Bitcoin ETFs have become a central force, shaping market dynamics and liquidity. On-chain analysis, particularly tracking holder behavior, provides valuable insights into market sentiment and potential turning points.

What to Know:

- Bitcoin ETFs have become a central force, shaping market dynamics and liquidity.

- On-chain analysis, particularly tracking holder behavior, provides valuable insights into market sentiment and potential turning points.

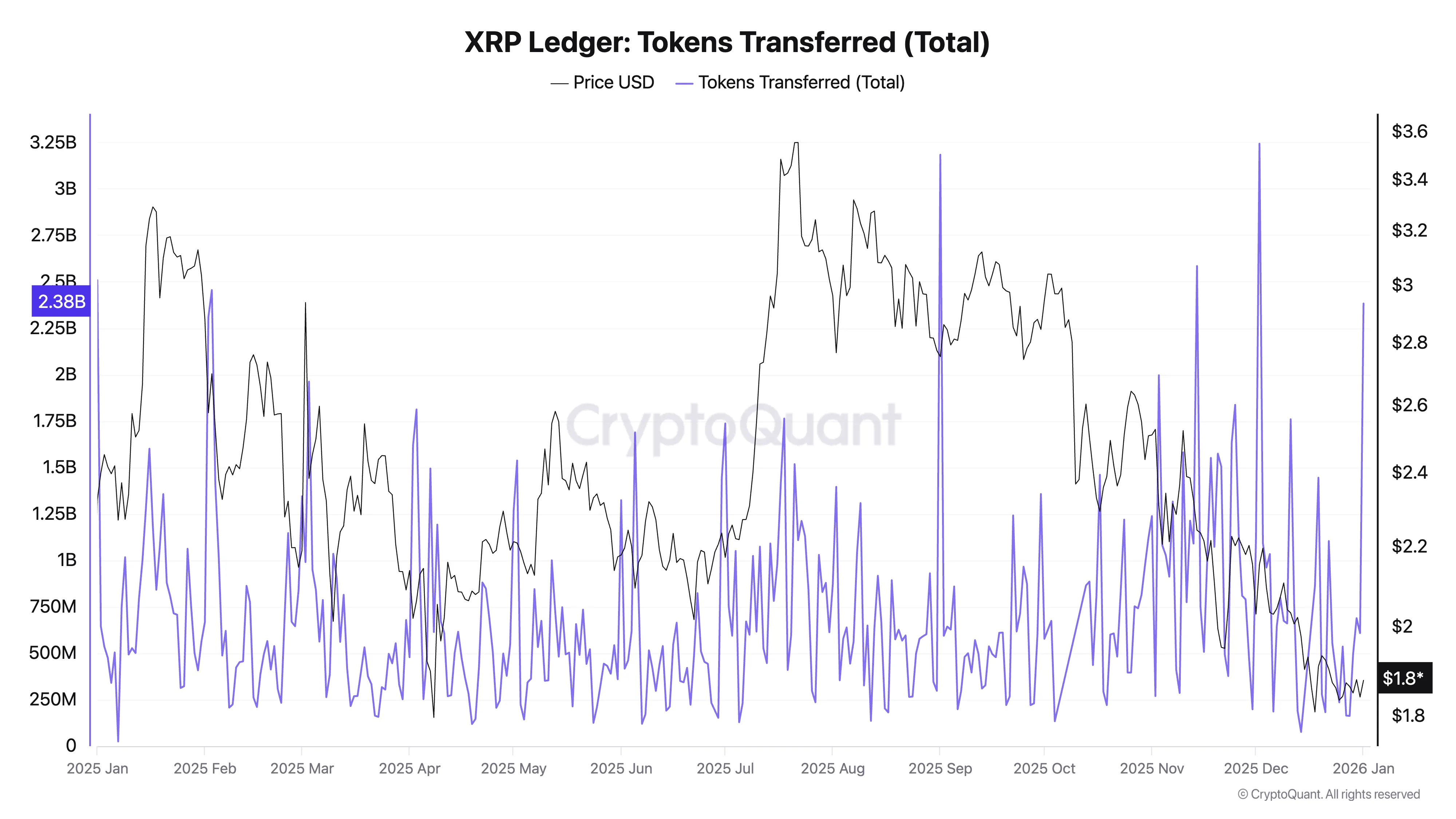

- Beyond Bitcoin, monitoring Ethereum fees and XRP Ledger transfers offers a glimpse into real-world adoption and network utility.

