Bitcoin experienced a significant “buy-the-dip” event following a sharp selloff, with accumulator addresses showing record inflows. While on-chain data suggests accumulation, Bitcoin ETFs continue to experience outflows, creating a mixed picture.

What to Know:

- Bitcoin experienced a significant “buy-the-dip” event following a sharp selloff, with accumulator addresses showing record inflows.

- While on-chain data suggests accumulation, Bitcoin ETFs continue to experience outflows, creating a mixed picture.

- Strategy’s continued Bitcoin purchases and Binance’s SAFU fund rebalancing are providing consistent demand, but the market’s next move depends on stabilization and re-risking.

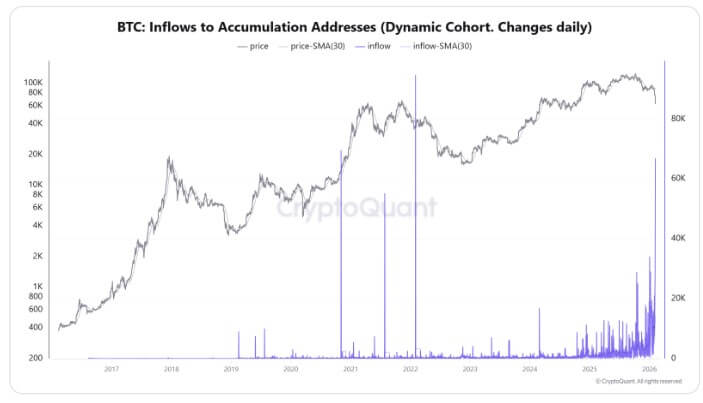

Bitcoin’s recent volatility has sparked intense debate among investors and traders, with a sharp selloff triggering what appears to be one of the largest “buy-the-dip” events in this market cycle. On-chain data indicates a record surge of coins moving into wallets associated with long-term holding behavior, even as exchange-traded fund (ETF) products experience net negative flows. This divergence highlights the ongoing tension between institutional and retail sentiment toward Bitcoin.

The timing of this accumulation is critical, as it occurred immediately after a deleveraging wave that significantly impacted crypto markets, driving Bitcoin’s price sharply lower. This suggests that some investors saw the dip as a buying opportunity, potentially signaling confidence in Bitcoin’s long-term prospects. However, the continued outflows from Bitcoin ETFs indicate that not all investors share this sentiment.

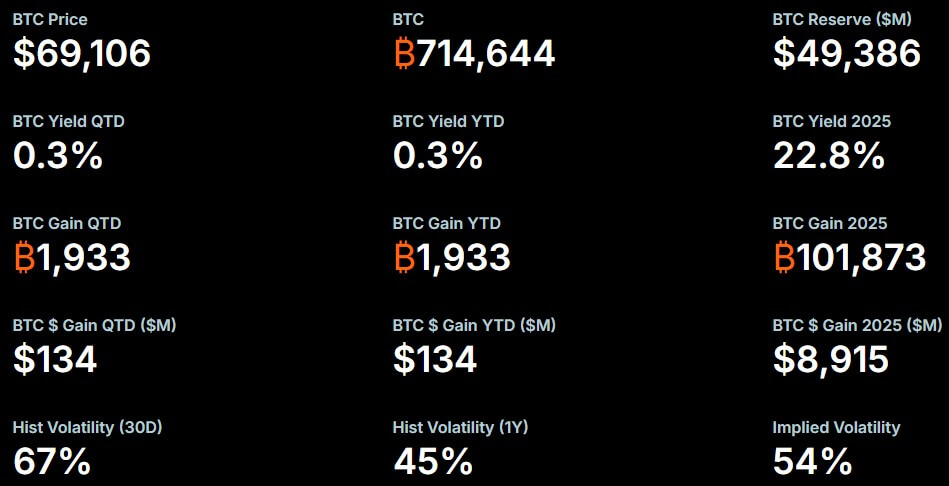

Strategy, known for its BTC-heavy treasury strategy, has been actively adding to its Bitcoin holdings during this period of volatility. Between Feb. 2 and Feb. 8, Strategy purchased 1,142 Bitcoin for approximately $90 million, increasing its total holdings to 714,644 Bitcoin. This move demonstrates the company’s confidence in Bitcoin and its willingness to capitalize on market downturns.

Binance’s SAFU fund has also been a notable buyer, acquiring an additional 4,225 Bitcoin on Feb. 9, equivalent to $300 million in stablecoins. This purchase is part of Binance’s strategy to rebalance the SAFU fund into Bitcoin, reflecting its long-term conviction in the cryptocurrency. Such actions from major players can provide a level of stability during market downturns.

