Crypto markets rebounded, driven by increased liquidity and renewed institutional interest. Normalization of the US Treasury’s balance sheet and dovish indicates from the Federal Reserve are key factors. Ethereum ETFs are seeing strong inflows, indicating a strategic shift in investment focus.

What to Know:

- Crypto markets rebounded, driven by increased liquidity and renewed institutional interest.

- Normalization of the US Treasury’s balance sheet and dovish signals from the Federal Reserve are key factors.

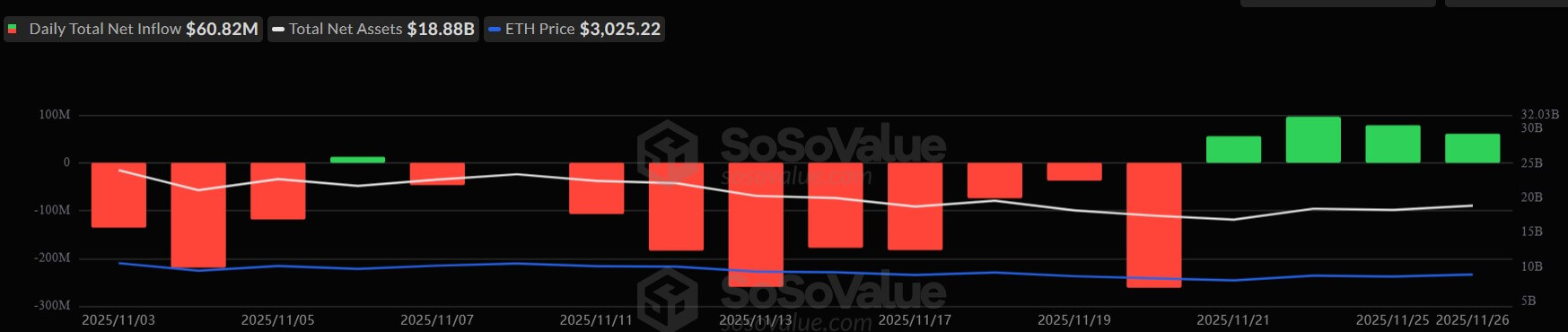

- Ethereum ETFs are seeing strong inflows, indicating a strategic shift in investment focus.

The crypto market experienced a notable resurgence, fueled by a critical shift in U.S. liquidity dynamics that encouraged capital to flow back into risk assets. Bitcoin reclaimed the $90,000 threshold, while Ethereum surpassed $3,000, signaling a recovery from a period of stagnation. This rally offers much-needed relief after a month of downward pressure on digital asset values.