In 2025, the crypto market matured, learning to coexist with mainstream attention brought by spot Bitcoin ETFs and other developments. Understanding the underlying market dynamics became crucial, moving beyond simple price charts to analyze liquidity, network activity, and user behavior. This year-in-review focuses on key charts that effectively narrate the market’s evolution and provide a framework for future analysis.

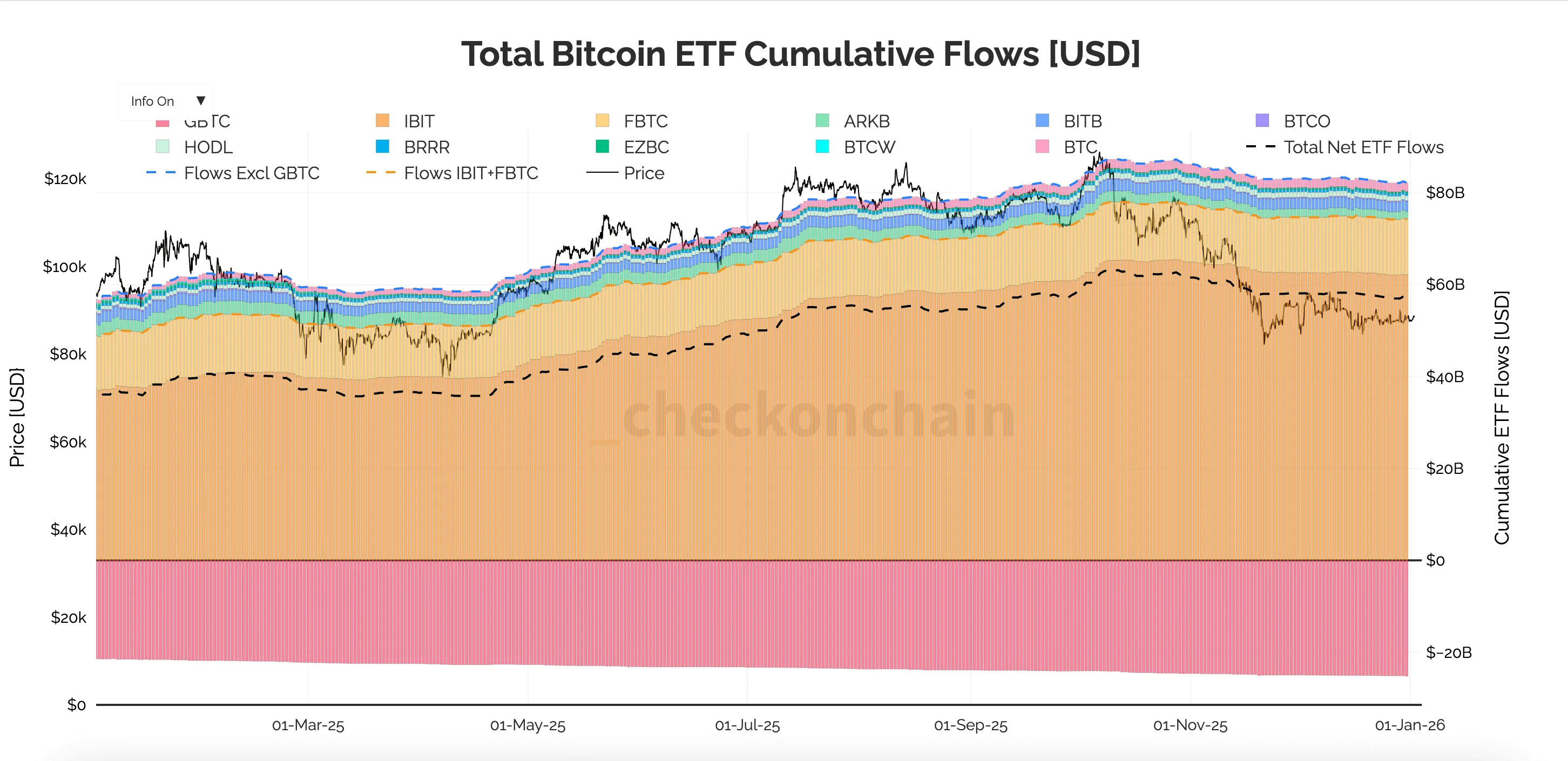

The performance of spot Bitcoin ETFs played a pivotal role, with daily net inflows directly influencing market momentum. Strings of green bars often preceded upward price movements, while clusters of red signaled potential downturns, highlighting the significance of ETF flows in shaping Bitcoin’s price action. The issuer split also revealed which vehicles attracted genuine liquidity, distinguishing them from mere marketing successes.

