Altcoins have significantly underperformed Bitcoin, resulting in retail traders missing out on substantial potential gains. Institutional flows, Bitcoin ETFs, and a general shift towards risk aversion are reshaping the crypto market.

What to Know:

- Altcoins have significantly underperformed Bitcoin, resulting in retail traders missing out on substantial potential gains.

- Institutional flows, Bitcoin ETFs, and a general shift towards risk aversion are reshaping the crypto market.

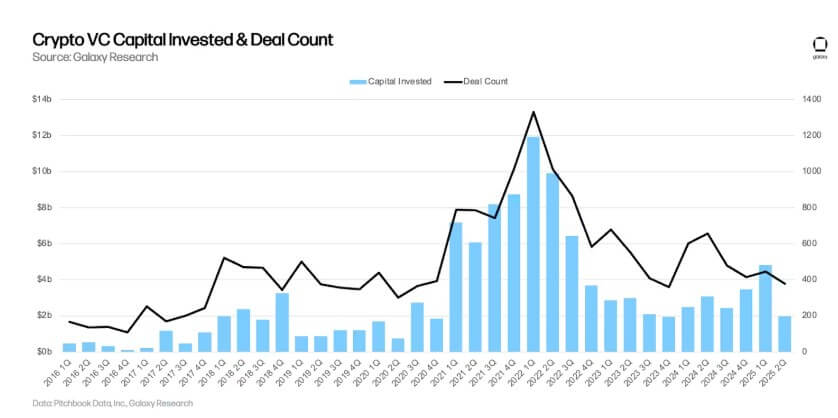

- Venture capital investment in Web3 projects has declined, impacting the emergence of new altcoin narratives.

