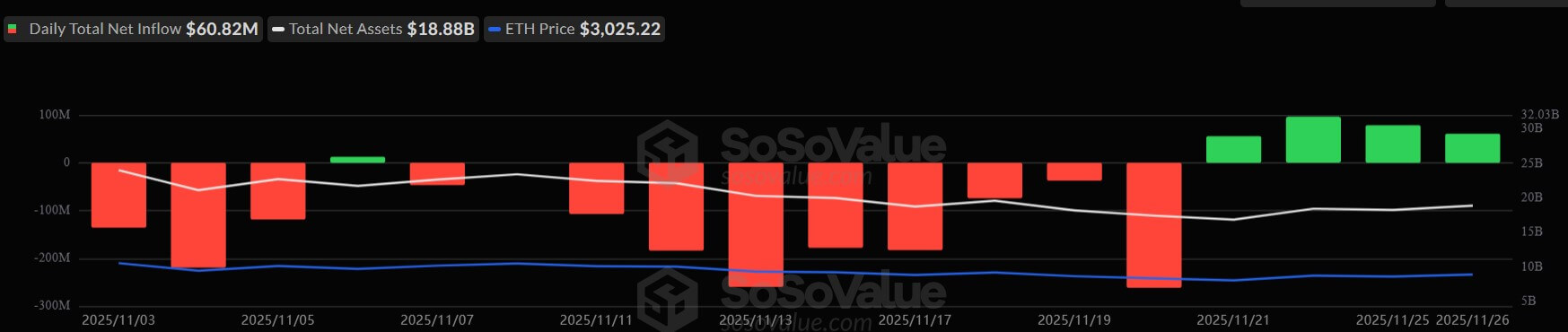

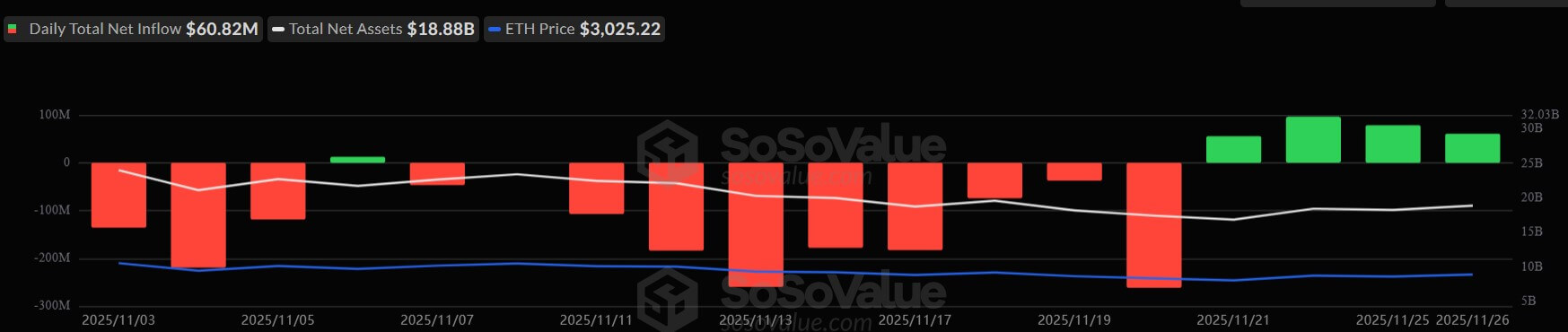

Institutional flows reveal a growing interest in Ethereum, with ETH products attracting significant net inflows into spot ETFs. Bitcoin and XRP investment vehicles also saw inflows, suggesting a broad-based recovery, though Solana products experienced outflows.

While the current market bounce is encouraging, traders should be aware of potential risks. Macroeconomic factors, such as inflation, could prompt the Federal Reserve to reverse its dovish stance, tightening financial conditions. Additionally, lower liquidity during the holiday season could amplify volatility, and large exchange deposits might signal whales using the rally to exit positions.

Overall, the crypto market’s recent recovery is driven by improved liquidity and shifting monetary policy expectations. Keep a close watch on Bitcoin’s ability to hold key levels as well as broader market conditions.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Crypto markets rebounded as US liquidity improved. Institutional interest is shifting towards Ethereum ETFs. Macroeconomic factors and liquidity remain key risks. The crypto market experienced a notable recovery, driven by shifts in U.S. liquidity dynamics that favored risk assets.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.