Shiba Inu derivatives are showing strong open interest growth, surpassing Bitcoin and XRP. This activity occurs amid broader market uncertainty, reflecting speculative interest in SHIB. Increased derivatives activity and positive long/short ratios may signal renewed institutional interest in SHIB.

What to Know:

- Shiba Inu derivatives are showing strong open interest growth, surpassing Bitcoin and XRP.

- This activity occurs amid broader market uncertainty, reflecting speculative interest in SHIB.

- Increased derivatives activity and positive long/short ratios may signal renewed institutional interest in SHIB.

Shiba Inu (SHIB) has recently distinguished itself in the crypto derivatives market, exhibiting open interest growth that outpaces leading assets like Bitcoin and XRP. This development occurs amidst a backdrop of general price weakness, suggesting a potential shift in market sentiment towards SHIB. The surge in derivatives activity could indicate renewed speculative interest or strategic positioning by institutional investors.

Shiba Inu’s Open Interest Surge

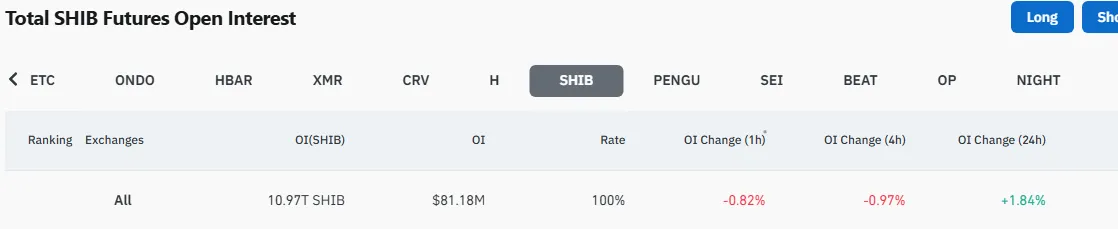

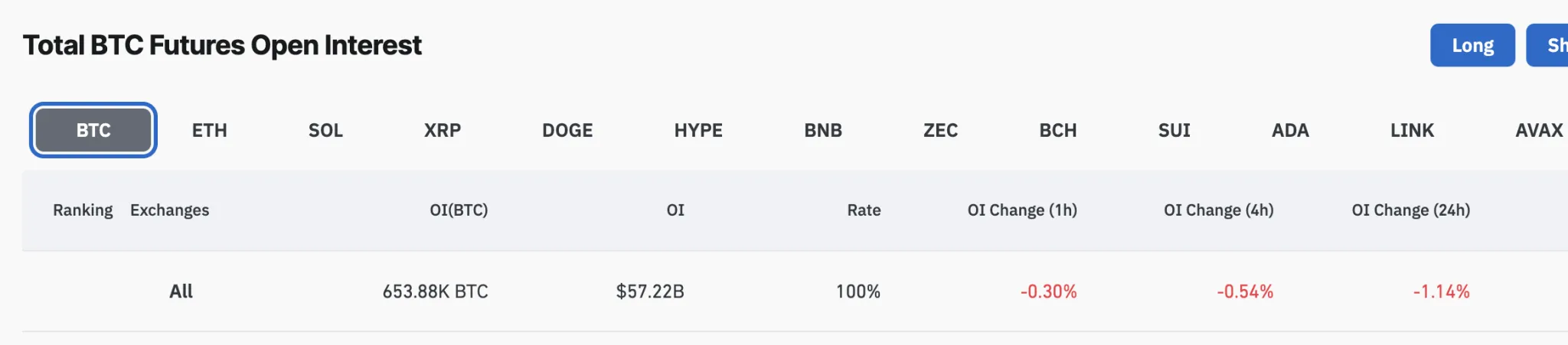

Shiba Inu has demonstrated remarkable growth in daily open interest, climbing 1.84% in the last 24 hours, according to CoinGlass data. This contrasts with Bitcoin’s 1.14% decline and XRP’s more substantial 2.3% decrease over the same period. Currently, approximately 10.97 trillion SHIB, valued at around $81.18 million, are committed to active futures contracts, signaling robust trading activity and liquidity in SHIB derivatives.

