Bitcoin surged past $94,000, fueled by strong ETF inflows and bullish derivatives positioning. Renewed institutional interest and favorable macro conditions contributed to the rally. Options traders are eyeing the $100,000 level, indicating positive market sentiment.

What to Know:

- Bitcoin surged past $94,000, fueled by strong ETF inflows and bullish derivatives positioning.

- Renewed institutional interest and favorable macro conditions contributed to the rally.

- Options traders are eyeing the $100,000 level, indicating positive market sentiment.

Bitcoin’s recent surge past $94,000 marks a significant recovery, driven by robust inflows into spot Bitcoin ETFs and positive shifts in derivatives markets. This rally, which added nearly $100 billion to the crypto market capitalization in a single day, signals renewed investor confidence. The combination of these factors has created a bullish outlook for Bitcoin as we enter 2026.

US spot Bitcoin ETFs experienced substantial net inflows, spearheaded by BlackRock’s IBIT, playing a crucial role in propelling Bitcoin above the $90,000 mark. This influx of institutional capital reflects a resurgence in demand following year-end consolidation, suggesting a potential “January effect” after the outflows seen in late 2025. The return of institutional appetite, coupled with reduced post-holiday liquidity, amplified the impact of these inflows on Bitcoin’s price.

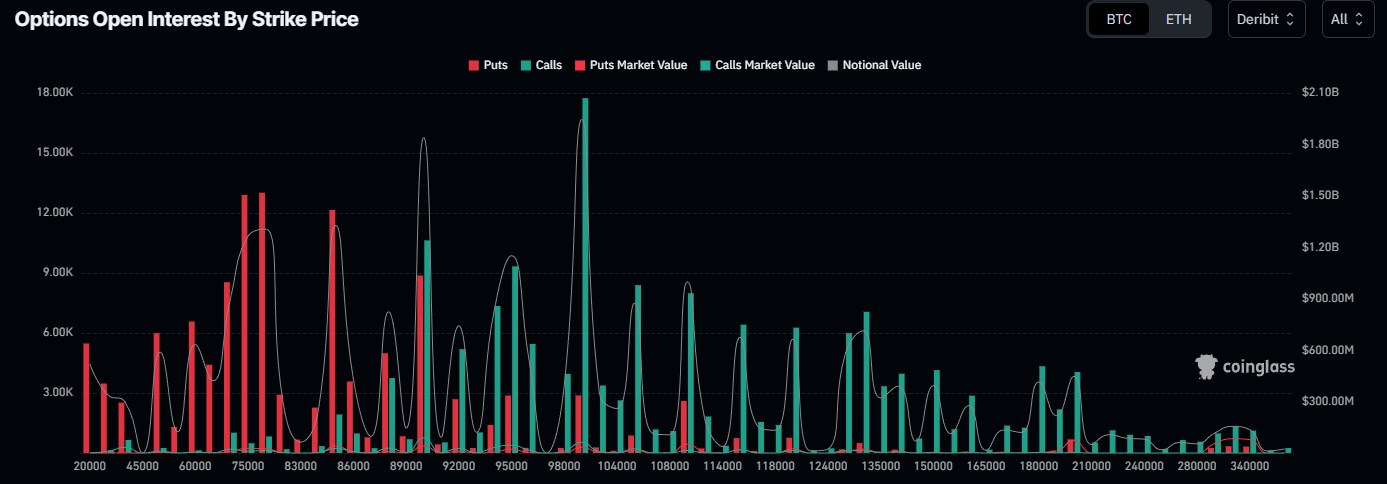

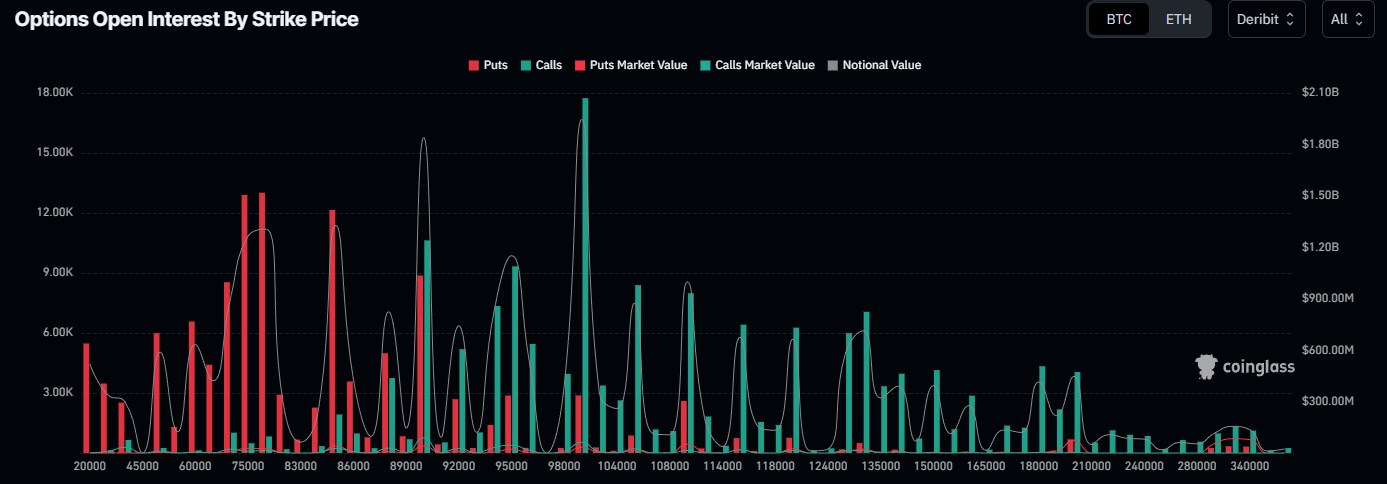

Derivatives markets further amplified the rally, with options traders actively purchasing upside calls, particularly around the $100,000 strike price. Open interest on Deribit surged, and total January options open interest reached approximately $1.45 billion, reflecting strong bullish sentiment. CoinGlass data revealed over $438 million in short positions were liquidated, triggering additional buying pressure as Bitcoin surpassed key resistance levels.

The broader crypto market mirrored Bitcoin’s positive momentum, with Ethereum, XRP, and Solana experiencing notable gains. XRP, in particular, demonstrated significant strength, posting an 11.5% increase, highlighting the diverse opportunities within the digital asset space. This widespread rally reinforces the overall positive sentiment and growing investor interest in cryptocurrencies.

The recent surge in Bitcoin’s price underscores the growing institutional adoption and positive market sentiment surrounding cryptocurrencies. As Bitcoin reclaims levels not seen since mid-December, the focus shifts to whether it can sustain this momentum and potentially challenge the $100,000 mark. Factors such as continued ETF demand, favorable macro conditions, and regulatory developments will play a crucial role in shaping Bitcoin’s trajectory in the coming weeks.

Related: XRP Signals Lift, Weaker Than Bitcoin Pattern

Source: Original article

Quick Summary

Bitcoin surged past $94,000, fueled by strong ETF inflows and bullish derivatives positioning. Renewed institutional interest and favorable macro conditions contributed to the rally. Options traders are eyeing the $100,000 level, indicating positive market sentiment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.