Bitcoin is facing increasing pressure in a volatile trading environment, while ether (ETH) remains unexpectedly resilient as investors and traders shift their preferences.

Bitcoin is facing increasing pressure in a volatile trading environment, while ether (ETH) remains unexpectedly resilient as investors and traders shift their preferences. The cryptocurrency market showed signs of risk aversion on Thursday, ahead of Federal Reserve Chair Jerome Powell’s scheduled address at the Jackson Hole Symposium.

Market Signals Point to Bitcoin Uncertainty

Bitcoin (BTC) slipped to $113,600 after peaking at $114,800 late the previous day. This drop came amid a broader pullback in major crypto assets. Derivatives markets, particularly in options, reflect caution, with more traders seeking downside protection. This was underscored by a long-term sentiment metric, which turned bearish for the first time since mid-2023.

Adding to the uncertainty, technical indicators show a declining short-term outlook for BTC. Meanwhile, investor behavior is changing — a large wallet sold off 660 BTC and used the proceeds to initiate $295 million in ETH positions, suggesting a rising interest in ether.

Decentralization Concerns Add Pressure to Bitcoin

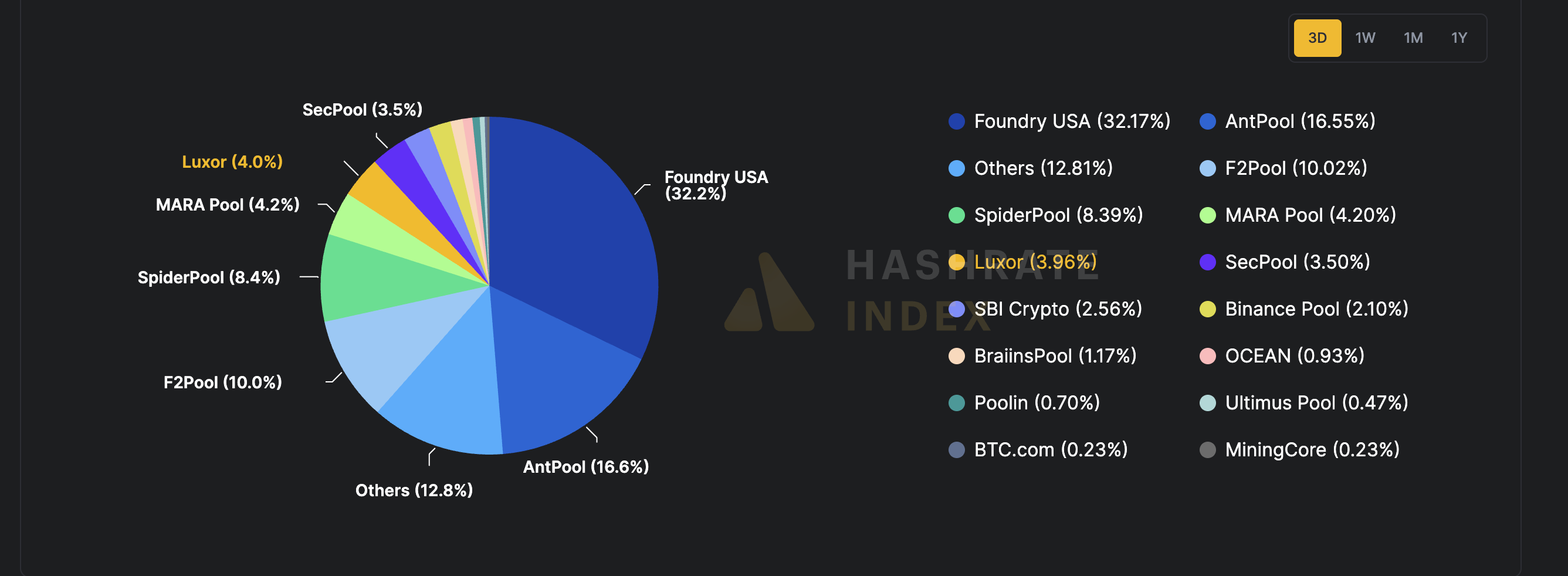

Decentralization chatter resurfaced after “WhaleWire” reported that Foundry USA and Antpool now account for more than 50% of the Bitcoin network’s hashrate. This level of mining concentration raises fears of centralization, especially in the wake of threats by Qubic to perform 51% attacks on cryptocurrencies like Monero and Dogecoin.