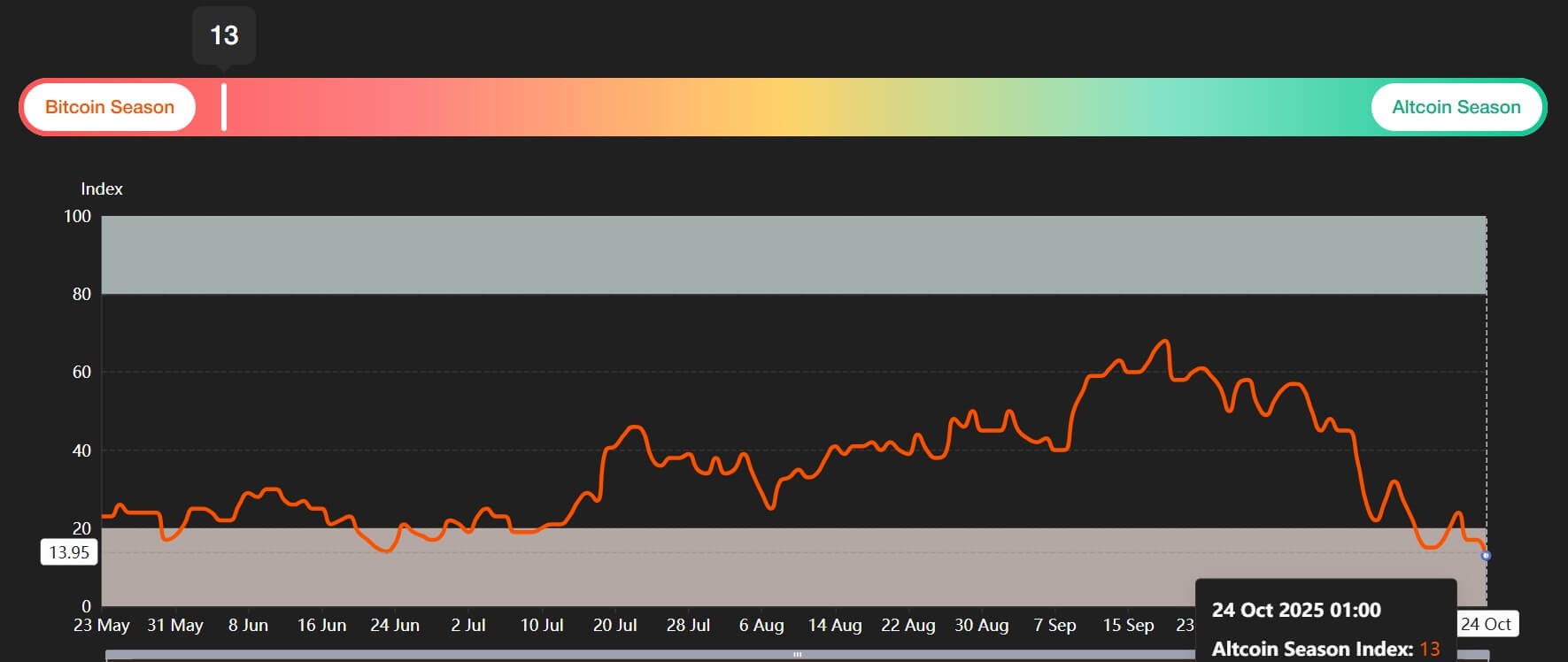

The anticipated altcoin season has yet to materialize, leaving retail crypto traders who bet against Bitcoin’s dominance missing out on roughly $800 billion in potential gains. A recent report from 10x Research highlights this underperformance, suggesting a shift in market dynamics favoring Bitcoin. This transformation is driven by institutional investments, the introduction of Bitcoin ETFs, and increased risk aversion among investors.

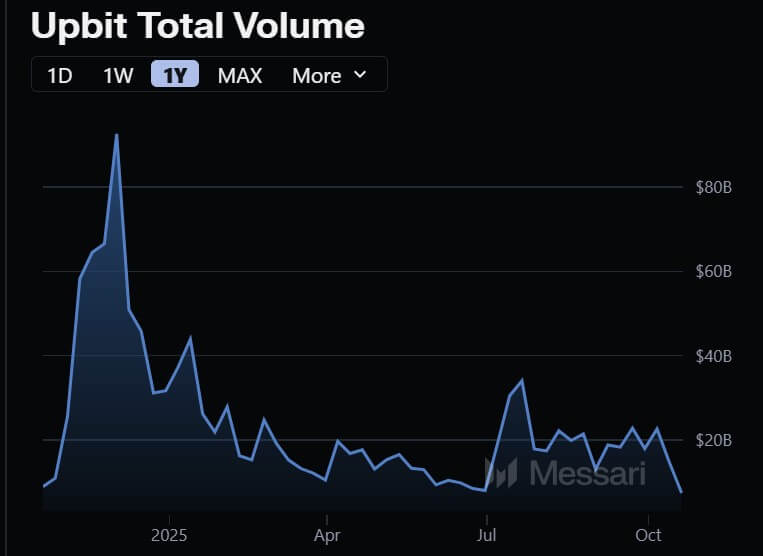

Traditionally, altcoin seasons see smaller cryptocurrencies outperform Bitcoin, but this cycle has seen liquidity consolidate around Bitcoin. Data indicates a significant reallocation towards BTC-denominated products, away from higher-risk altcoins. Even Korean retail traders, historically a driving force behind altcoin speculation, have shifted towards US-listed crypto equities.

“Over the past 30 days, our tactical altcoin model has favored Bitcoin over altcoins, reflecting a bottoming out in Bitcoin dominance. This shift follows a 75-day period in which the model preferred altcoins, a phase that coincided with Ethereum’s rally, but that trend has clearly ended.”

The decline in venture capital investment in early-stage Web3 projects has further impacted the altcoin market. Without fresh narratives and token launches, altcoins face an uphill battle. The recent market shock further exacerbated the situation, wiping out billions from leveraged crypto positions, disproportionately affecting altcoins.

The rise of institutional capital, particularly through spot Bitcoin ETFs, has redefined “safe” crypto exposure. These ETFs have attracted substantial inflows, overshadowing altcoins and altering market dynamics. While retail interest in altcoins persists, the current landscape favors established cryptocurrencies and infrastructure projects.

In conclusion, the crypto market is experiencing a structural shift, with Bitcoin leading the charge and altcoins struggling to keep pace. Investors are closely monitoring regulatory developments and the performance of Bitcoin ETFs as key indicators of future market trends. While the potential for altcoin growth remains, the path forward appears to be paved with caution and a focus on fundamental value.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Altcoins have significantly underperformed Bitcoin, resulting in retail traders missing out on substantial potential gains. Institutional flows, Bitcoin ETFs, and a general shift towards risk aversion are reshaping the crypto market. Venture capital investment in Web3 projects has declined, impacting the emergence of new altcoin narratives.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.