A Bitcoin crash can trigger systemic contagion, pulling altcoins down through liquidity and confidence channels. During crises, the market often treats crypto as a single risk asset, as seen in high BTC-ETH and BTC-XRP correlations.

What to Know:

- A Bitcoin crash can trigger systemic contagion, pulling altcoins down through liquidity and confidence channels.

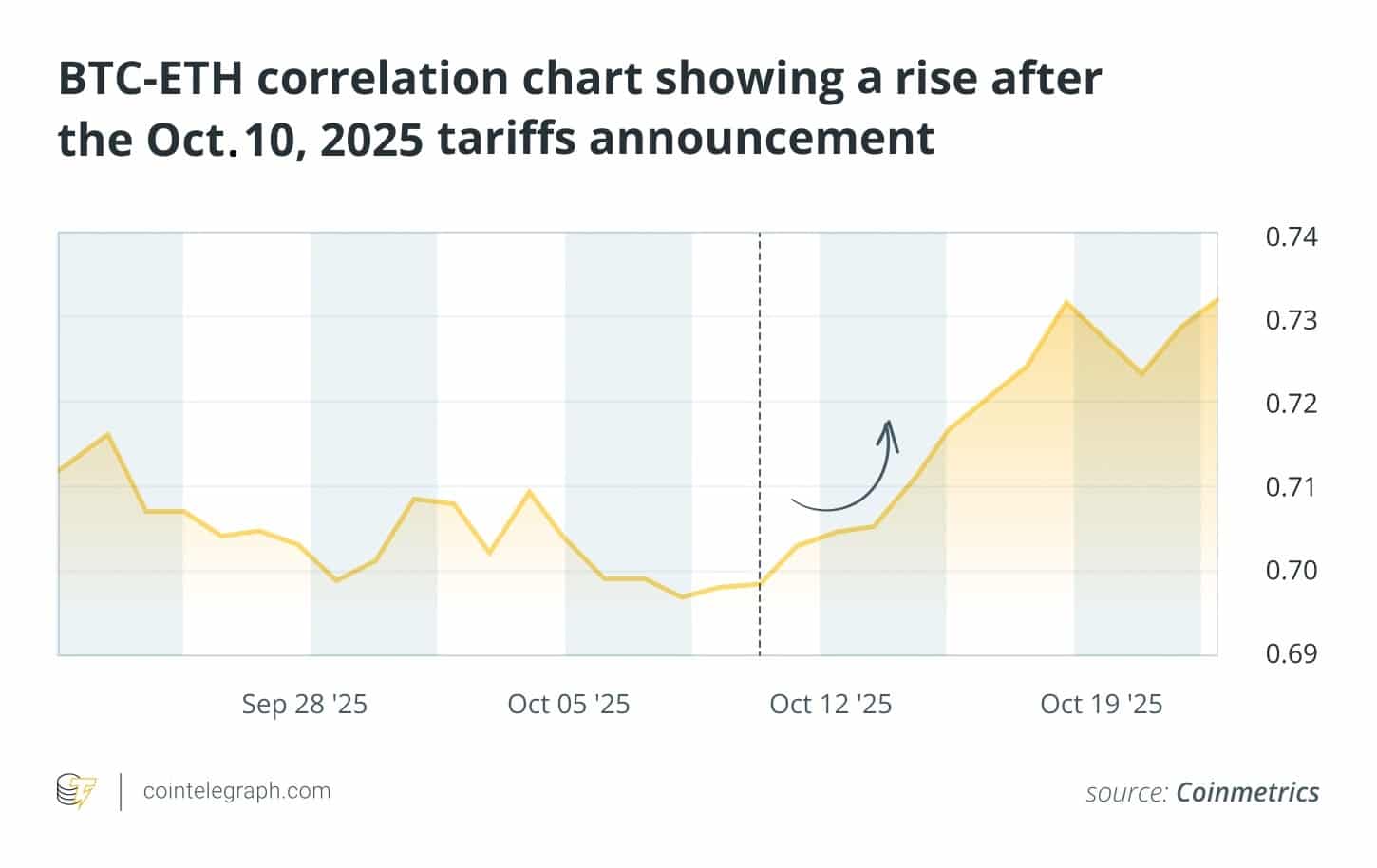

- During crises, the market often treats crypto as a single risk asset, as seen in high BTC-ETH and BTC-XRP correlations.