Additional stress emerged from Strategy, a major BTC holder, which revealed plans to potentially issue equity to manage debt and dividend obligations. Though financial services firm Swan emphasized that Strategy’s substantial BTC reserves and robust balance sheet could withstand deep price corrections, investor confidence appeared shaken.

Ether’s Growing Edge Over Bitcoin

Data from derivatives markets show that institutional and large traders are increasingly leaning toward ether. Futures open interest for ETH continues to grow, while Bitcoin futures show stagnation. On Deribit, longer-dated ETH options are skewed toward calls, signaling bullish expectations. Similar patterns in the ETF market reinforce this, with ETH holdings relatively steady despite minor outflows.

On centralized platforms like CME and Paradigm, there is growing interest in protective BTC puts, financed by call selling. Conversely, ETH trades show more mixed strategies. These patterns hint at a maturing preference for ether among sophisticated market participants.

Celebrity Influence and Token Speculation

On the speculative side of the crypto spectrum, Ye (formerly Kanye West) launched the YZY token on Solana. The token briefly amassed a $3 billion market cap before collapsing below $1 billion, reflecting waning enthusiasm for celebrity-driven tokens. Insider transactions and AI-generated promotional content added to the controversy surrounding the launch.

Retail investors bore the brunt of the losses. One wallet reportedly lost nearly $500,000 in under two hours, underscoring the risks inherent in such hyped-up launches.

Chart visualizing the concentration of hashing power controlled by two major Bitcoin mining pools.

Derivatives Activity Reflects Diverging Preferences

Open interest in ETH derivatives is nearing 2 million ETH, while BTC futures have plateaued. LINK futures continue to hit record levels as well, highlighting trending alternatives. Theta and other top tokens saw slight reductions in activity, excluding BNB.

BTC funding rates and volatility indexes remained stable, suggesting that significant price swings are not expected during Powell’s upcoming address. However, the combination of bearish sentiment in BTC options and bullish activity in ETH points to diverging investor positioning heading into macroeconomic uncertainty.

Global and Traditional Market Overview

Markets intersecting with crypto—such as equities and commodities—also showed volatility. Global indices including Nasdaq, Nikkei, and the Euro Stoxx 50 registered modest declines. Meanwhile, bond yields, including Japan’s, continued to edge higher, potentially impacting crypto sentiment indirectly.

Technical analysis on Nasdaq e-mini futures indicates weakening bullish momentum, which could impact the crypto market.

ETF Flows and Crypto Majors Performance

ETFs continue to see negative flows. Bitcoin ETF outflows amounted to $315.9 million on the day, while ETH ETFs lost $240.2 million. Bitcoin’s dominance increased slightly to 59.5%, but its weakening sentiment was unmistakable.

In terms of performance, BTC was down 0.84% by close, while ETH remained stronger, closing over $4,283, up 1.23% in the last 24 hours.

Watchlist and Upcoming Events

Investors are keeping an eye on several key macro and crypto events:

Related: Cardano Bull Setup Points to December Rally

- Jackson Hole Symposium continues, with Powell’s speech expected on Aug. 22.

- Q2 GDP data from Mexico and Peru, due Aug. 22, may reveal economic trends affecting EM crypto demand.

- Token unlocks for Venom, Jupiter, and Sui in the coming days could impact market supply.

Altogether, the current market landscape features a cautious approach to bitcoin, a growing tilt toward ether, and an environment shaped by macroeconomic expectations and speculative bursts. With major events on the horizon, both institutional and retail traders have plenty of catalysts to monitor.

Quick Summary

Bitcoin is facing increasing pressure in a volatile trading environment, while ether (ETH) remains unexpectedly resilient as investors and traders shift their preferences. The cryptocurrency market showed signs of risk aversion on Thursday, ahead of Federal Reserve Chair Jerome Powell’s scheduled address at the Jackson Hole Symposium.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.