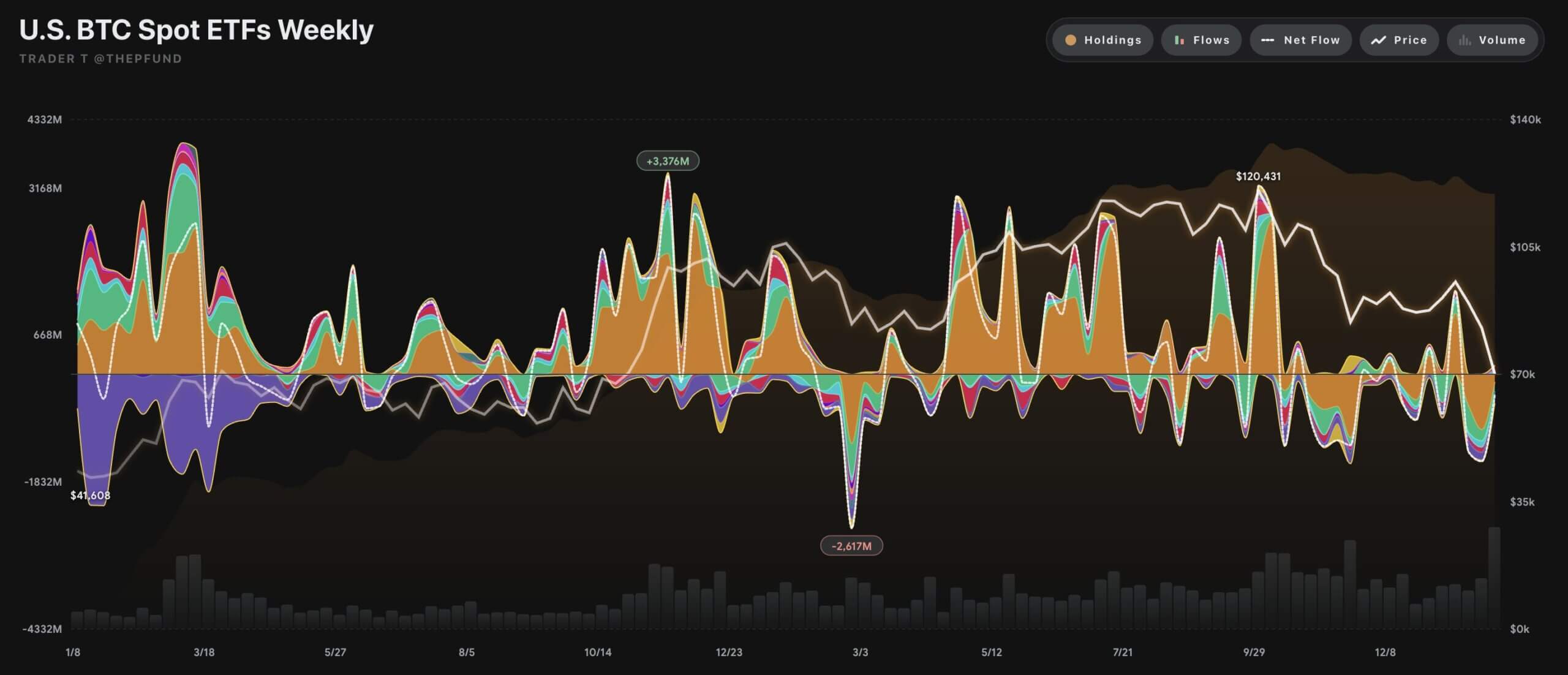

Despite these positive signals, Bitcoin ETFs continue to experience outflows, indicating ongoing pressure from traditional investors. CoinShares reported that digital asset investment products saw outflows slow sharply to $187 million last week, with Bitcoin accounting for $264 million in outflows. This divergence between on-chain accumulation and ETF outflows underscores the mixed sentiment surrounding Bitcoin.

The market’s next move will likely depend on whether the current regime shifts from “capitulation and transfer” to “stabilization and re-risking.” Monitoring accumulator inflows, ETF flows, and the continued buying activity of non-price-sensitive buyers like Strategy and Binance’s SAFU fund will be crucial in determining the direction of Bitcoin’s price. As Bitcoin remains tethered to broader risk sentiment, developments in other markets and regulatory landscapes will also play a significant role.

Related: Bitcoin Stays Tight Under $70K Before Jobs Report

Source: Original article

Quick Summary

Bitcoin experienced a significant “buy-the-dip” event following a sharp selloff, with accumulator addresses showing record inflows. While on-chain data suggests accumulation, Bitcoin ETFs continue to experience outflows, creating a mixed picture.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.