Investors are increasingly seeking ways to minimize screen time while maintaining exposure to Bitcoin and other cryptocurrencies. Hardware wallets are gaining traction, driven by both the desire for digital minimalism and the need for enhanced security against hacks and physical attacks.

What to Know:

- Investors are increasingly seeking ways to minimize screen time while maintaining exposure to Bitcoin and other cryptocurrencies.

- Hardware wallets are gaining traction, driven by both the desire for digital minimalism and the need for enhanced security against hacks and physical attacks.

- Custody solutions are evolving to meet the demands of both retail and institutional investors looking for secure, low-touch ways to hold crypto assets.

As investors embrace the concept of “Analog January,” a movement focused on reducing digital consumption, Bitcoin custody is transforming into a lifestyle choice. This trend, coupled with market volatility, is driving demand for secure, low-touch methods of holding Bitcoin. The shift highlights a growing need for custody solutions that align with both convenience and security.

The desire to disconnect from constant price monitoring, especially during volatile periods, is pushing investors toward custody solutions that require minimal interaction. Bitcoin’s unique ability to be held in cold storage, without the need for a perpetual account with an exchange, makes it an attractive option for those seeking an “anti-screen” store of value. This approach positions Bitcoin more like a vault than a constantly monitored app.

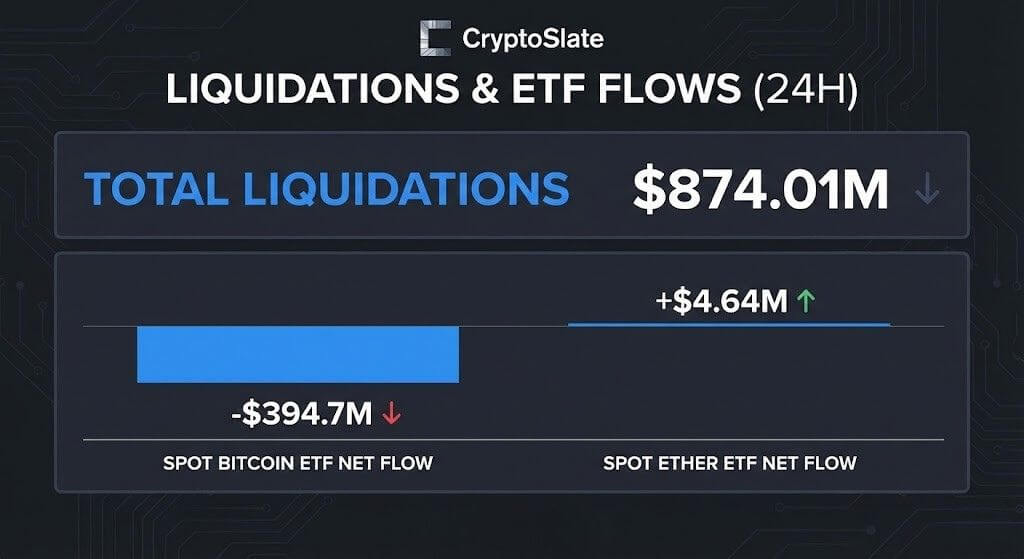

ETF flows also reflect this behavior, as they reduce touchpoints by delegating custody and execution to fund managers. Spot Bitcoin ETFs have seen significant flows, indicating that investors are comfortable with the convenience of regulated wrappers. This demonstrates that “set-and-forget” can be achieved through both regulated financial products and self-custody solutions.

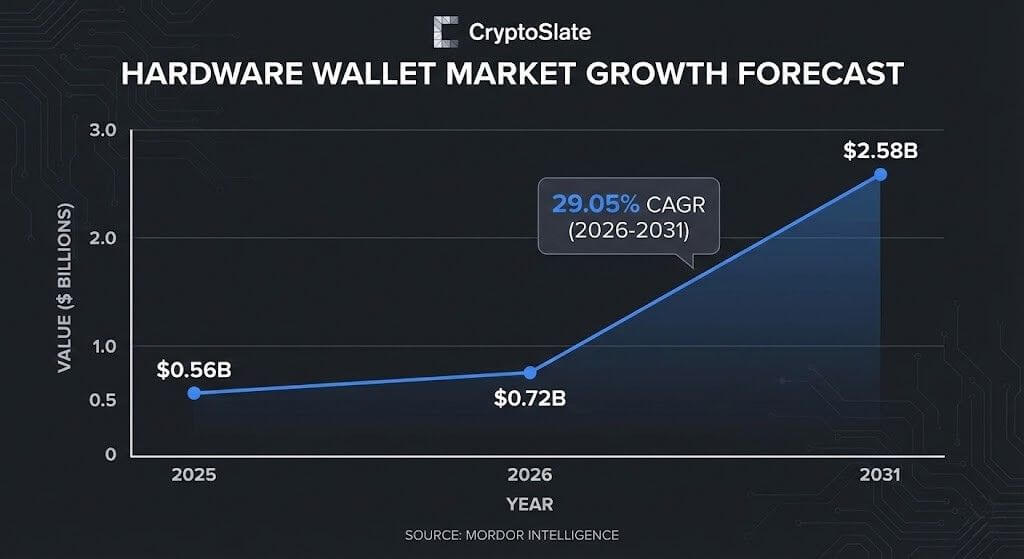

Hardware wallets are central to the offline custody pathway, and the market is expanding beyond early adopters. Projections indicate substantial growth in the hardware wallet market, suggesting that supply chains and retail distribution are maturing. This growth will ensure that cold storage solutions are more accessible during periods of high volatility or increased security concerns.

Security concerns are another major driver for offline custody. Reports of increasing hacks and thefts targeting individual crypto wallets are pushing investors to take more aggressive security measures. The rise in “$5 wrench attacks,” where criminals use physical threats to gain access to crypto assets, underscores the importance of robust personal security and discreet handling of crypto wealth.

The convergence of digital minimalism and security concerns is reshaping how investors approach Bitcoin custody. As the market matures, custody solutions are adapting to meet the demands of both retail and institutional investors, providing secure, low-touch options for holding crypto assets. The trends suggest a positive outlook for the continued adoption and integration of Bitcoin into broader financial strategies.

Related: Bitcoin Down: Crypto Markets Show Negative Returns

Source: Original article

Quick Summary

Investors are increasingly seeking ways to minimize screen time while maintaining exposure to Bitcoin and other cryptocurrencies. Hardware wallets are gaining traction, driven by both the desire for digital minimalism and the need for enhanced security against hacks and physical attacks.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.