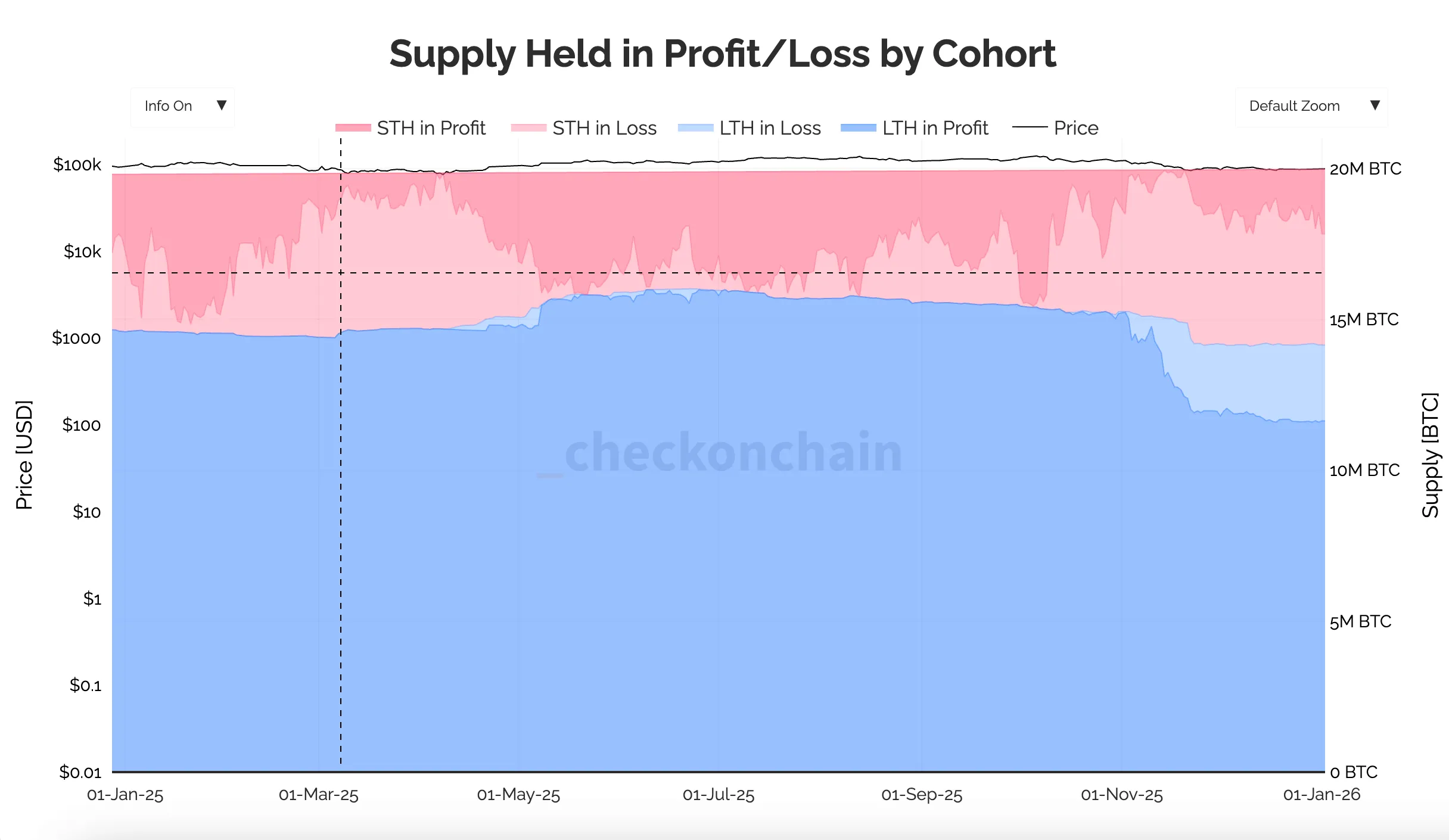

Analyzing the supply held in profit or loss by long-term (LTH) and short-term holders (STH) offered a quantitative view of market sentiment. Shifts in this balance indicated whether the market was in an accumulation or distribution phase, providing insights into potential turning points. This metric helped differentiate between exuberant tops and constructive resets, proving valuable in navigating market volatility.