Exchange-Specific Trends

An analysis of open interest across different exchanges reveals nuanced trends. MEXC leads with a 37.69% increase in SHIB open interest, followed by Coinbase at 20.04% and LBank at 15.04%. Conversely, KuCoin experienced a significant drop of 44.53%. These variations may reflect differences in regional investor sentiment, regulatory postures, or the availability of specific trading tools on each platform. Institutional investors often monitor these exchange-specific trends to gauge market depth and potential arbitrage opportunities.

Long/Short Positioning

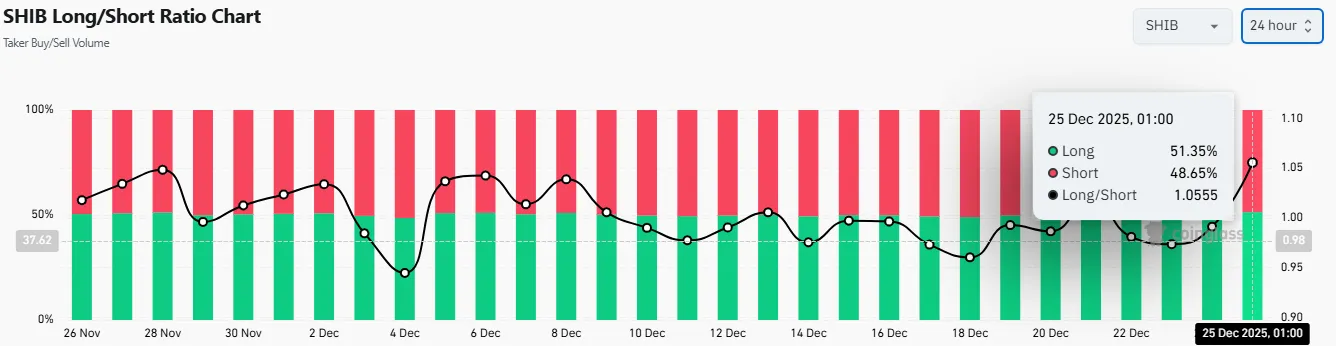

The current long-to-short ratio for SHIB stands at 1.0555, with 51.35% of positions being long and 48.65% short. This slight bias towards long positions suggests that a majority of traders are anticipating a price increase. However, the relatively balanced ratio also indicates a degree of uncertainty and potential for volatility, as shifts in sentiment could trigger significant liquidations and price swings. Prudent institutional investors will likely employ sophisticated risk management strategies when trading SHIB derivatives.

Potential Catalysts

Several factors could be contributing to the renewed interest in SHIB. These include potential regulatory clarity from the CLARITY Act, advancements in Fully Homomorphic Encryption (FHE) on Shibarium, and speculation about a dedicated SHIB ETF. The passage of the CLARITY Act could provide a more defined legal framework for digital assets, potentially attracting institutional capital. Similarly, technological advancements on Shibarium may enhance the utility and scalability of the SHIB ecosystem. The introduction of a SHIB ETF could further broaden access to the token for traditional investors.

Price Performance and Outlook

In the last 24 hours, Shiba Inu has gained 3.21%, outperforming Bitcoin and XRP, which posted more modest gains. Despite this recent uptick, SHIB remains approximately 27.6% below the $0.00001 psychological level, a threshold it last traded near over six weeks ago. While renewed strength in the futures market has reignited hopes of a rebound, investors should remain cautious and monitor broader market conditions, regulatory developments, and technological advancements within the SHIB ecosystem. The inherent volatility of meme coins requires a disciplined and risk-aware investment approach.

The recent surge in Shiba Inu’s derivatives activity, coupled with positive long/short positioning, suggests renewed speculative interest in the token. While potential catalysts such as regulatory clarity and technological advancements could further drive momentum, investors should remain vigilant and employ sound risk management strategies. As always, thorough due diligence and a balanced approach are crucial when navigating the dynamic landscape of digital assets.

Related: XRP Liquidity Signals Potential Turn

Source: Original article

Quick Summary

Shiba Inu derivatives are showing strong open interest growth, surpassing Bitcoin and XRP. This activity occurs amid broader market uncertainty, reflecting speculative interest in SHIB. Increased derivatives activity and positive long/short ratios may signal renewed institutional interest in SHIB.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.