Bitcoin experienced another rejection at the $90,000 level, triggering a market-wide pullback. The broader crypto market mirrored Bitcoin’s volatility, with Ethereum also retracing after an initial surge. XRP failed to hold above a key support level, reflecting the overall market uncertainty.

What to Know:

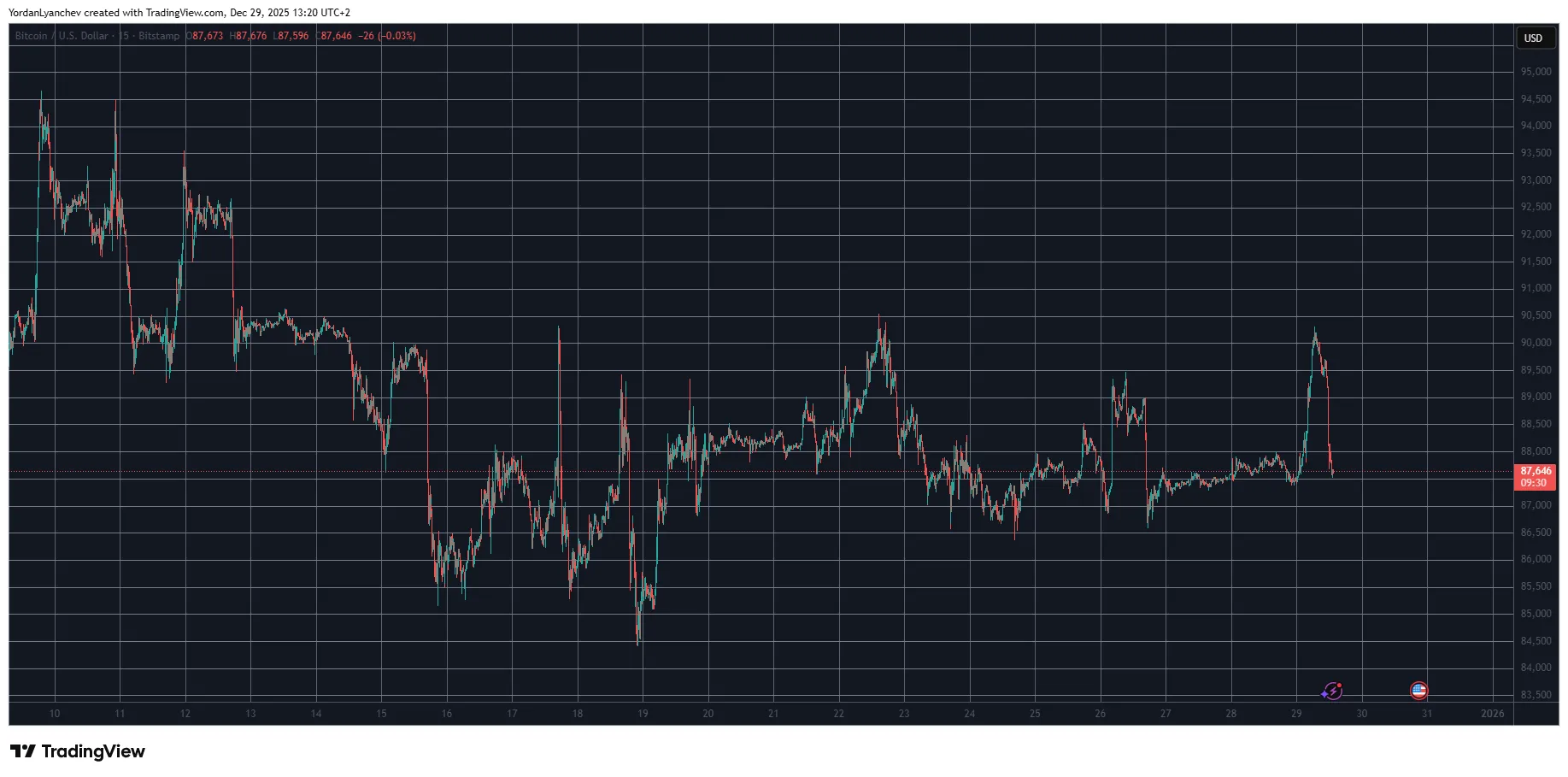

- Bitcoin experienced another rejection at the $90,000 level, triggering a market-wide pullback.

- The broader crypto market mirrored Bitcoin’s volatility, with Ethereum also retracing after an initial surge.

- XRP failed to hold above a key support level, reflecting the overall market uncertainty.

The cryptocurrency market experienced a familiar pattern of volatility, marked by a rapid surge followed by a sharp decline. Bitcoin’s repeated inability to break the $90,000 resistance level has injected caution into the market. Altcoins, including Ethereum and XRP, mirrored Bitcoin’s movements, underscoring the interconnectedness of the crypto space.

Bitcoin’s Stalled Momentum

Bitcoin has struggled to overcome the $90,000 resistance, facing rejection multiple times in recent weeks. Despite several attempts, including two in the past week alone, Bitcoin has failed to sustain a breakout. This resistance has led to significant pullbacks, reinforcing a bearish sentiment among some traders.

Altcoins Follow Suit

Ethereum experienced a similar trajectory, briefly surpassing $3,000 before retracing. Other altcoins, such as BNB and XRP, also reflected the market’s volatility. XRP, in particular, struggled to maintain its position above a critical support level, indicating potential weakness.

Market Capitalization Swings

The total crypto market capitalization saw significant fluctuations, gaining and losing $70 billion within hours. This volatility highlights the speculative nature of the market and the potential for rapid shifts in sentiment. As of the latest assessment, the total market capitalization stands at $3.060 trillion.

XRP’s Liquidity Considerations

XRP’s struggle to maintain support levels is particularly relevant for liquidity providers and traders. Fluctuations in XRP’s price can impact trading strategies and risk management. Market participants should closely monitor XRP’s price action and liquidity dynamics to navigate potential volatility.

Potential Catalysts

The market is awaiting potential catalysts that could trigger a more decisive move. These include regulatory developments, macroeconomic factors, and further institutional adoption. The approval of a spot Bitcoin ETF in the US, for example, could provide a significant boost to the market.

Conclusion

The crypto market remains in a state of uncertainty, with Bitcoin’s inability to break through resistance weighing on sentiment. While the long-term outlook remains positive for many, traders should exercise caution and manage risk accordingly. Monitoring key levels and potential catalysts will be crucial for navigating the market in the coming weeks.

Related: Bitcoin Reverses Gains as Nasdaq Futures Wilt

Source: Original article

Quick Summary

Bitcoin experienced another rejection at the $90,000 level, triggering a market-wide pullback. The broader crypto market mirrored Bitcoin’s volatility, with Ethereum also retracing after an initial surge. XRP failed to hold above a key support level, reflecting the overall market uncertainty.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.