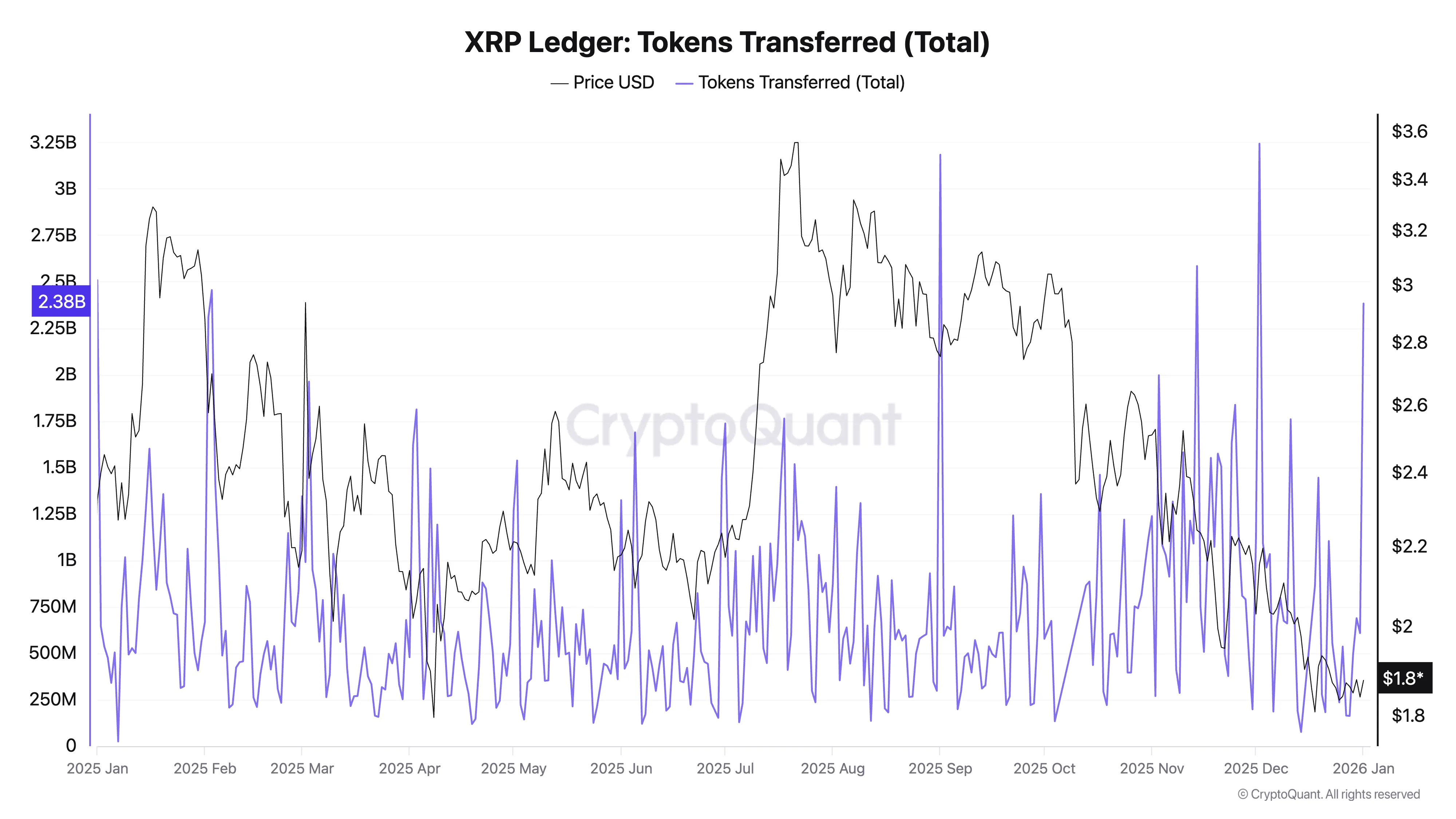

Beyond Bitcoin, monitoring Ethereum fees and XRP Ledger token transfers provided a broader perspective on the crypto ecosystem. The ability of Ethereum’s Layer 2 solutions to scale without compromising the fee engine demonstrated the platform’s growing utility. Meanwhile, consistent token transfers on the XRP Ledger highlighted the potential for real-world payment solutions, independent of speculative market trends.

In summary, 2025 was a year of maturation for the crypto market, marked by the growing influence of Bitcoin ETFs and the increasing sophistication of on-chain analysis. By focusing on key metrics such as ETF flows, holder behavior, and network activity, investors gained a deeper understanding of market dynamics and identified potential opportunities. These insights will be invaluable as the market continues to evolve and adapt to new challenges and opportunities.

Related: Shiba Inu Break Signals Uncertainty

Source: Original article

Quick Summary

Bitcoin ETFs have become a central force, shaping market dynamics and liquidity. On-chain analysis, particularly tracking holder behavior, provides valuable insights into market sentiment and potential turning points. Beyond Bitcoin, monitoring Ethereum fees and XRP Ledger transfers offers a glimpse into real-world adoption and network utility.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.