Bitcoin experienced a significant dip, reaching its lowest levels since May, influenced by economic uncertainty and a recent government shutdown. XRP showed relative resilience amid the market downturn, possibly due to the anticipation surrounding new spot ETFs.

What to Know:

- Bitcoin experienced a significant dip, reaching its lowest levels since May, influenced by economic uncertainty and a recent government shutdown.

- XRP showed relative resilience amid the market downturn, possibly due to the anticipation surrounding new spot ETFs.

- Analysts suggest the current market conditions may lead to further price corrections before a potential recovery driven by macro liquidity improvements.

The crypto market experienced a downturn this week, with Bitcoin struggling below $95,000 after a bruising week that dragged prices to their lowest since May. Ethereum and Solana also faced significant losses, while XRP showed relative strength. Market analysts attribute the current volatility to economic uncertainty and a recent U.S. government shutdown.

XRP’s comparative stability, dipping just 1%, may be linked to the debut of its first spot ETF in the U.S., issued by Canary Capital. This development could signal growing institutional interest and acceptance of XRP within established financial markets. The performance of crypto-related equities was mixed, reflecting the broader market uncertainty.

The market retracement is the result of an information vacuum and political uncertainty,” they wrote in a Friday note shared with CoinDesk. “Key economic data is still missing to guide the market and the Federal Reserve, putting investors on standby.

Analysts suggest that a lack of clarity on U.S. economic conditions, exacerbated by the government shutdown, is contributing to the market’s struggles. The temporary funding bill passed by lawmakers does little to resolve the underlying uncertainty. Expectations for balance sheet adjustments or other easing measures and “liquidity injections” could help rebuild optimism around risk assets including BTC.

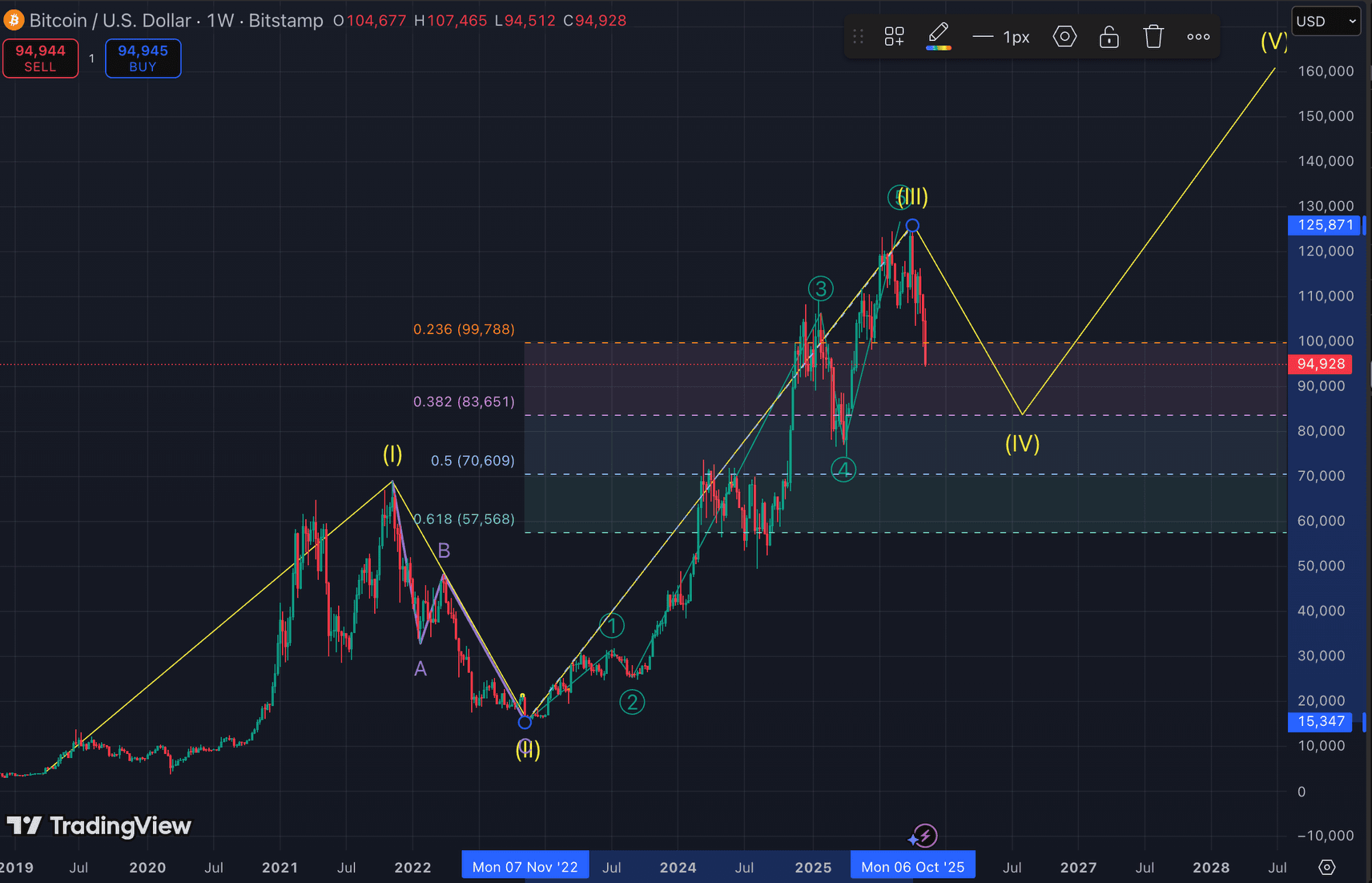

Technical indicators suggest that Bitcoin may have further to fall, potentially reaching levels around $84,000. Despite the current pullback, analysts anticipate volatile action in the coming months, with potential for prices to rebound above $100,000 before any sustained break below $90,000. The full correction could extend through the summer of 2026.

The crypto market is currently navigating a period of uncertainty, influenced by macroeconomic factors and regulatory developments. Investors should remain vigilant and informed as the market seeks to establish a clearer direction. The resilience of XRP amid the broader downturn highlights the potential impact of new financial products like spot ETFs on specific cryptocurrencies.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

Bitcoin experienced a significant dip, reaching its lowest levels since May, influenced by economic uncertainty and a recent government shutdown. XRP showed relative resilience amid the market downturn, possibly due to the anticipation surrounding new spot ETFs.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.