Whale activity on Binance has increased, focusing on Bitcoin amid market consolidation. The whale inflow ratio, comparing the largest Bitcoin deposits to total exchange inflows, indicates this activity in the context of market retracement.

What to Know:

- Whale activity on Binance has increased, focusing on Bitcoin amid market consolidation.

- The whale inflow ratio, comparing the largest Bitcoin deposits to total exchange inflows, highlights this activity in the context of market retracement.

- This trend matters for institutional flows as whale behavior can signal shifts in sentiment and potential market direction for Bitcoin and related assets like XRP.

Bitcoin whales are stirring on Binance, the world’s largest centralized exchange, as the crypto market navigates a period of consolidation. Increased activity among these large holders can offer clues about potential market direction. Monitoring their behavior provides insight into whether the market is gearing up for a rebound or bracing for further correction.

Bitcoin Whales Come Alive on Binance

Market turbulence continues to test the resolve of crypto investors, with price swings eliciting varied reactions across different segments. While retail traders often react impulsively to market volatility, larger players tend to operate with more calculated strategies. A recent analysis from CryptoQuant indicates that Bitcoin whales are now actively engaging on Binance as Bitcoin’s price consolidates.

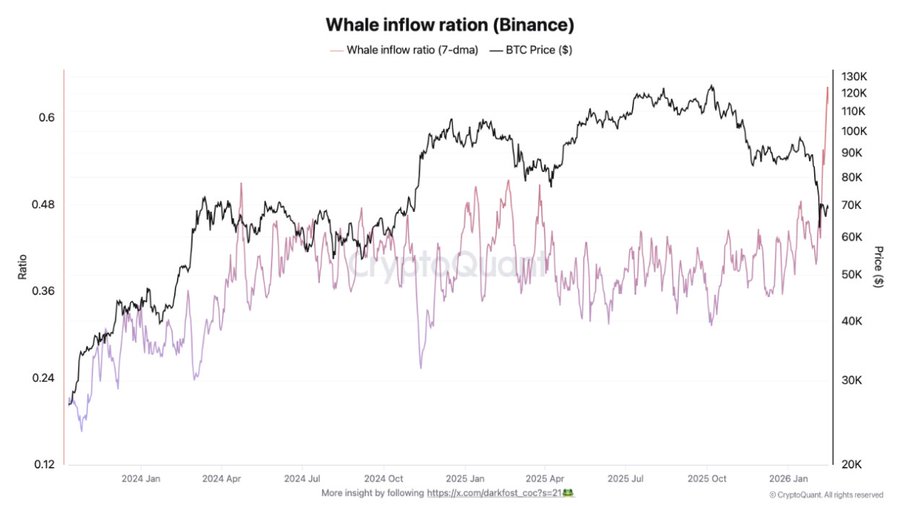

The analysis highlights this increased activity using the whale inflow ratio, a metric that compares the volume of the ten largest Bitcoin deposits to the total amount entering an exchange. By smoothing the data with a weekly average, the indicator highlights a clearer behavioral trend among BTC whales.

In early February, that ratio stood near 0.40. However, within two weeks, it has risen to 0.62. Notably, this uptick indicates that massive Bitcoin deposits now account for a much larger share of the exchange’s inflows.

Historically, this pattern often appears when large holders prepare for major moves regarding their holdings. In this case, the CryptoQuant analysis suggests the start of a heavier sell-side pressure following a persistent price correction.

Notable Whales Push BTC to Binance

The analysis also identified a popular wallet that pioneered this inflow to Binance. According to the report, Garrett Jin, also known as the “Hyperunit whale,” recently transferred nearly 10,000 BTC to Binance.

Still, the wallet is not alone in this shift. Several other large deposits from unrelated addresses suggest that multiple whales are responsible for this increased Bitcoin movement to Binance. This collective behavior could amplify volatility, especially given that broader market investors are already skeptical of the current price trend.

Nonetheless, rising whale inflows do not automatically mean they are selling, and prices will fall. It means that large holders may be preparing to either reduce exposure, hedge positions, or simply rotate capital from BTC to other cryptocurrencies.

Potential Implications for Market Structure

The observed increase in Bitcoin deposits on Binance by whale entities has several potential implications for market structure. A surge in exchange inflows could increase sell-side liquidity, which may be necessary to facilitate larger institutional exits or portfolio rebalancing activities. Such liquidity is crucial for maintaining orderly markets, especially during periods of high volatility.

Conversely, these inflows could also be strategic moves to position for potential arbitrage opportunities or to take advantage of derivative market inefficiencies. For instance, whales might deposit BTC to engage in basis trading, exploiting price differences between spot and futures markets.

Regulatory Posture and Institutional Sentiment

The regulatory posture towards digital assets continues to evolve, impacting institutional sentiment and market behavior. Recent clarifications or shifts in regulatory frameworks can influence how whales manage their holdings. For example, stricter KYC/AML requirements might prompt some large holders to consolidate their assets on exchanges that offer robust compliance measures, such as Binance.

Moreover, the anticipation of further regulatory developments can drive strategic positioning among whales. If new regulations are expected to favor certain types of crypto assets or trading activities, whales might adjust their portfolios accordingly, leading to increased inflows into specific exchanges.

Derivatives Positioning and ETF Mechanics

Whale activity on Binance could also be linked to derivatives positioning and ETF mechanics. Large holders may use their spot Bitcoin holdings to collateralize derivative positions, such as futures or options, to hedge against downside risk or amplify their returns. Increased inflows might indicate a build-up of short positions or a hedging strategy in anticipation of market corrections.

Additionally, the mechanics of Bitcoin ETFs can influence whale behavior. As ETFs accumulate Bitcoin, they may source liquidity from exchanges like Binance, potentially leading to increased inflows as whales respond to arbitrage opportunities between ETF prices and spot market prices.

Conclusion

The recent uptick in Bitcoin whale activity on Binance signals a potentially pivotal moment for the crypto market. While the exact intentions behind these movements remain speculative, the increased inflows suggest that significant players are strategically positioning themselves amid ongoing market consolidation. Monitoring how these inflows evolve in the coming weeks may provide insight into whether the market will rebound or correct further, impacting broader institutional investment strategies.

Related: XRP Signals Breakdown After Rejection

Source: Original article

Quick Summary

Whale activity on Binance has increased, focusing on Bitcoin amid market consolidation. The whale inflow ratio, comparing the largest Bitcoin deposits to total exchange inflows, highlights this activity in the context of market retracement.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.