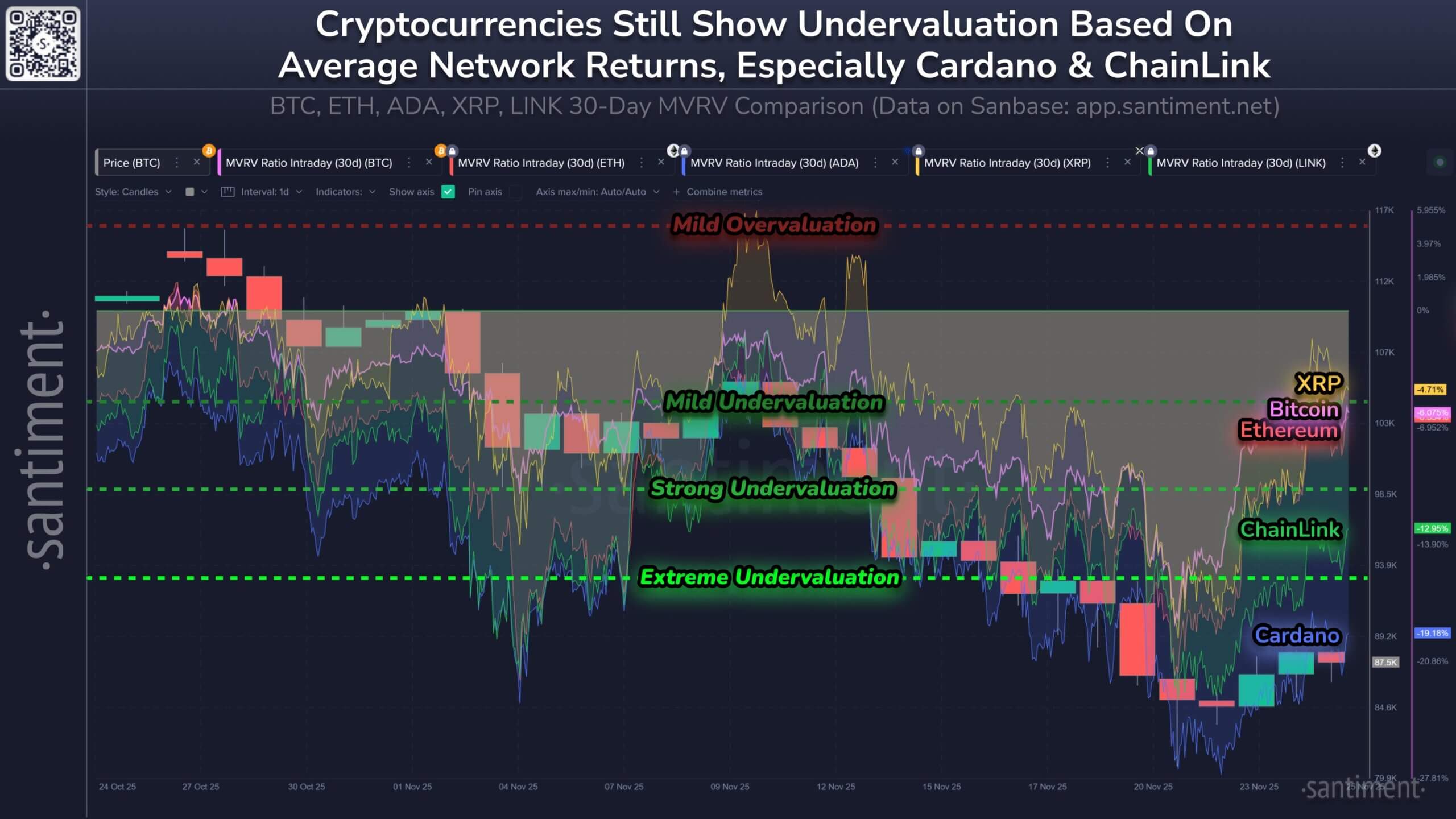

Recent data indicated that investors in major digital assets were facing significant losses, with average wallet investments deeply underwater. Cardano investors had seen an average loss of 19.2%, Chainlink traders were down 13.0%, and even Bitcoin and Ethereum holders experienced losses of 6.1% and 6.3%, respectively. XRP showed a slightly better performance but was still down by 4.7%.

The rally appears to be driven more by the structural reopening of fiscal policy and an increased risk appetite among institutional investors rather than specific news within the crypto sector. This shift is closely tied to changes in the U.S. Treasury’s balance sheet and adjustments in monetary policy messaging.

