PCE data release was patched due to input disruptions, leading to less certainty in the inflation figures. Bitcoin’s price reaction was muted, indicating the market focused on data quality and the rate market’s response rather than the headline inflation number.

What to Know:

- PCE data release was patched due to input disruptions, leading to less certainty in the inflation figures.

- Bitcoin’s price reaction was muted, indicating the market focused on data quality and the rate market’s response rather than the headline inflation number.

- The next clean inflation release will be crucial in validating the accuracy of the patched PCE data and influencing Bitcoin’s market direction.

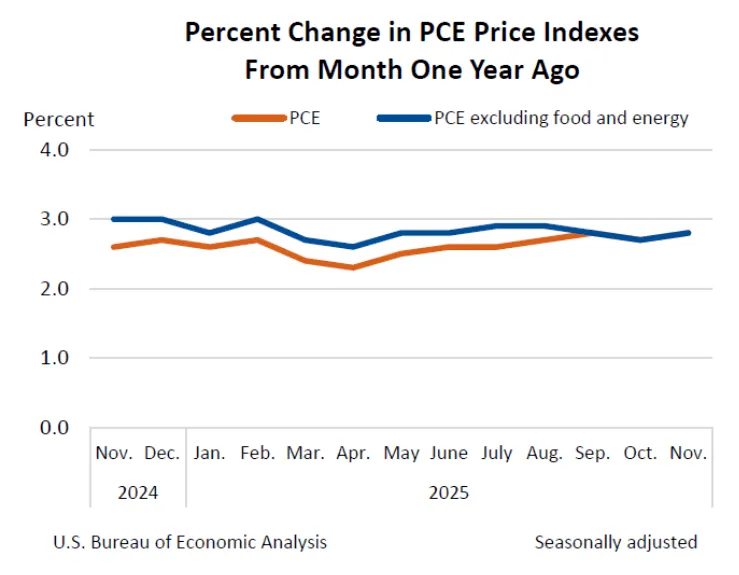

The Bureau of Economic Analysis (BEA) recently released its Personal Income and Outlays report, which included both October and November PCE inflation data. The report revealed a headline PCE of 0.2% month over month for both months, with year-over-year figures at 2.7% and 2.8% respectively, impacting Bitcoin’s market outlook. The muted reaction from Bitcoin suggests that traders are carefully weighing the implications of the data and the potential impact on monetary policy.

The core PCE, also at 0.2% month over month, with year-over-year figures mirroring the headline rates, further underscores the persistence of inflation above the 2% target. This consistency is likely to keep rate-cut expectations in check, as the Federal Reserve will want to see more convincing evidence of cooling inflation before adjusting its policy. The market’s focus will remain on how these inflation figures translate into the Federal Reserve’s policy decisions.

Bitcoin’s subdued response to the PCE data release highlights the importance of data quality and market interpretation. Because the BEA had to patch inputs due to disruptions, the inflation print became more dependent on estimation choices, reducing certainty about the underlying price behavior. This uncertainty led traders to refrain from making significant policy bets, waiting instead for more reliable data.

Real yields, which represent the opportunity cost of holding non-yielding assets like Bitcoin, play a crucial role in determining market sentiment. Higher real yields increase the hurdle rate for Bitcoin, tightening financial conditions, while lower real yields ease conditions and support risk assets. Therefore, monitoring the rate market’s reaction to the PCE data is essential for gauging Bitcoin’s potential trajectory.

The updated estimate for Q3 2025 GDP, revised slightly higher to 4.4% annualized, provides additional context for the Federal Reserve’s policy decisions. While strong growth can support risk appetite, it can also keep the Federal Reserve cautious, maintaining elevated real yields. The interplay between growth and inflation will ultimately dictate the direction of yields and, consequently, Bitcoin’s market performance.

Related: XRP Signals: Price Analysis

Source: Original article

Quick Summary

PCE data release was patched due to input disruptions, leading to less certainty in the inflation figures. Bitcoin’s price reaction was muted, indicating the market focused on data quality and the rate market’s response rather than the headline inflation number.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.