- Correlation and beta analyses are crucial for understanding how Ether and XRP depend on Bitcoin’s performance.

Bitcoin’s dominance in the cryptocurrency market is a key factor influencing crypto cycles. But what happens if Bitcoin’s dominance fades or its price plunges? In that scenario, Ether (ETH) and XRP become crucial test cases for how the market responds.

This article will explain how to evaluate ETH and XRP during a Bitcoin shock, measuring dependence, assessing risk, and devising effective hedging strategies.

When the biggest player in a sector stumbles, the ripple effects are immediate. Smaller firms often lose value as they depend on the leader’s ecosystem, investor confidence, supply-chain links, and reputation. Bitcoin serves as the “anchor asset,” and when it weakens, the entire market loses its sense of stability and direction. Historically, most altcoins, including Ether and XRP, have shown a strong correlation with Bitcoin’s price movements.

The implication is clear: If Bitcoin’s dominance drops or its price collapses, ETH and XRP are unlikely to move independently. They would likely suffer through liquidity and sentiment channels. A major Bitcoin crash could trigger large-scale liquidations driven by margin calls and cascading sell-offs, which often leads to massive capital outflows that hit all crypto assets, regardless of their fundamentals.

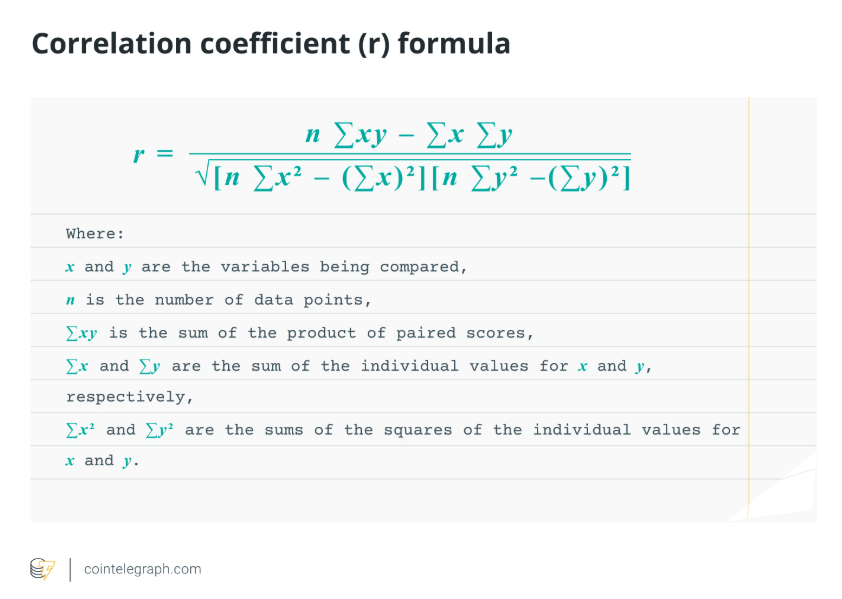

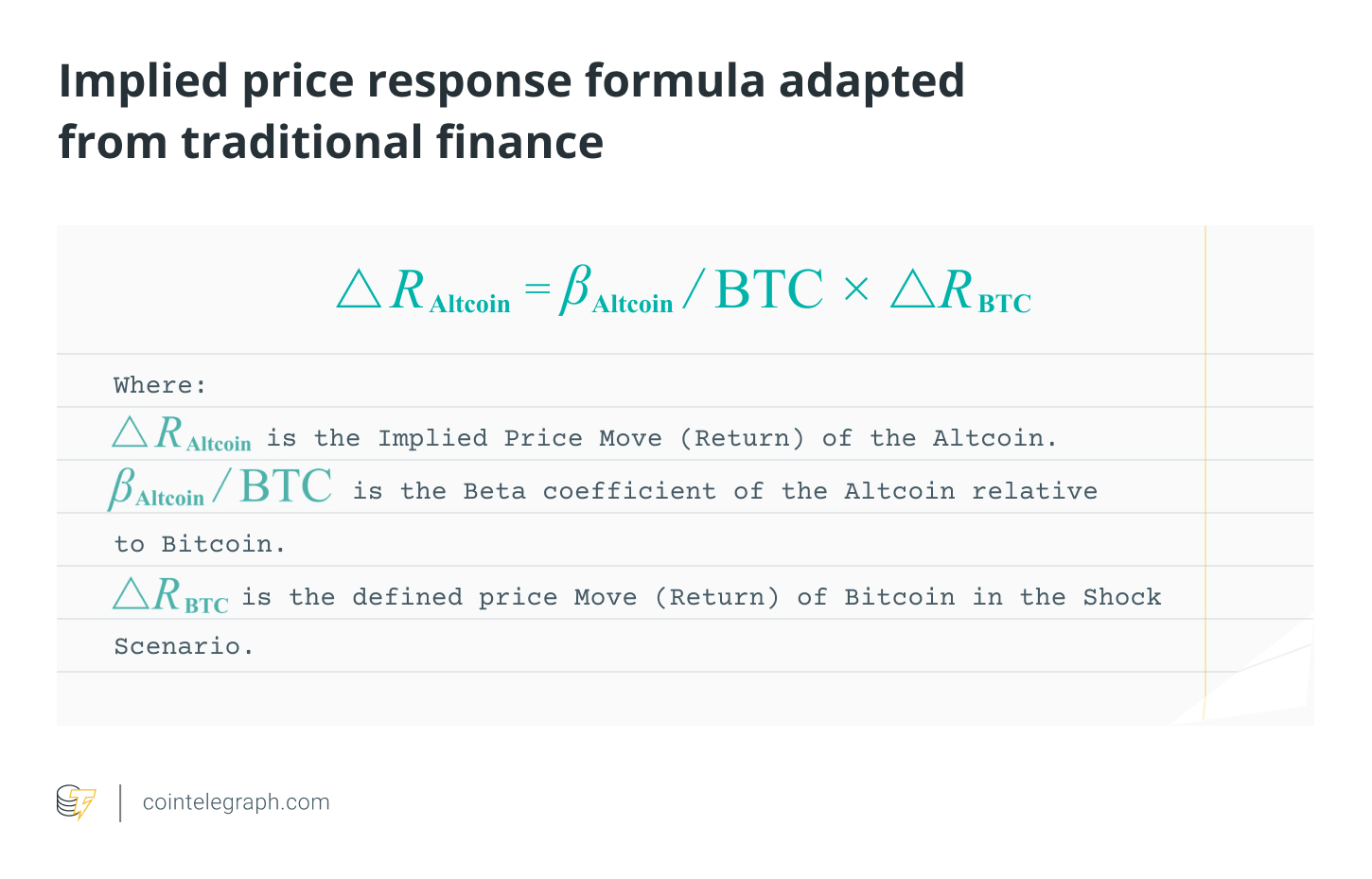

To measure Bitcoin dependence and risk, one should define a plausible, high-impact Bitcoin event, such as a 50% BTC drop within 30 days, or Bitcoin’s dominance falling from 60% to 40%. Then, calculate the current Pearson correlation coefficient between ETH, XRP, and BTC to capture the linear relationship between the assets’ daily returns, providing a baseline for dependence. Next, using correlation data, apply regression analysis to calculate each altcoin’s beta (β) relative to BTC to estimate the expected price movement of the altcoin for every one-unit change in Bitcoin.

In a Bitcoin shock scenario, data from previous crises reveals a clear pattern: When Bitcoin falls, altcoins are typically dragged down with it. Bitcoin continues to serve as the market’s primary risk indicator. Although Ether benefits from robust layer-1 utility, it is not immune; during market stress, its correlation with Bitcoin often increases, as institutional capital treats both as risk assets. Assets such as XRP, on the other hand, which face higher regulatory and structural risks, could be hit disproportionately.

Hedging a crypto portfolio against a sharp Bitcoin decline requires more than basic diversification. During periods of extreme panic, the futures market can trade at a steep discount to the spot price, creating opportunities for sophisticated traders to pursue relatively low-risk, non-directional arbitrage. Holding positions in tokenized gold, real-world assets (RWAs), or fiat-backed stablecoins to preserve portfolio value can also act as liquidity reserves when crypto markets spiral downward.

Related: Cardano Bull Setup Points to December Rally

Source: Original article

Quick Summary

A Bitcoin crash can trigger systemic contagion, pulling altcoins down through liquidity and confidence channels. During crises, the market often treats crypto as a single risk asset, as seen in high BTC-ETH and BTC-XRP correlations. Correlation and beta analyses are crucial for understanding how Ether and XRP depend on Bitcoin’s performance.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.