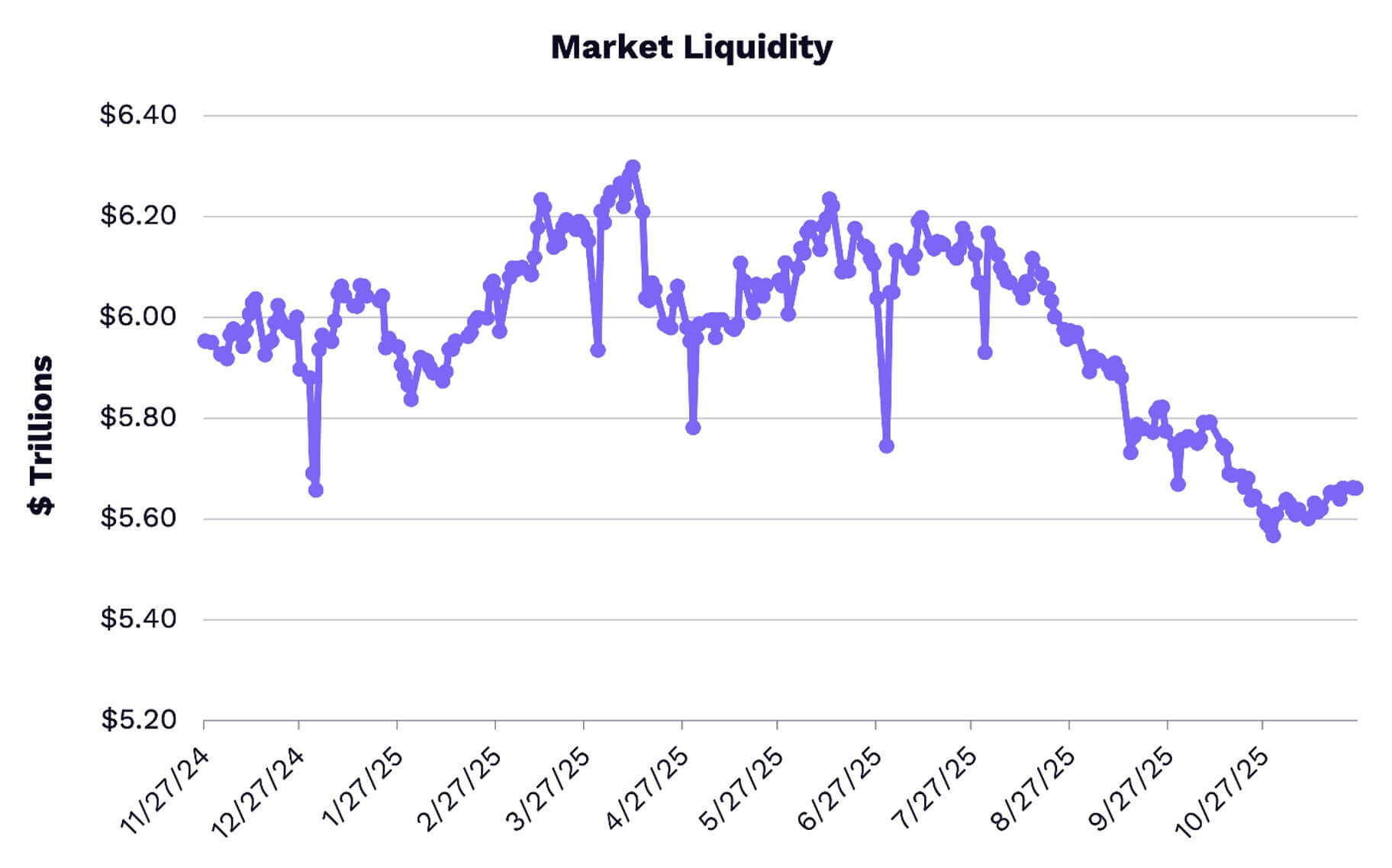

The normalization of liquidity following the end of a six-week government shutdown played a crucial role in this market reversal. The shutdown had drained approximately $621 billion in liquidity from the financial system, but the resumption of government operations has started to reverse this trend. The Treasury General Account (TGA) holds balances near $892 billion, significantly above the historical baseline, indicating that a considerable deployment of cash is expected to flow back into the banking sector and broader economy.

Institutional flows show a distinct rotation towards Ethereum, with ETH products attracting net inflows for the fourth consecutive session, totaling around $61 million. Bitcoin funds experienced more modest inflows, while XRP investment vehicles also saw positive inflows. Solana products, however, faced headwinds with notable redemptions.

The crypto market’s recent rally is underpinned by improved liquidity conditions and a shift in investor sentiment, particularly towards Ethereum. While potential risks remain, such as fluctuations in the macro environment and seasonal trading dynamics, the overall outlook appears cautiously optimistic as the market aims to solidify its gains.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Crypto markets rebounded, driven by increased liquidity and renewed institutional interest. Normalization of the US Treasury’s balance sheet and dovish signals from the Federal Reserve are key factors. Ethereum ETFs are seeing strong inflows, indicating a strategic shift in investment focus.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.