Precious metals have significantly outperformed crypto since January 2025. This trend reflects broader market uncertainty and a flight to safe-haven assets. XRP and other cryptocurrencies have seen negative performance, impacting liquidity.

What to Know:

- Precious metals have significantly outperformed crypto since January 2025.

- This trend reflects broader market uncertainty and a flight to safe-haven assets.

- XRP and other cryptocurrencies have seen negative performance, impacting liquidity.

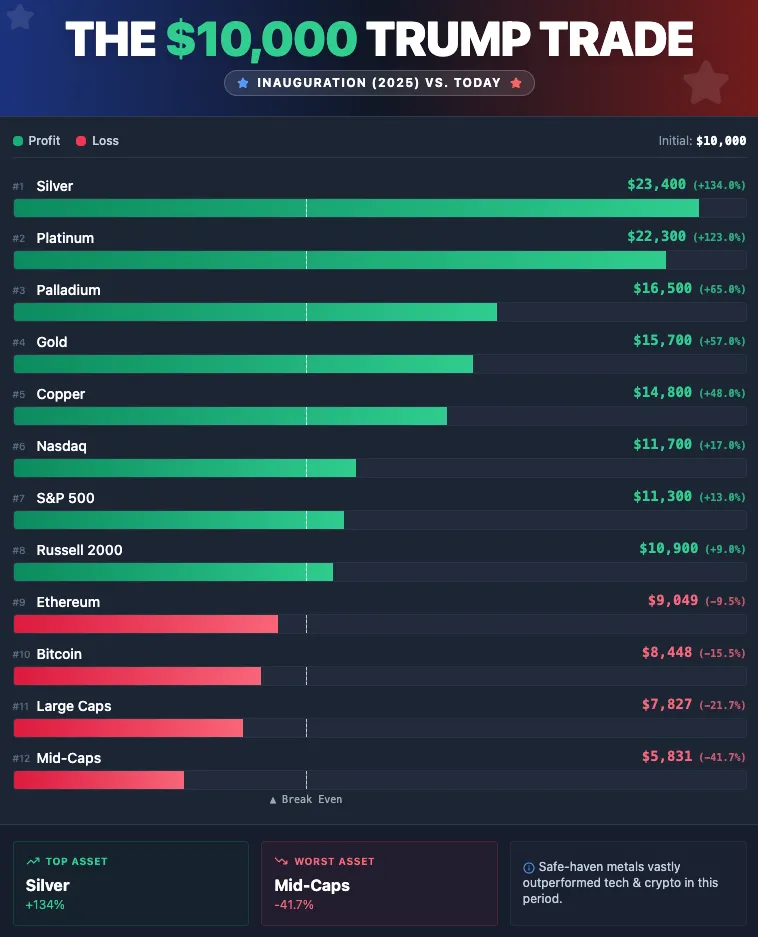

Since January 2025, traditional safe-haven assets have outperformed most cryptocurrencies, defying expectations of a crypto-led bull market. A hypothetical portfolio rebalancing on Inauguration Day reveals a notable shift from speculative assets to more stable commodities. This trend underscores growing market uncertainty and a preference for tangible stores of value.

Precious Metals Dominate

Precious metals have emerged as the top-performing asset class, with silver leading the charge with a 134% return. Gold has also seen substantial gains, up by approximately 60%. This performance is attributed to several factors, including geopolitical tensions, the demand for metals in industries like EV manufacturing and AI, and concerns over potential tariffs. The limited supply of these natural resources further exacerbates price increases, as demand continues to rise.

Factors Driving Metals’ Rally

Experts suggest that the parabolic rise in precious metals is driven by a combination of fundamental and macroeconomic factors. Geopolitical uncertainty surrounding conflicts and trade policies has increased demand for safe-haven assets. Additionally, the demand for metals used in electric vehicles and AI-related technologies has further tightened supply, driving prices higher. Some analysts also believe that markets are pricing in increasing inflation and uncertainty, with silver acting as a leveraged play on gold.

Crypto Market Underperforms

In contrast to the gains in precious metals, the cryptocurrency market has generally underperformed since January 2025. Despite regulatory progress and increased institutional involvement, many cryptocurrencies have experienced negative returns. Bitcoin, Ethereum, and XRP have all struggled to maintain positive momentum, with some altcoins experiencing even more significant declines. This lackluster performance has dampened market sentiment, with some investors expressing disappointment despite the overall progress in the crypto space.

XRP and Altcoin Struggles

XRP has been among the cryptocurrencies facing headwinds, with a notable price decrease since January 2025. Similarly, other altcoins like Solana, Dogecoin, Cardano, and Avalanche have also seen substantial declines. This broad underperformance across the altcoin market indicates a general shift away from higher-risk, speculative assets. The negative returns in these assets may also impact liquidity across various crypto exchanges and trading platforms.

Implications for Market Liquidity

The shift from crypto to precious metals has implications for market liquidity. As investors reallocate capital to traditional assets, liquidity in the crypto market may decrease, potentially leading to increased volatility and wider price swings. This trend could also affect the ability of institutional investors to execute large trades efficiently, particularly in less liquid altcoins. The performance of Bitcoin ETFs will be critical as they mature and the broader market digests macroeconomic developments.

Conclusion

The market landscape has shifted notably since January 2025, with precious metals outperforming cryptocurrencies. This trend reflects broader market uncertainty and a flight to safe-haven assets. While the crypto industry has seen regulatory progress, price action has been disappointing, impacting market sentiment and liquidity. Investors should closely monitor these trends as they navigate the evolving financial landscape.

Related: XRP Price Forecast: Analyst Targets $0.80

Source: Original article

Quick Summary

Precious metals have significantly outperformed crypto since January 2025. This trend reflects broader market uncertainty and a flight to safe-haven assets. XRP and other cryptocurrencies have seen negative performance, impacting liquidity. Since January 2025, traditional safe-haven assets have outperformed most cryptocurrencies, defying expectations of a crypto-led bull market.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.